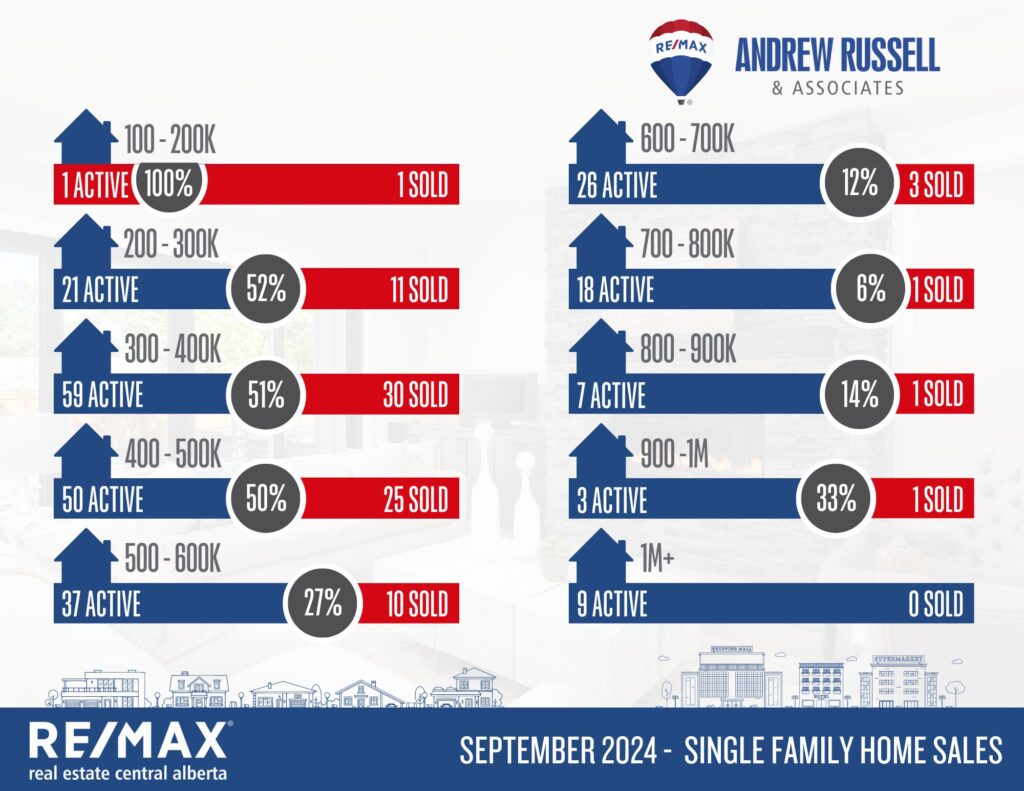

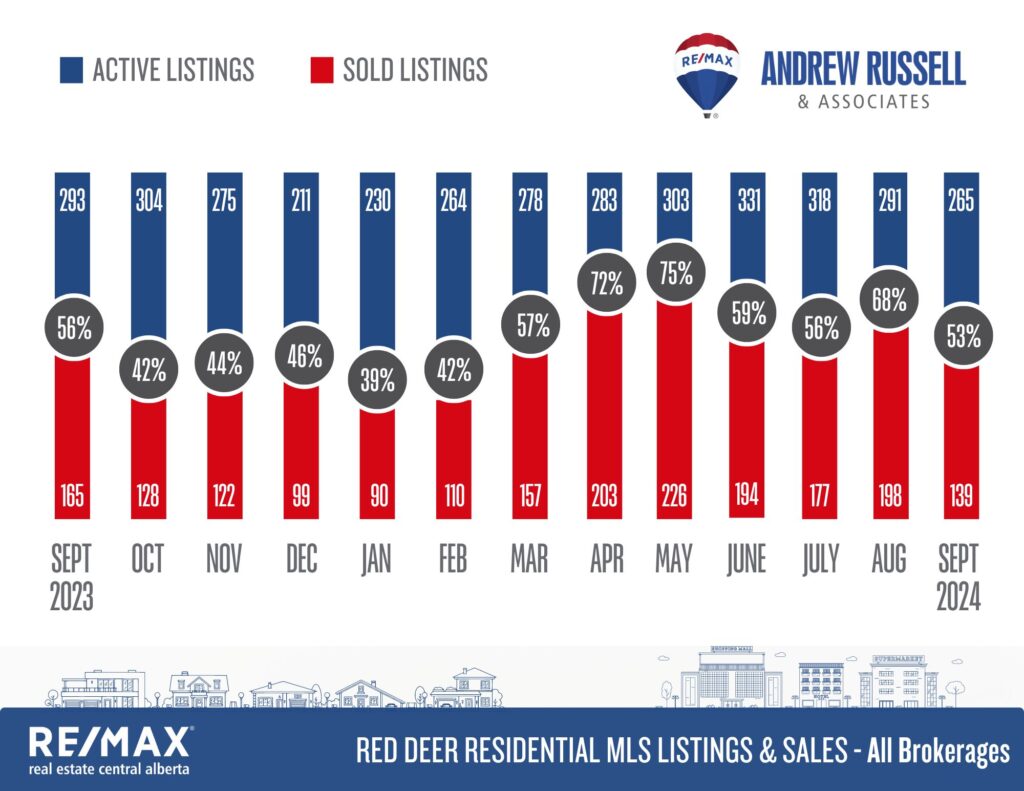

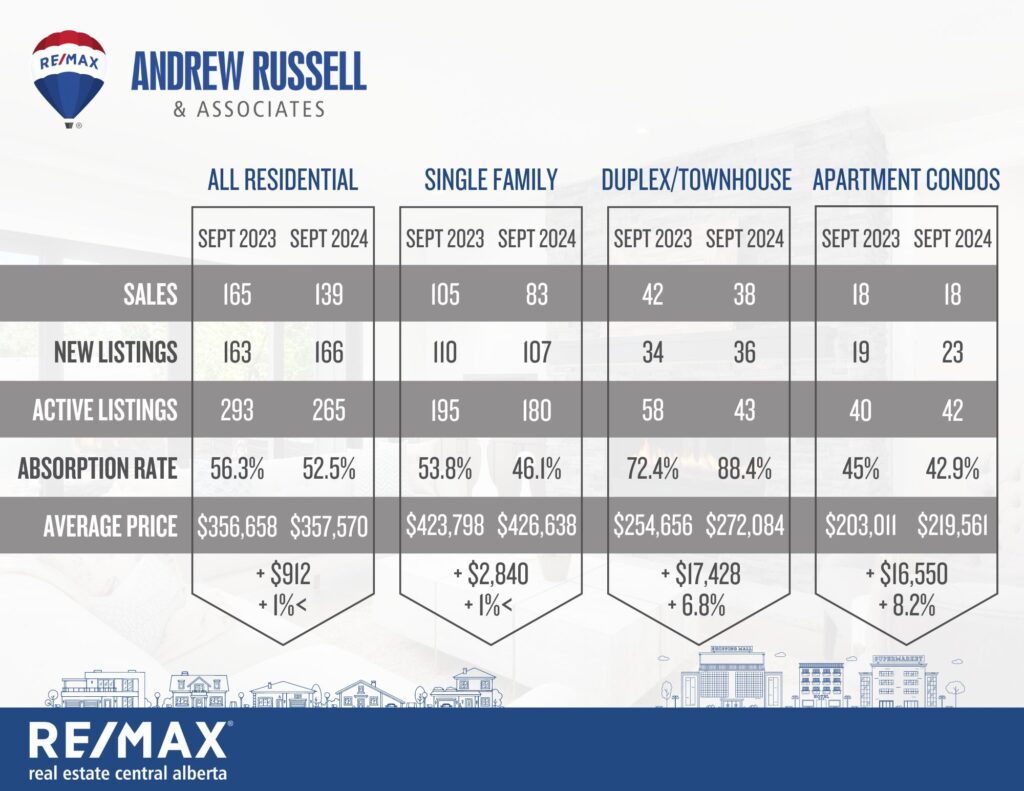

Much like the weather, September sales cooled after a very busy spring and summer market. Red Deer posted 139 sales in September, the lowest number of sales since February, and a 30% drop compared to August. As drastic as that might seem, the market overall is still very active and is still heavily favouring sellers in the under 600k price points.

Here’s some quick facts:

- Listing inventory in Red Deer is currently at 252 active listings, and 62 (or 25%) of those have conditional offers.

- The 500-600k price range cooled in September, but is still a balanced market.

- Detached homes under 500k are still a seller’s market.

- Homes over 600k are heavy buyers markets currently, with only 6 sales in September from 600k to 999k, and no sales posted over 1 million. There are currently 63 listings over 600k, which means roughly only 10% of these homes are selling per month.

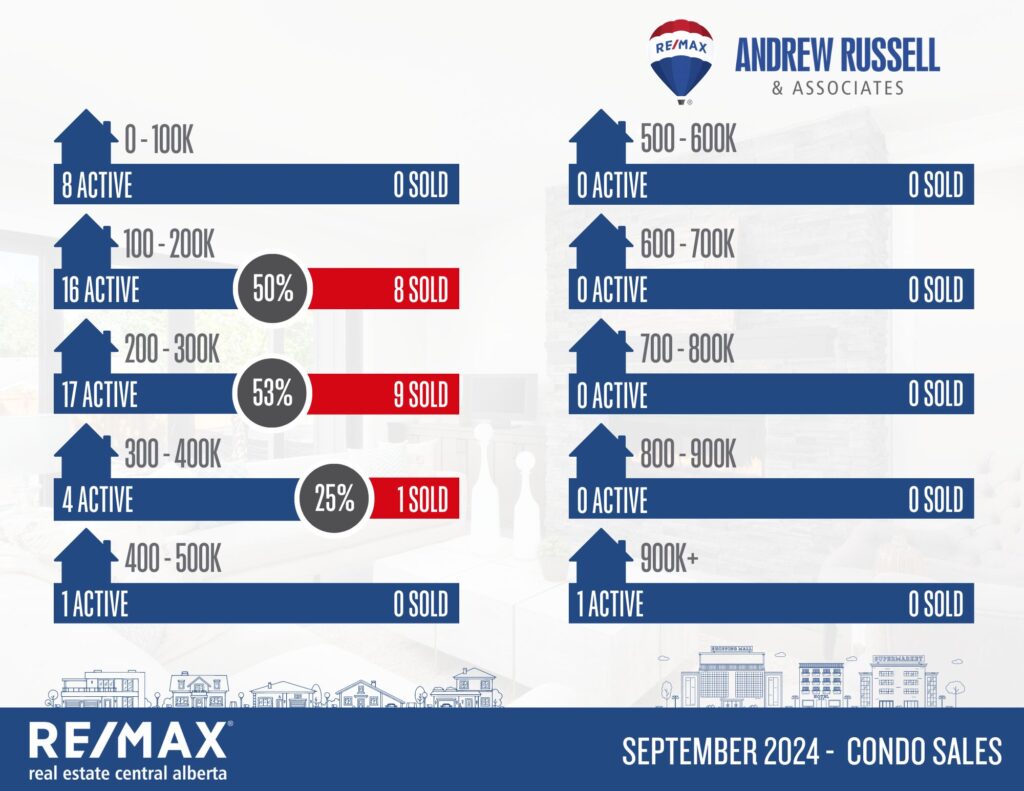

- Condo sales are still very active and prices have pushed up beyond the previous peak in 2014 on most buildings. Condos have once again become attractive as a step into home ownership given the increased pricing of detached homes over the last 2 years.

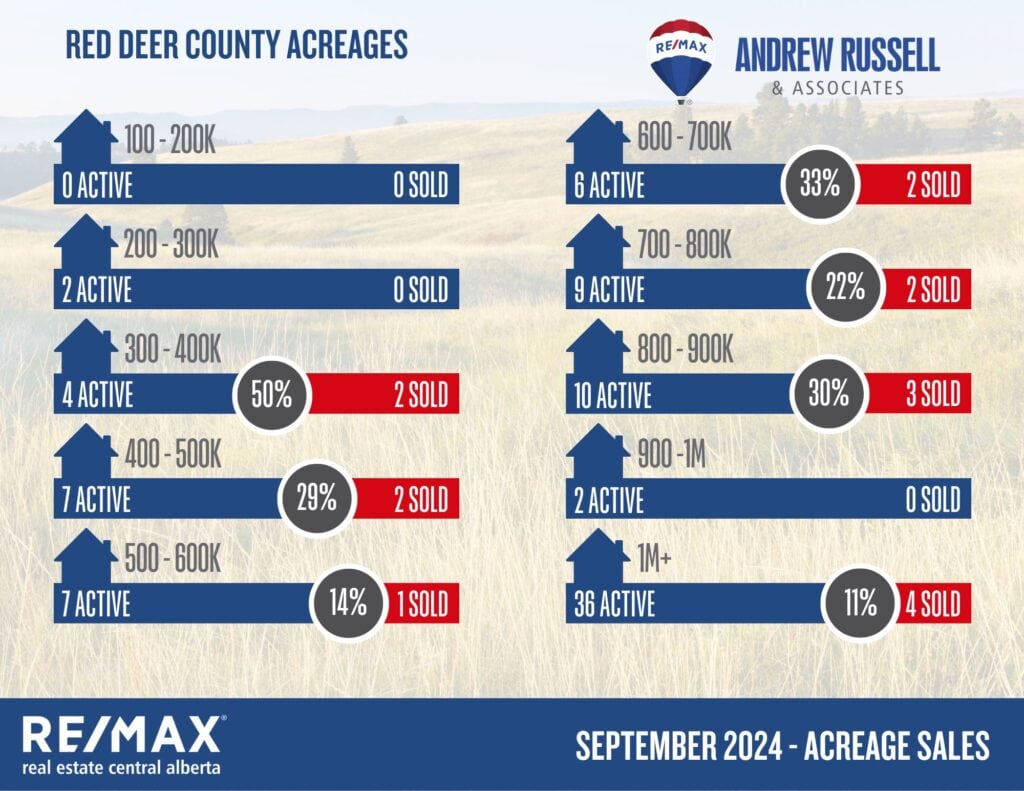

- Acreage sales have been lower than normal this year, however available inventory is also very low.

We are expecting to see the Bank of Canada announce a 0.5% reduction to its key interest rate on October 25th, and then another .25% in December. This will be good news for the economy as a whole, and should lead to fixed mortgage rates declining over time.

The federal government also announced 30 year amortizations are now available for first time buyers on new construction homes, which should help builders bring new inventory into the market that we desperately need.

While both of these announcements will be positive for short term affordability in the market, reduced interest rates and longer amortizations will drive demand which also drives prices when there’s not enough inventory. I believe prices will remain stable in Central Alberta through the winter, and it’s very possible that we’ll see further price increases in the spring/summer market in 2025. One major positive that will come from reduced interest rates will be more activity in our 600k+ markets, which have been unaffordable for many people at 5%+ rates, but will come back within reach as rates continue to fall.