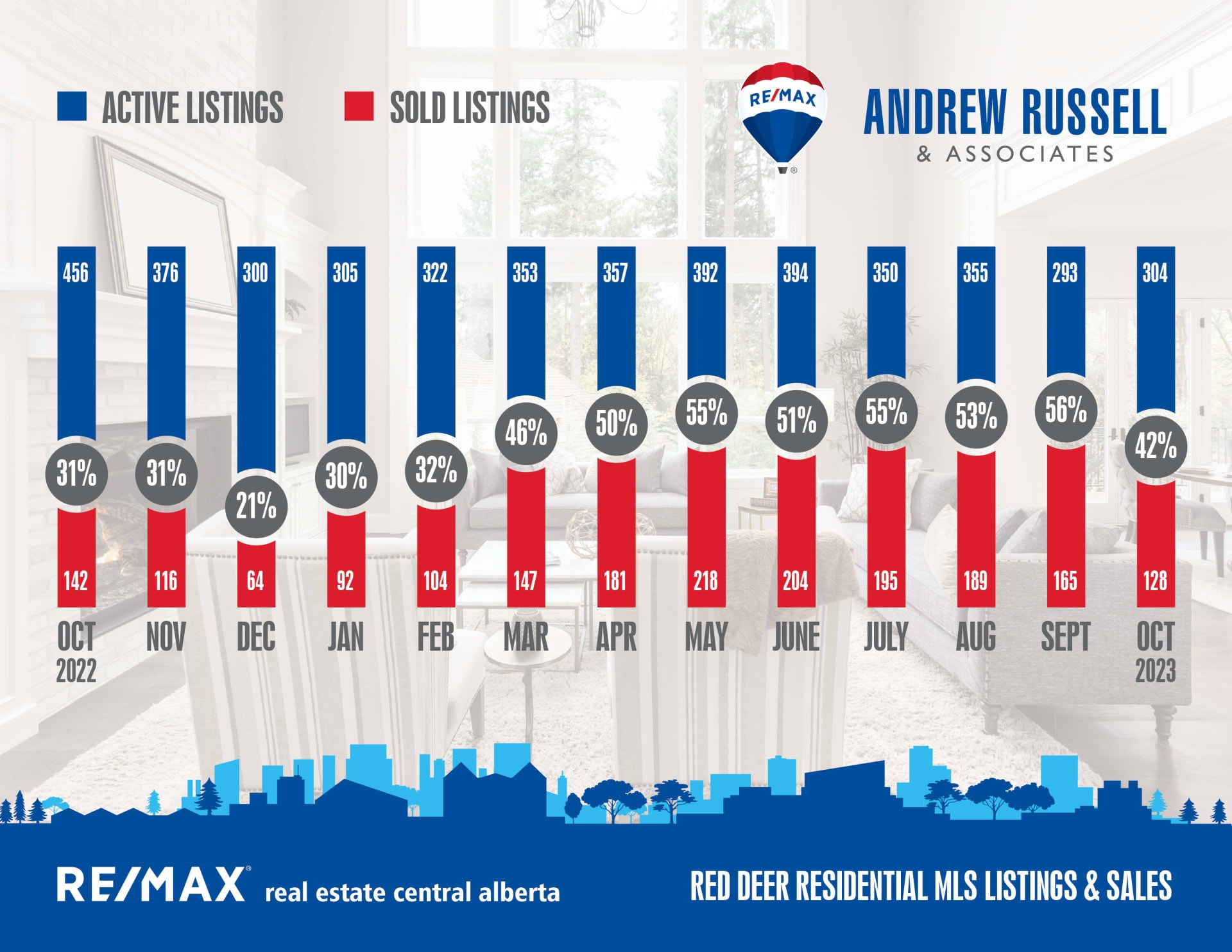

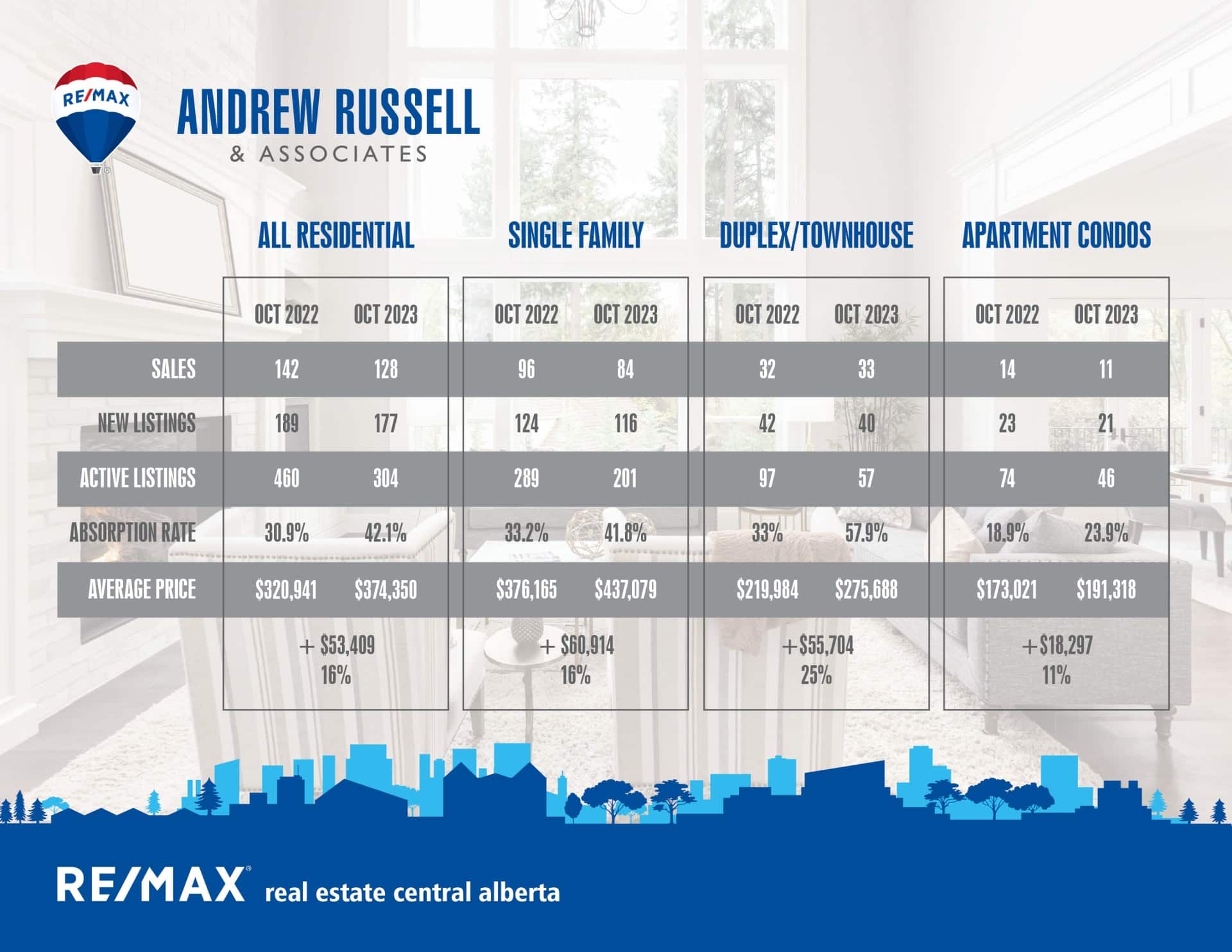

October sales dipped 22% (or 37 sales) from September, however this is a pretty normal trend as we move into the winter months. Inventory has remained stable but still historically low, currently sitting at 291 listings as I type this, with 18.5% of those with conditional offers in place.

The market is still in great shape overall, and the Bank of Canada choosing to hold interest rates should help keep things active. For reference, ATB currently has a 5 year rate at 5.69% and 3 year rates are sitting at 6.14%. The forecast is still that we’ll see rates start to drop by mid 2024, however there are too many variables at play to really know. Inflation appears to be heading in the right direction, but we’ve seen it fluctuate a bit, which could continue.

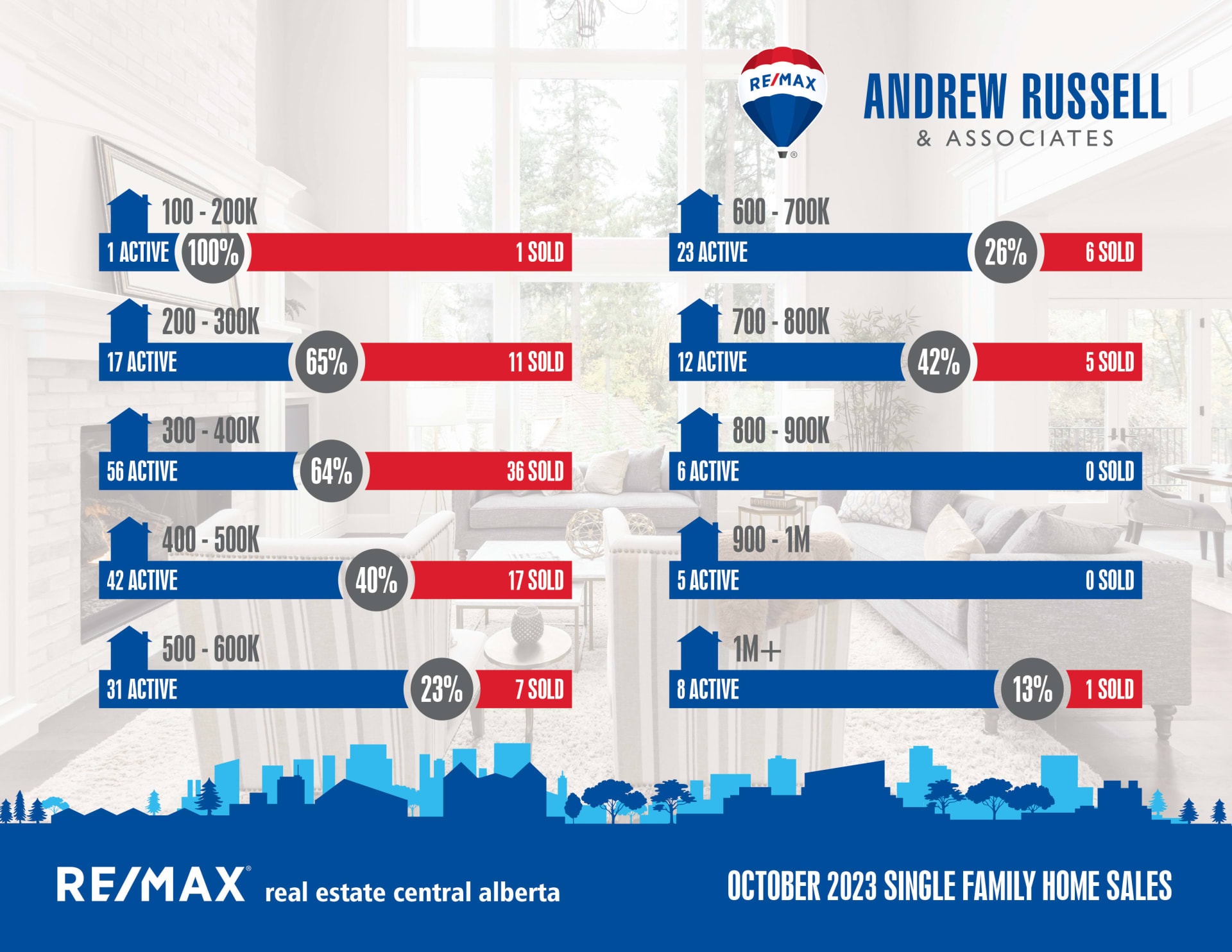

Single family homes under $400k are still in high demand, while over $400k has started to ease off a bit and sales numbers are slowly ticking down. I’m starting to see lots of offers on homes over $400k coming in with “subject to sale of home” conditions again. Now that we’re later in the year, migration from other provinces has slowed down, and local buyers either don’t qualify to hold two homes or aren’t confident enough that their home is a guarantee to sell, so they’re looking for sellers to be more flexible with them.

For the last 2 years, the trend for the majority of buyers is they want turn key, move in ready homes. Homes that need work, updating, and renovations do not sell at the same pace as move in ready homes. I believe that access to money and trades has become a big factor in this. Using a line of credit to renovate a home will cost you 10-12% interest on average, whereas if you buy move in ready, you can put it on the mortgage and be done with it. With that being said, buyers are not willing to overpay just for the sake of it, largely due to the rest of their lives becoming less affordable thanks to the massive cost of living increases. Demand levels in Central Alberta haven’t hit the point where people will just buy whatever they can get a hold of just to secure a property.

Elsewhere, markets in Ontario and BC are cooling, and prices are dropping. While this is great if you want to buy in those markets, it could slow down provincial migration next year if people opt to wait for those markets to bounce back before they relocate. I’m not sure that’s the smart play, especially if prices continue to increase in Alberta, however people are generally hesitant about selling in down markets unless there’s necessity involved. If the number of people moving into Alberta slows down, it will obviously slow our market down as well. While I don’t see us going back into a buyer’s market at any point in the near future, or any situation where prices come down, it’s possible we could see pricing and demand stabilize until interest rates start to come down.

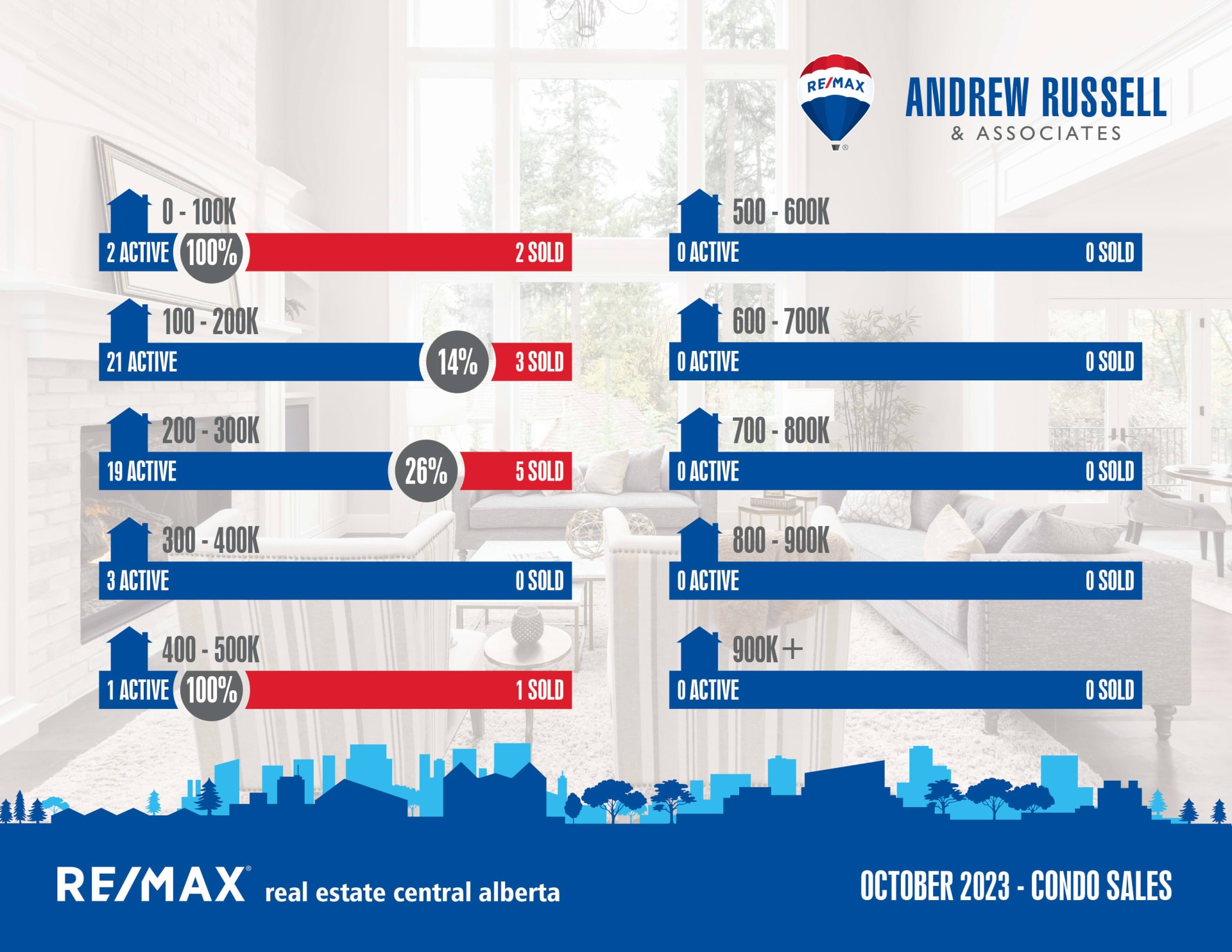

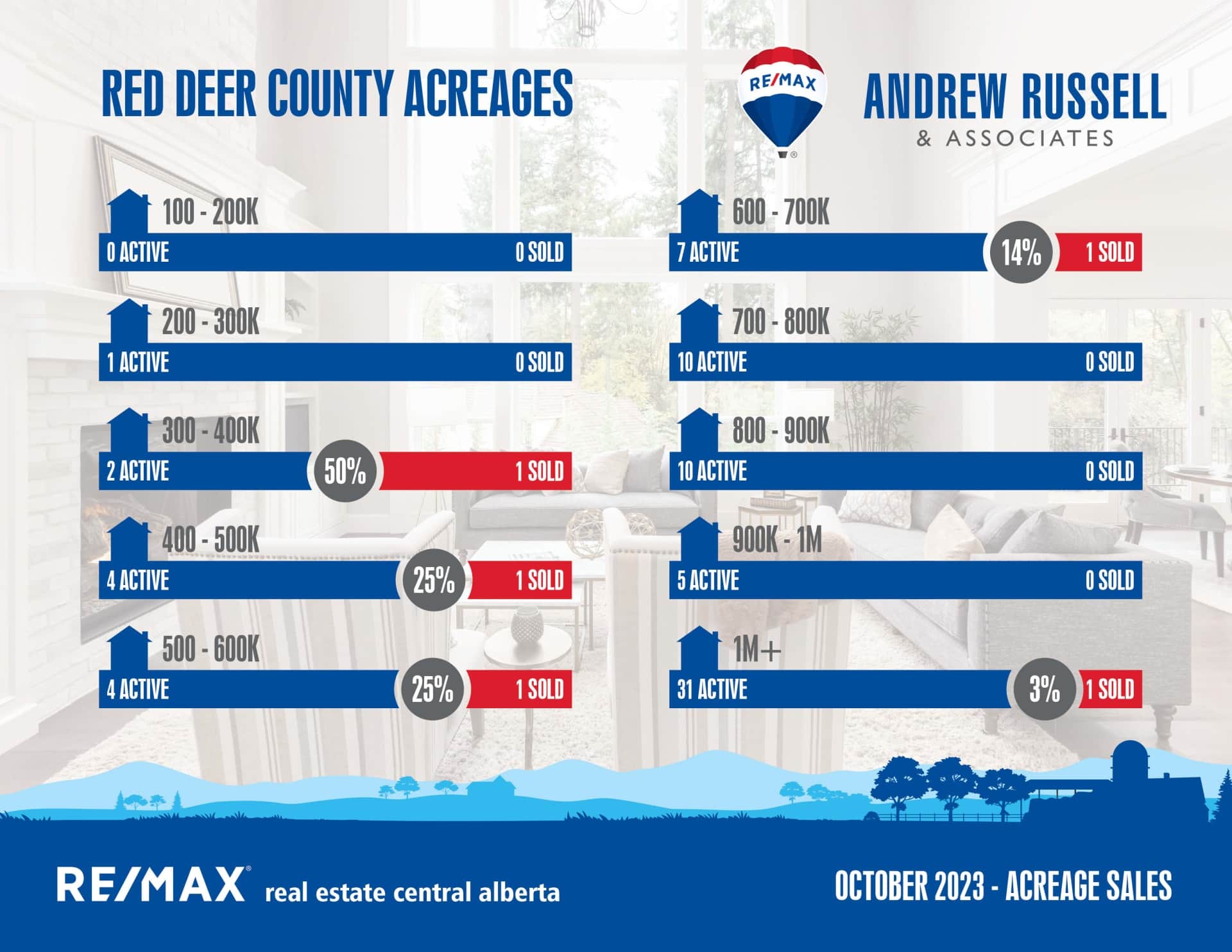

Looking at the stats, acreage availability is very low unless you’re shopping over 1 million, as has been the case for most of this year. Demand for condos has also cooled down, although options for nicer/newer units is quite limited at this point. The single family market is still ticking along nicely, with activity slowing down once you get up over 400k, although the 700-800k had a more active month, and we did see 1 home sell over a million. It was an infill property in Mountview that sold for $1,650,000 after 232 days on market, the most expensive sale to date in Red Deer for 2023. There have been a total of 7 homes sold over 1 million in town this year. Interestingly enough, there’s only been 4 acreages in Red Deer County on 10 acres or less than have sold over 1 million in 2023, which means luxury buyers are opting for city life over acreage life.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 34

Sales in October – 21

Likelihood to Sell – 61.7% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 109

Sales in October – 46

Likelihood to Sell – 42% (Balanced Market)

Penhold:

Current Active Listings – 13

Sales in October – 3

Likelihood to Sell – 23% (Balanced Market)