The housing boom of the last few years has been primarily driven by the number of people who moved into our province, causing buyer demand to massively outpace our supply of available homes, which drove prices up. With immigration slowing, demand for homes should ease and the market should eventually level out into a more balanced pace. With that said, I don’t foresee a massive drop in home prices incoming. Alberta is still an attractive and affordable place to live compared to other provinces, our economy is still in great shape relative to the rest of the country, and the cost of building materials and new construction is not likely to come down between inflation and tariffs.

I think what we are currently dealing with is a slight market correction. We had a small correction in June of 2024 as months of multiple offers and rising prices finally hit a point where buyers were no longer interested in participating. As showing activity and sales slowed down, sellers started to reduce their asking prices slightly, and buyer demand returned. We’ve seen a large number of properties reducing their asking prices over the last month, and I’ve already noticed showing activity levels starting to pick back up in the last week, which is a positive sign that buyers are making a return to the market.

So far, the majority of the increased showing activity has been at the lower end of the market, but over time this should start to trickle back up to the higher end price points (600k+). Overall, the Central Alberta housing market is still in great shape. The pace has shifted slightly, and prices are shifting slightly, but most homeowners are still in a place of positive equity in their homes.

Will prices go up again in the spring? If inventory levels stay steady and buyer demand increases, it’s possible. However, with the decrease in immigration and increasing inventory levels, I think prices are more likely to remain stable at the lower end and possibly come down slightly more at the higher end. Continued drops in interest rates could potentially justify higher home prices, but everything will ultimately come down to supply and demand.

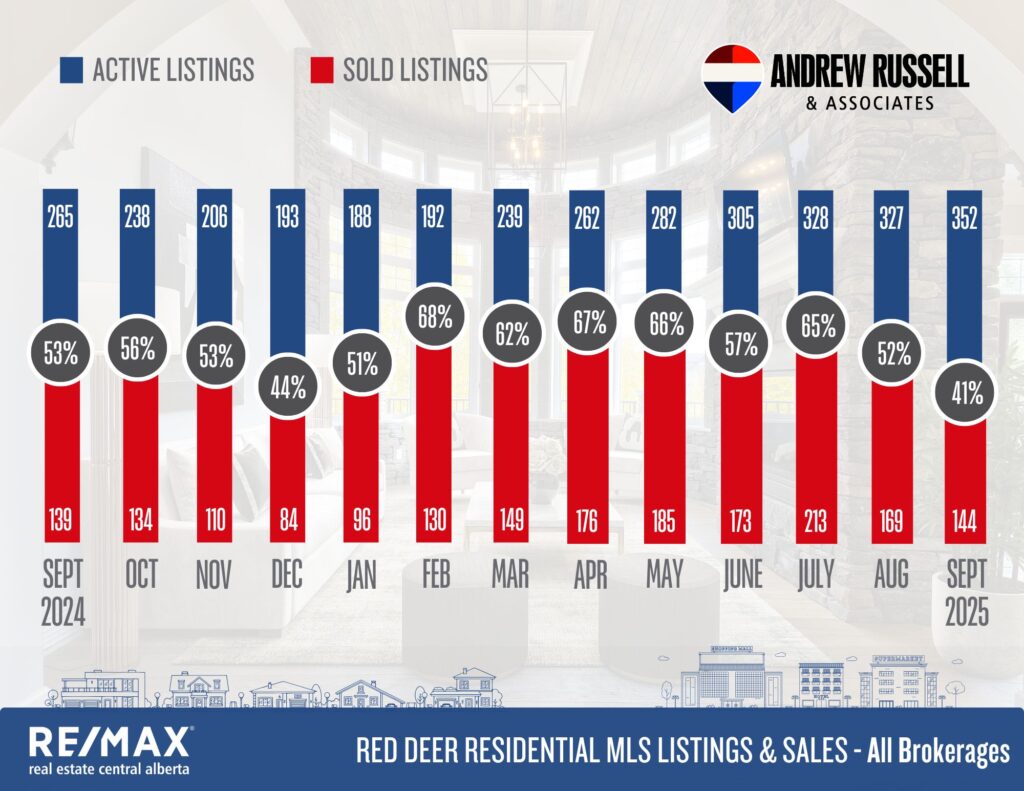

Overall Market Trends

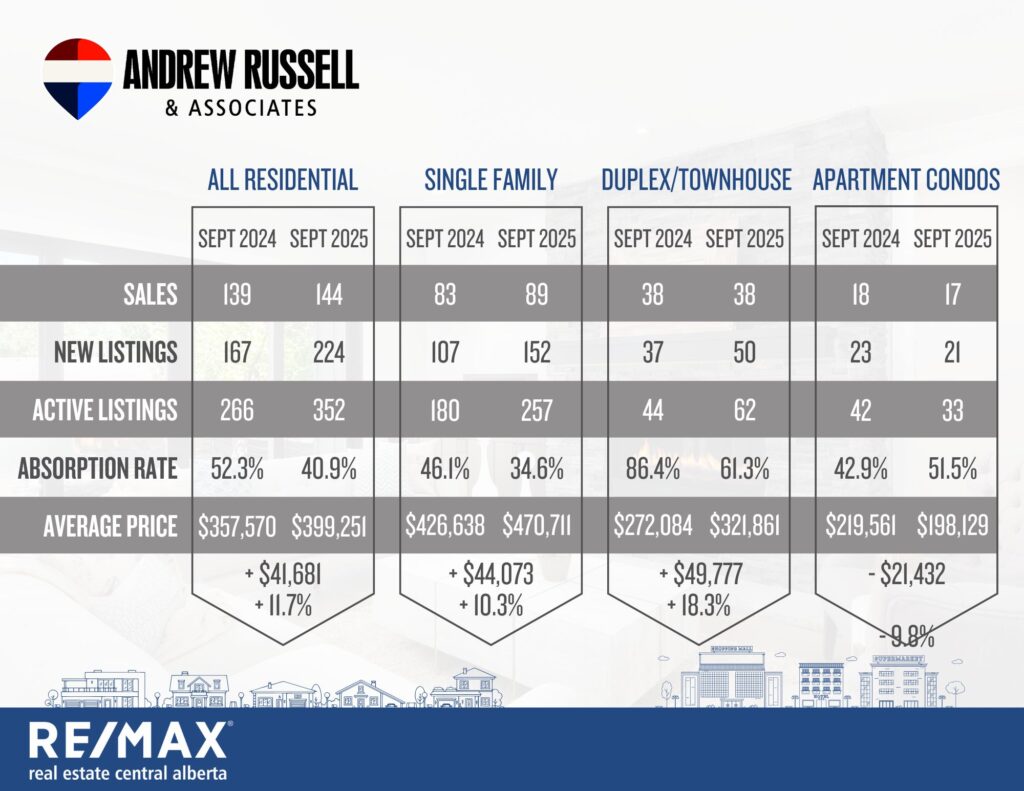

✅ Sales Activity: Residential sales dropped to 144, down 15% from August of 2025.

✅ New Listings: Rose significantly to 224, compared to 167 last year.

✅ Active Listings: Inventory climbed to 352, up from 266 a year ago.

✅ Absorption Rate: Slowed to 40.9%, down from 52.3% in September 2024.

✅ Average Home Price: Currently $399,251, up 11.7% compared to 1 year ago.

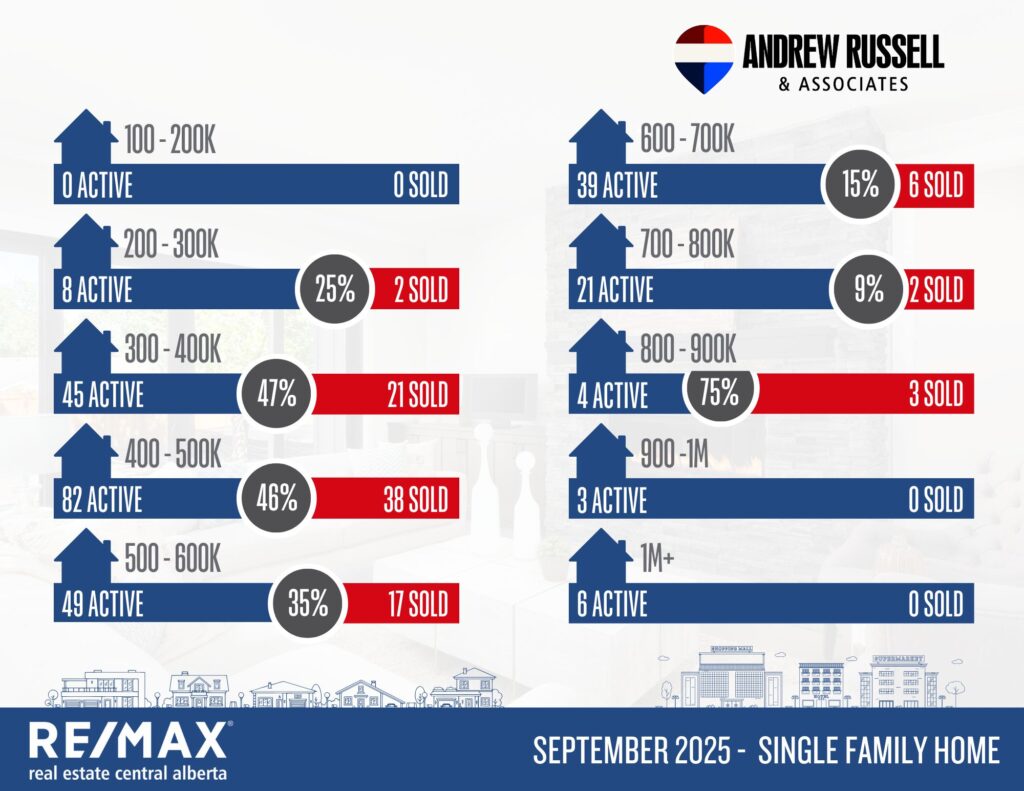

Single Family Homes

🏡 Sales Performance: Sales dropped 14% compared to last month.

🏡 New Listings: 152 new listings in September, up slightly from last month.

🏡 Absorption Rate: Slowed to 34.6%, down from 46.1% last year.

🏡 Price Trends: Average price is currently $470,711, up from $426,638 in 2024.

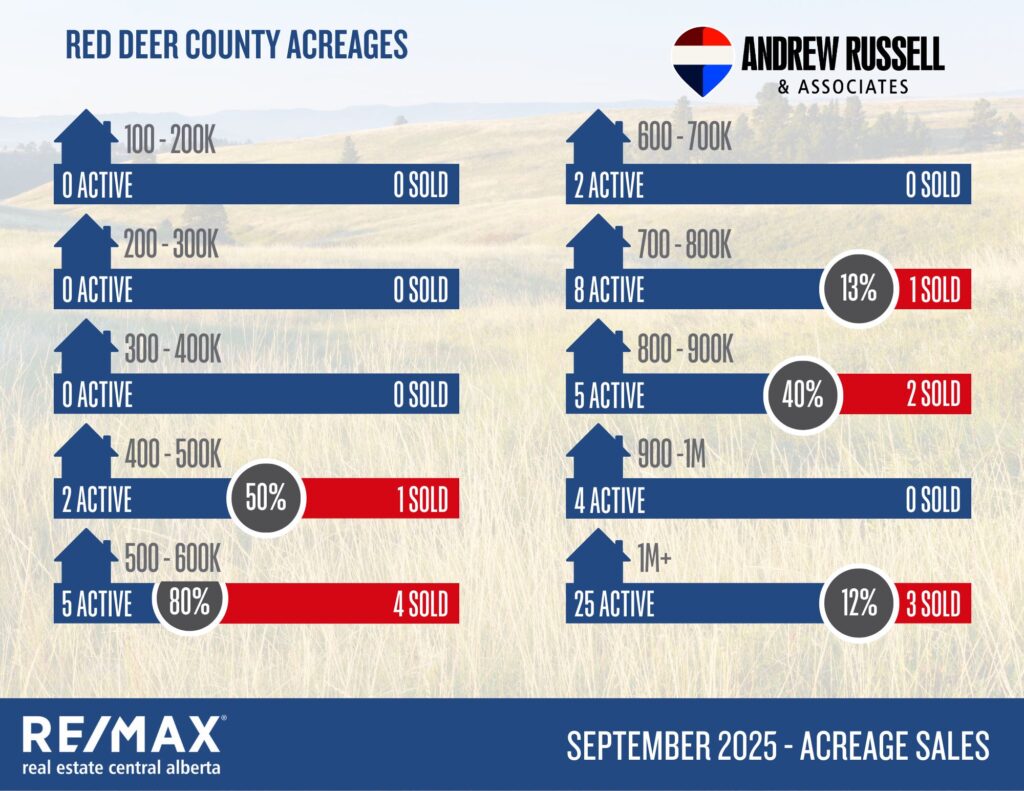

Red Deer County Acreage Market

🌲 Very Low Inventory: There’s only 9 total listings in Red Deer County under 700k.

🌲 Sales Performance: More affordable acreages are selling quickly, while the 700k+ price points are much slower.

🌲 Luxury Market Remains Slow: Last month there was a 12% chance of selling an acreage above 1 million.

Market Supply & Demand Trends

📉 Rising Inventory: Active listings continue to climb, up nearly 33% year-over-year.

📉 Slower Sales: Less demand and less sales point to a slower-moving market compared to last fall.

⬆️ Duplex/Townhouse Segment: Sales are still strong but inventory is increasing rapidly.

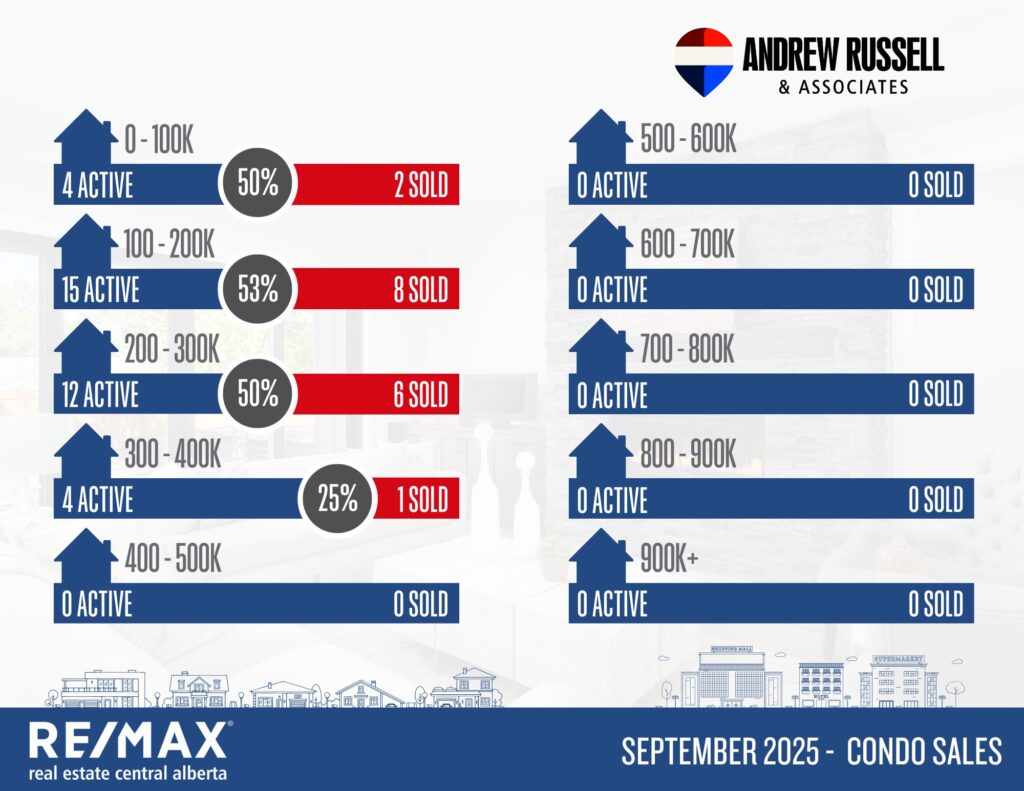

⬇️ Condo Market: Average condo prices slipped 9.8% to $198,129, with sales dropping slightly from 18 to 17.

What This Means for Buyers and Sellers

Buyers:

✅ More Options: Rising inventory means more choice and less competition in most price brackets. Multiple offers are still possible in lower price points but much less likely than in the spring/summer markets.

✅ Leverage in Higher-End Market: Luxury homes and acreages over $600K are slow moving, giving buyers more choice, more time, and more room to negotiate.

✅ Mid-Range Still Competitive: Homes priced $300K–$500K are still the most in demand, but the number of active, motivated buyers has fallen off this month.

Sellers:

✅ Mid-Range Advantage: If you’re selling in the $300K–$500K single-family range, demand is still steady but competition is increasing with more listings coming to market.

✅ Strategic Pricing is Key: Buyers have noticed the shift in market activity and are no longer willing to overpay for a home just to secure something. With less pressure, buyers are now shopping for best value and bang for their buck.

✅ Market Shift Awareness: With inventory rising and sales slowing, sellers need to stay realistic and competitive.

Surrounding Community Stats:

Blackfalds:

Current Active Listings – 52

Sales in September – 24

Likelihood to Sell – 46% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 111

Sales in September – 34

Likelihood to Sell – 31% (Balanced Market)

Penhold:

Current Active Listings – 18

Sales in September – 4

Likelihood to Sell – 22% (Balanced Market)