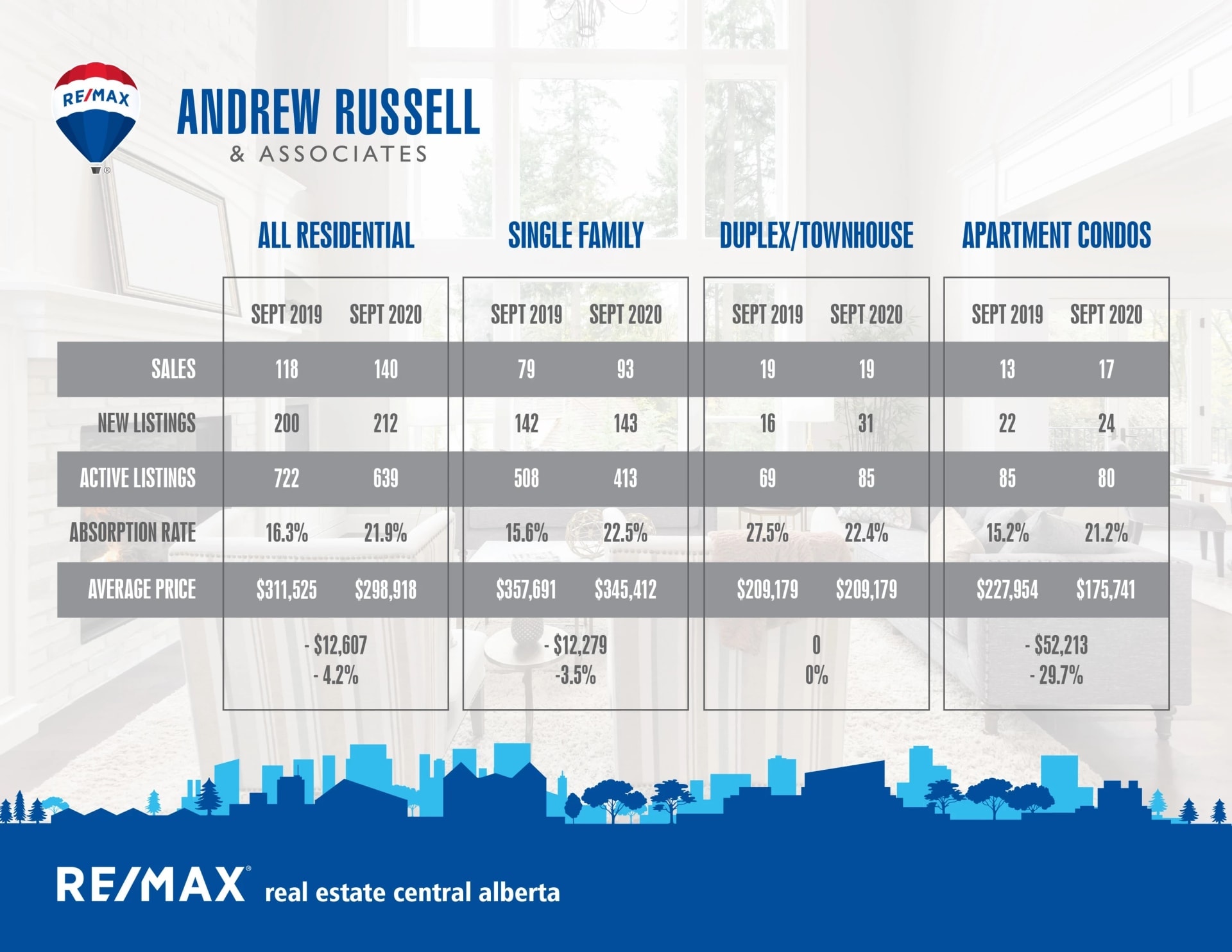

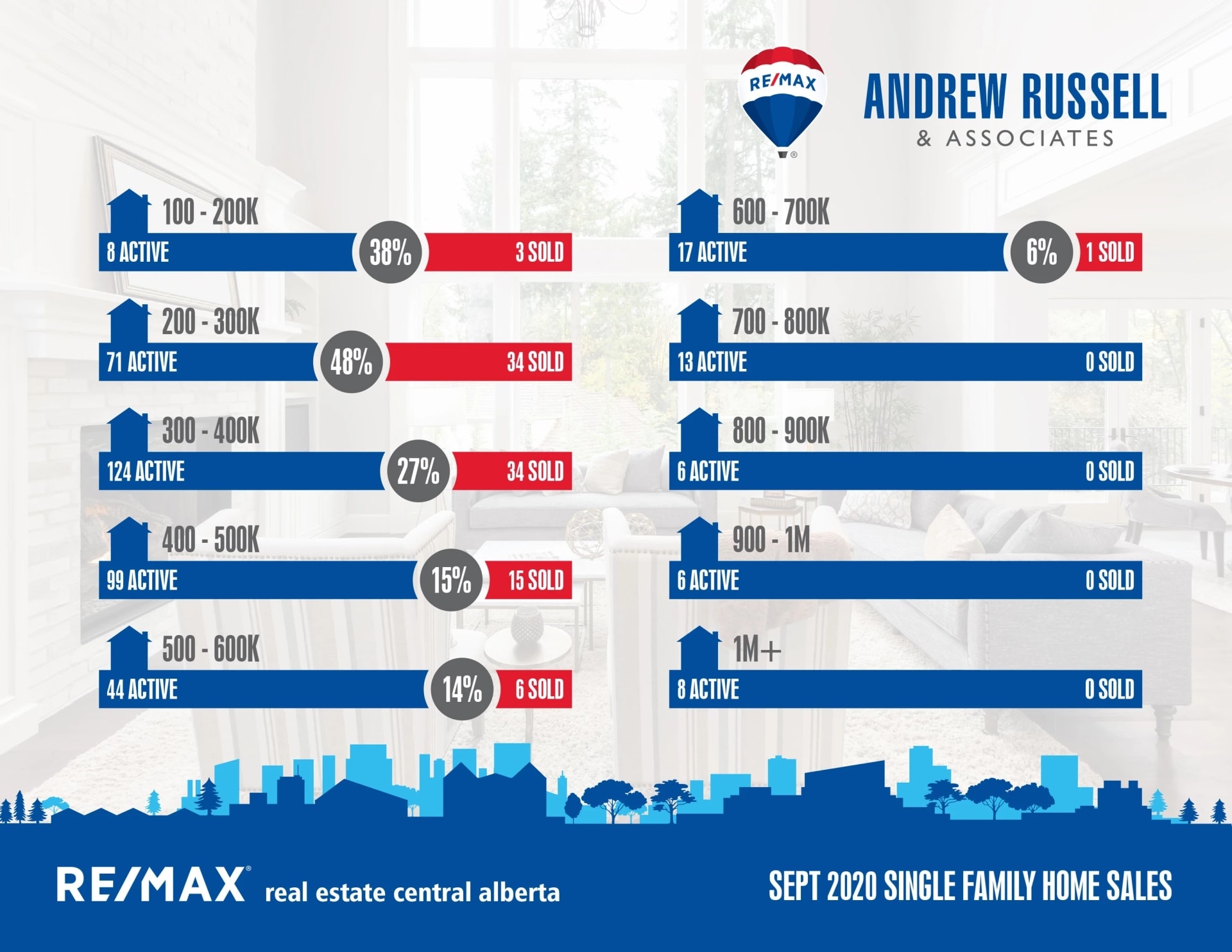

Fall is in full force with overnight frost becoming an almost daily occurrence and leaves dropping off the trees, but this was one of the nicest September’s I can remember in quite a while! The real estate market was reasonably nice as well, specifically if you’re a seller with a home under $400,000. The market for single family homes under $400,000 is as hot as I’ve seen it in the last 5 years, while the market over $400,000 continues on in buyer’s market territory, as it has for the last few years.

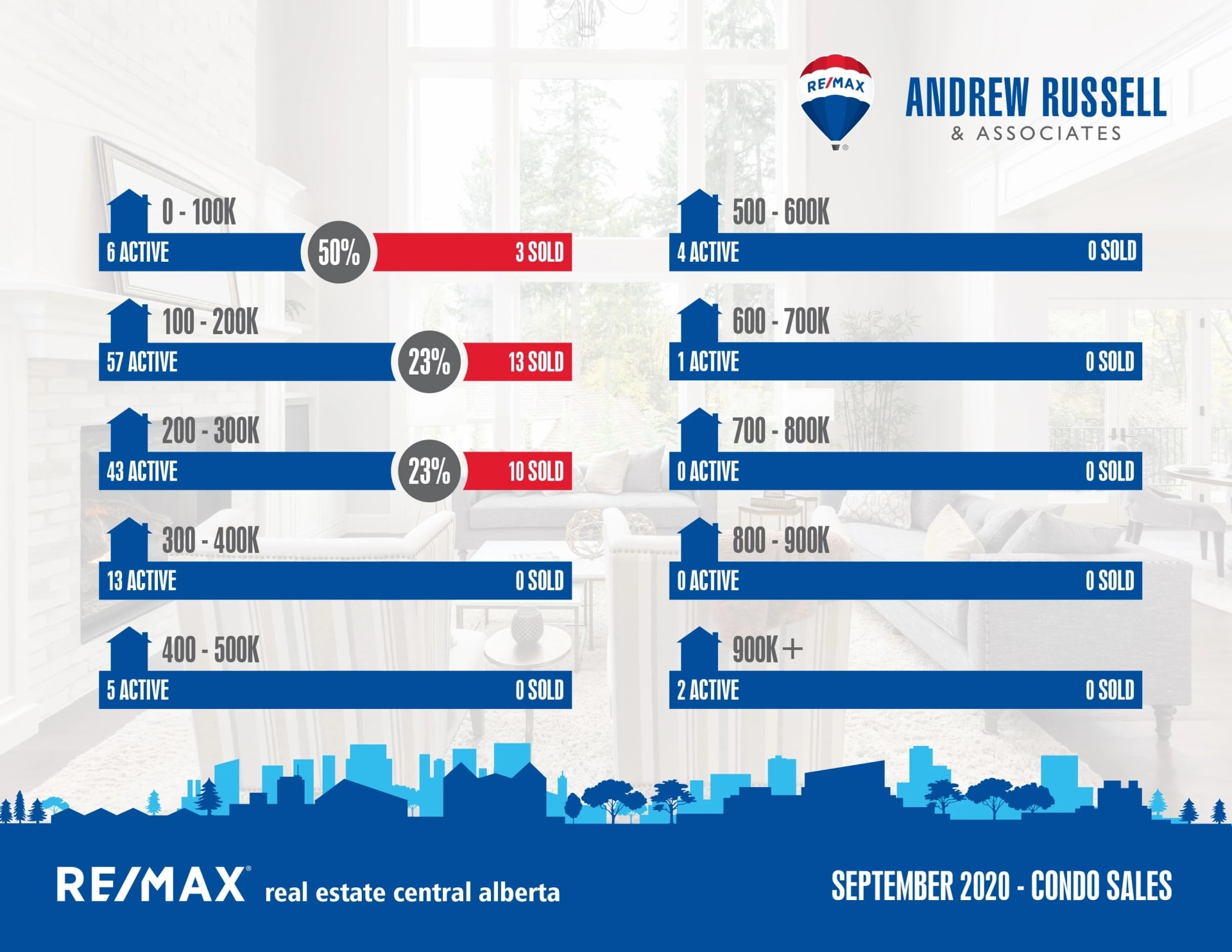

First time buyers are driving the starter market right now, with 48% of the single family home inventory between $200,000 – $300,000 selling in September, which is a market that heavily favors sellers. The duplex and condo markets at the same price point are not seeing the same amount of activity, although they did jump into balanced territory for the first time in 5 to 6 years.

Prices are as low as they’ve been since pre-boom 2006, and with interest rates at record lows (1.79% with some lenders right now), it’s actually cheaper to own than rent. On July 1, the government made it more difficult to qualify for a mortgage by increasing the minimum credit score rating to 680 and by dropping both total debt servicing and mortgage debt servicing ratios. This took some potential buyers out of the market, therefore dropping demand, which will usually push prices down. For the people out there who do still qualify for a mortgage, this presented an amazing opportunity to get into a home.

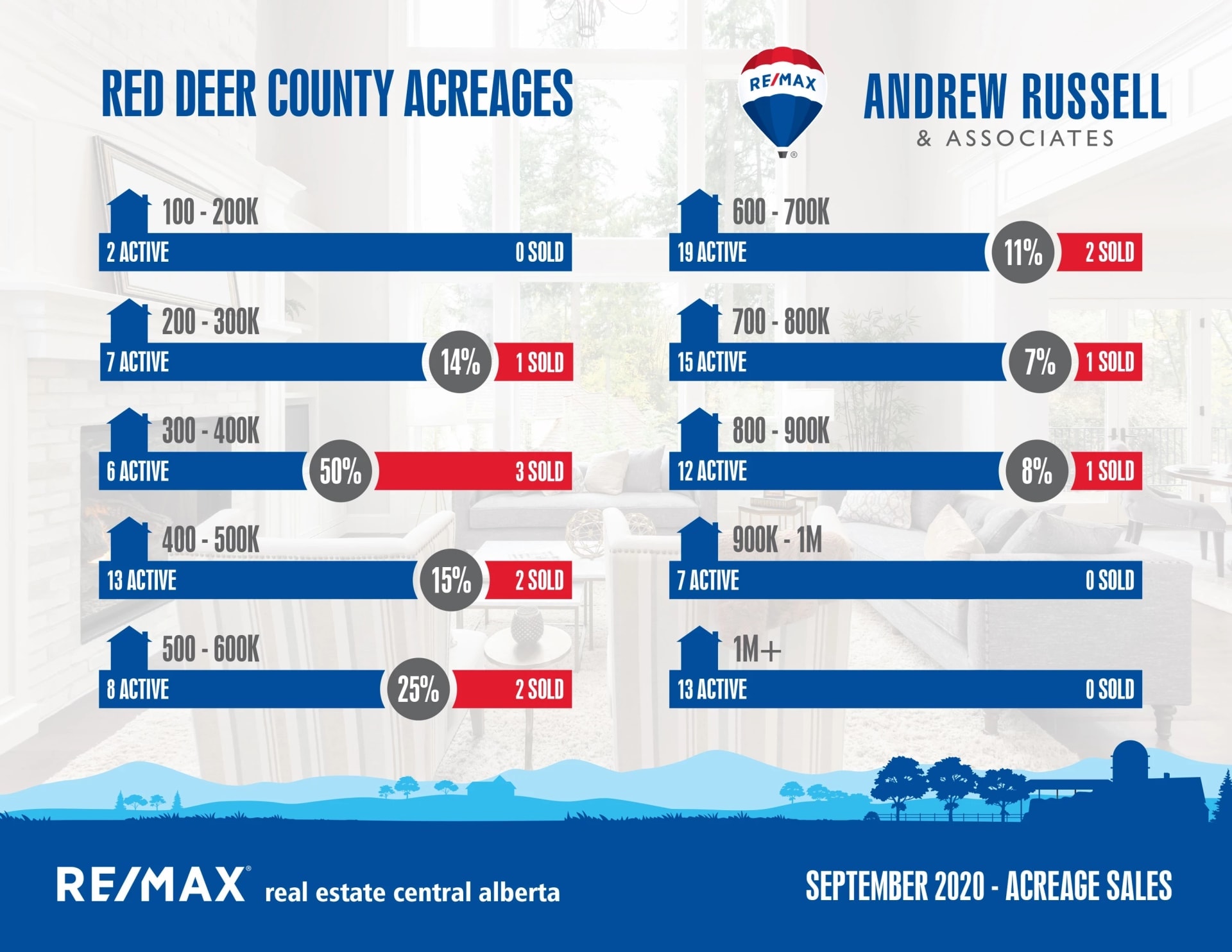

The curious case in all of this, is that we’ve lost most of the move up market. When prices are going up and people have “free” equity in their homes, it’s easy to take that equity and put it into the down payment on a more expensive home, without increasing your mortgage payment. People who timed it properly during the boom years were able to move up multiple times without ever increasing their monthly payments. In today’s market, where many people are selling for less than they paid, moving up requires either an increase in household income, purposeful saving to buy a new home, or some type of cash windfall through inheritance, lottery, or sale of large assets. With COVID and the impacts it’s had on the global economy, very few people are seeing pay raises and increasing wages, which means people are less likely to move up in the market, or are moving up in smaller increments instead of taking large jumps.

If you’re one of the people who have benefitted from the recent COVID economy (many retail sales are hitting record levels), there’s an opportunity to move into a nicer home at a drastically lower price (six figures in many cases) than 6 years ago. The lack of buyer activity at the higher price points has brought the overall inventory down, as many seller’s know this is not a great time to maximize the sale prices for their homes. This means when good inventory comes on the market at an attractive price, there is a good chance of moving it, but buyers are very sensitive to price right now and want to feel like they’re getting a good deal.

Here’s the stats for surrounding communities:

Blackfalds:

Current Active Listings – 104

Sales in July – 17

Likelihood to Sell – 16% (buyer’s market)

Sylvan Lake:

Current Active Listings – 176

Sales in July – 26

Likelihood to Sell – 15% (buyer’s market)

Penhold:

Current Active Listings – 36

Sales in July – 12

Likelihood to Sell – 33% (balanced market)