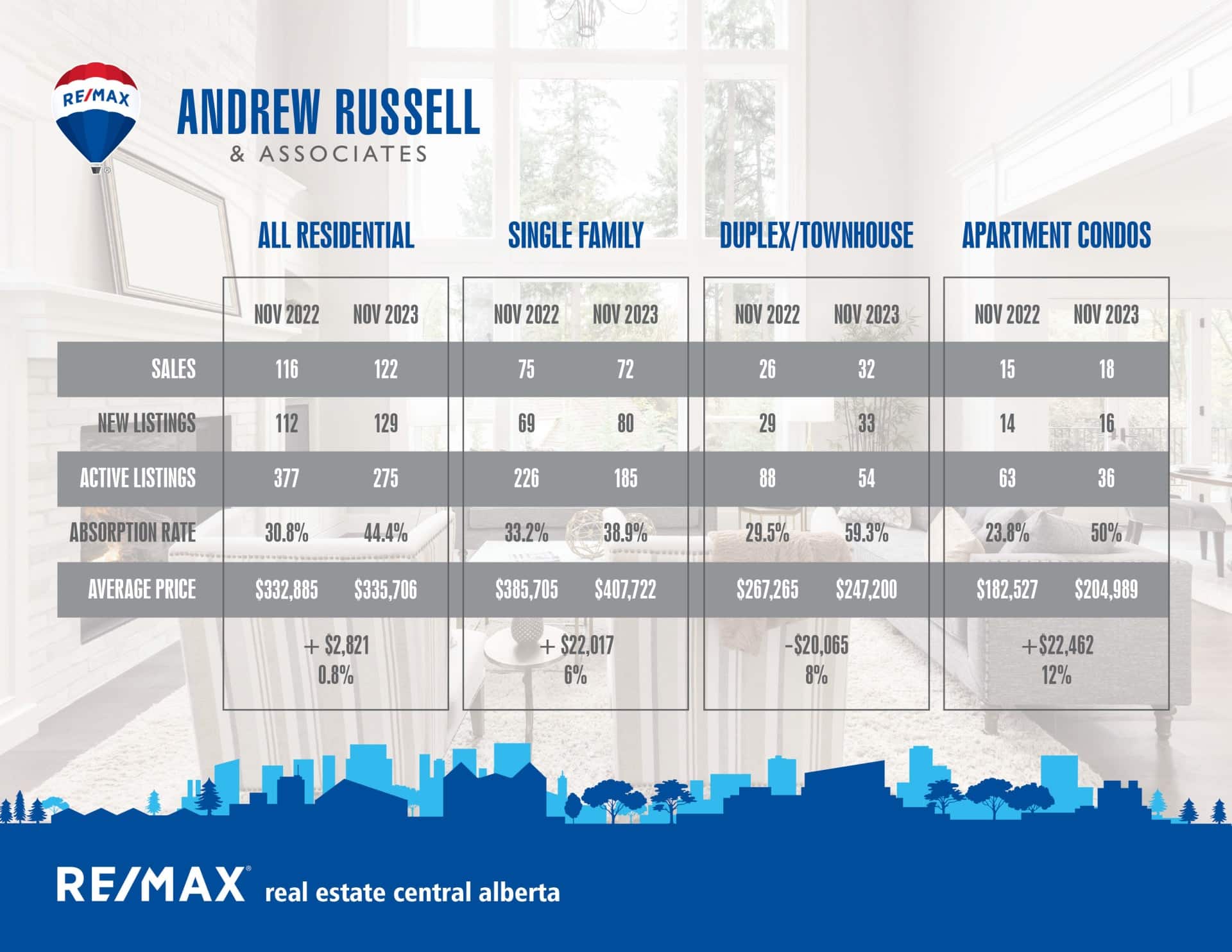

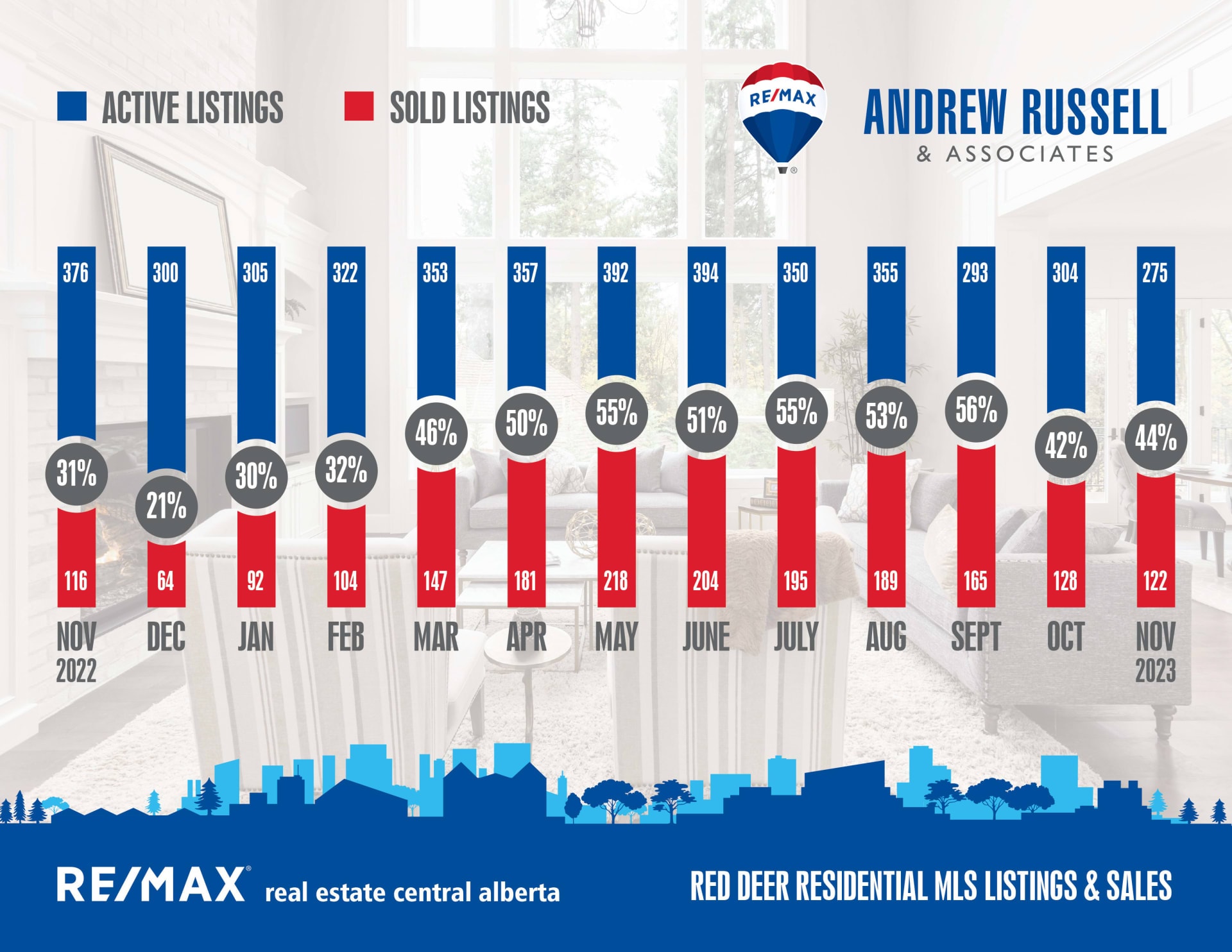

The market remains strong and we saw another good month of activity in November, with Red Deer posting 122 sales. Sales were down slightly from October, but inventory has dropped even more. As I type this, Red Deer has 254 properties on the market, and 43 of those are marked with pending sales. Year to date sales in Central Alberta are down 12% compared to 2022, largely due to there being less homes available to buy.

Alberta’s economy is humming along in high gear. The Provincial Government’s Major Projects website lists 555 projects across all sectors valued at $178 Billion that are either proposed or underway. Some notable projects include Dow’s $11.5 billion petrochemical project in Fort Saskatchewan, the De Havilland Aircraft plant in Balzac and the new $1.8 billion Red Deer Regional Hospital.

Alberta has experienced employment gains of 4.1 percent in 2023, well above the national average of 2.5 percent with 8,900 jobs added in November. And, the Province is projecting a $5.5 billion surplus for this fiscal year. All that economic activity combined with lower cost of living has enticed almost 200,000 people to the province in the past year. It’s no wonder our housing markets are still very busy in spite of historical low housing inventories and high interest rates. Those low inventory levels will likely persist for the foreseeable future because the residential construction industry doesn’t have enough access to trades to keep up to the level of demand. It seems good news is always tempered by challenges, but we believe the future is incredibly bright for Albertans.

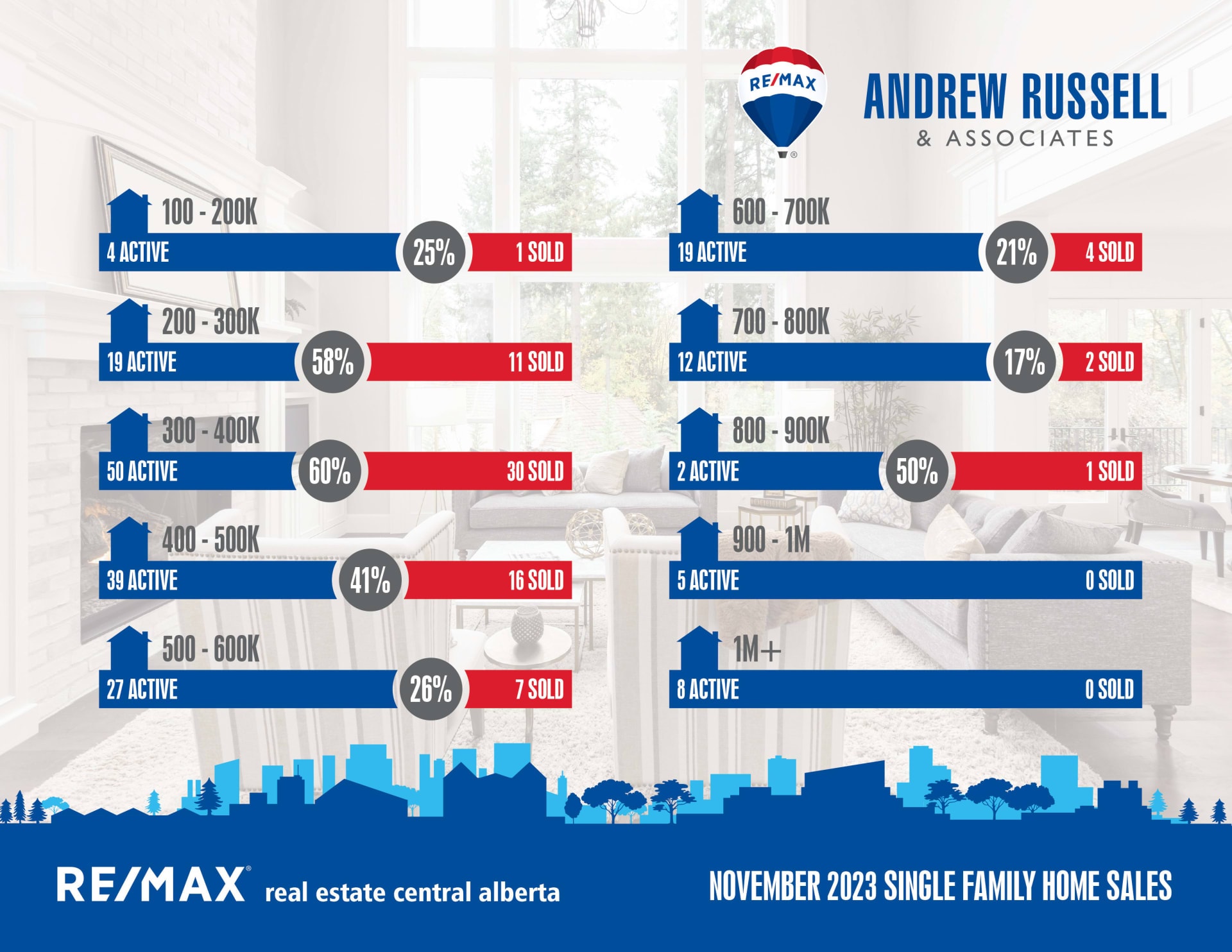

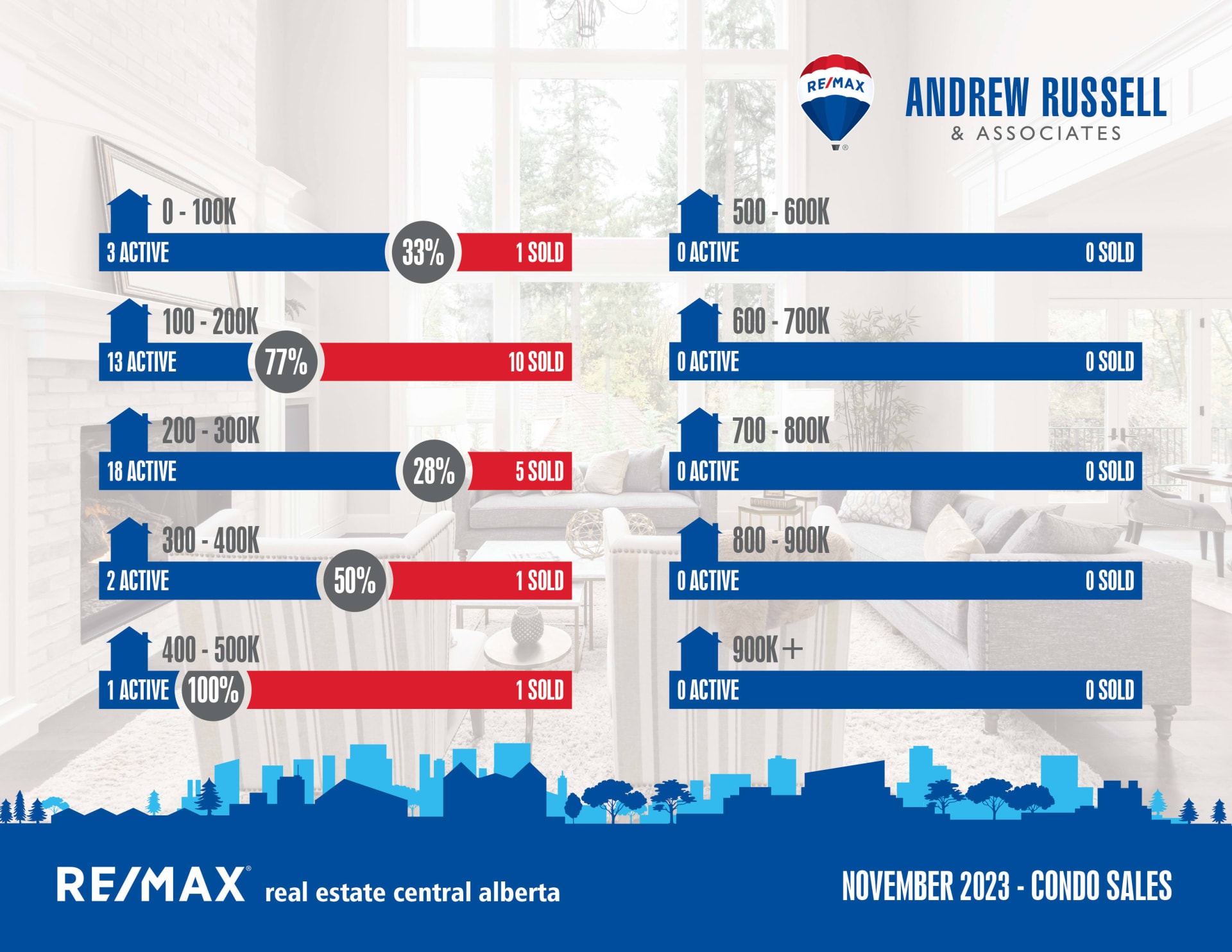

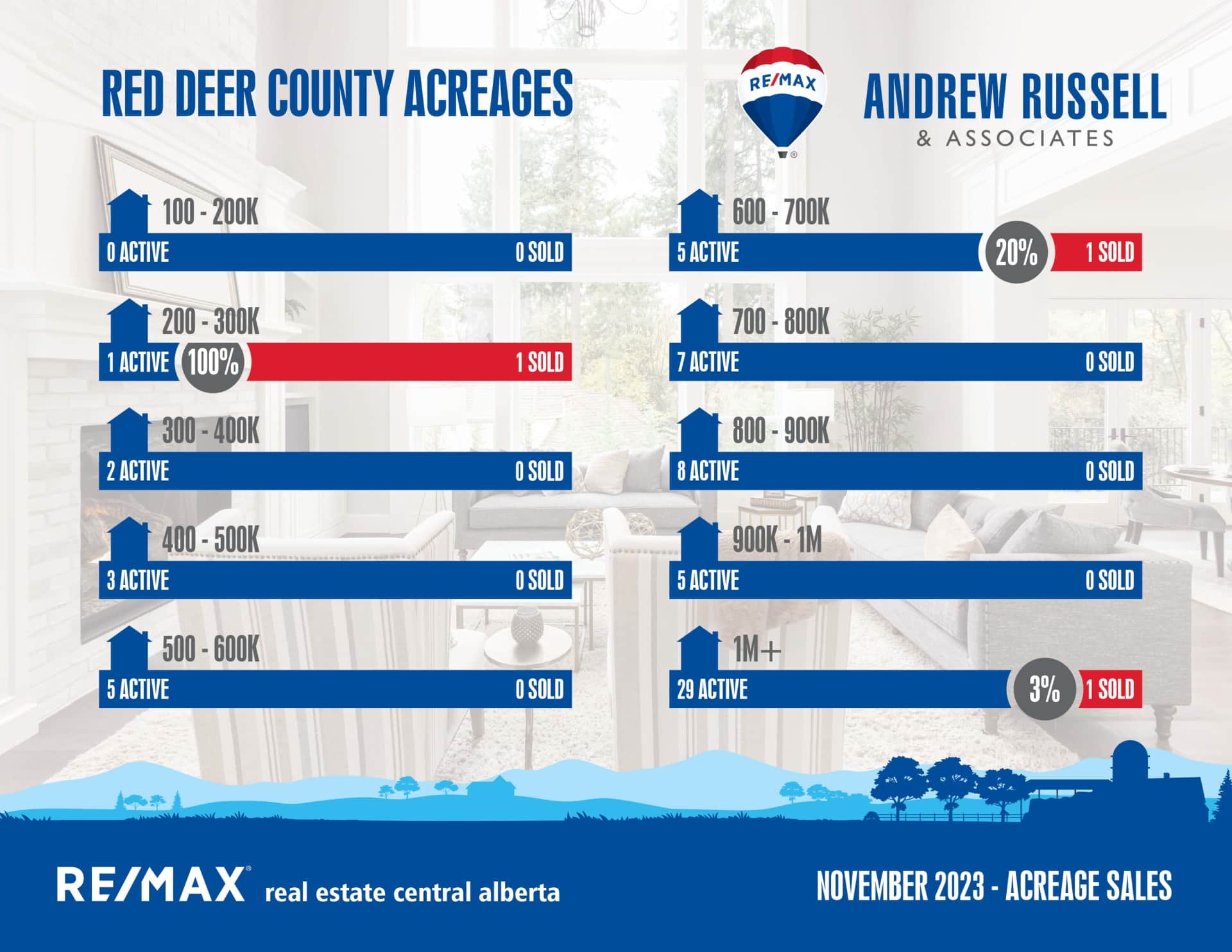

Demand for all types of homes under $500k is still very high, which has been the case for the last 2 years now. Acreage sales were very slow in November, with only 3 sales in all of Red Deer County, however it’s normal for acreage sales to temper in winter months, and once again low inventory is having a big impact here. Looking at average days to sell in Red Deer, the days increase as you move up the price scale, which is reflected in sales numbers, from as low as 38 days in the 300-400k range, and as high as 163 days in the 900k-1m range. If we see rates come down in summer of 2024 as predicted, it should help increase activity at the higher price points, however I’m expecting rate drops to very incremental, likely .25% at a time, so it’ll be a slow and steady process.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 33

Sales in November – 13

Likelihood to Sell – 39% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 105

Sales in November – 27

Likelihood to Sell – 25% (Balanced Market)

Penhold:

Current Active Listings – 9

Sales in November – 6

Likelihood to Sell – 66% (Seller’s Market)