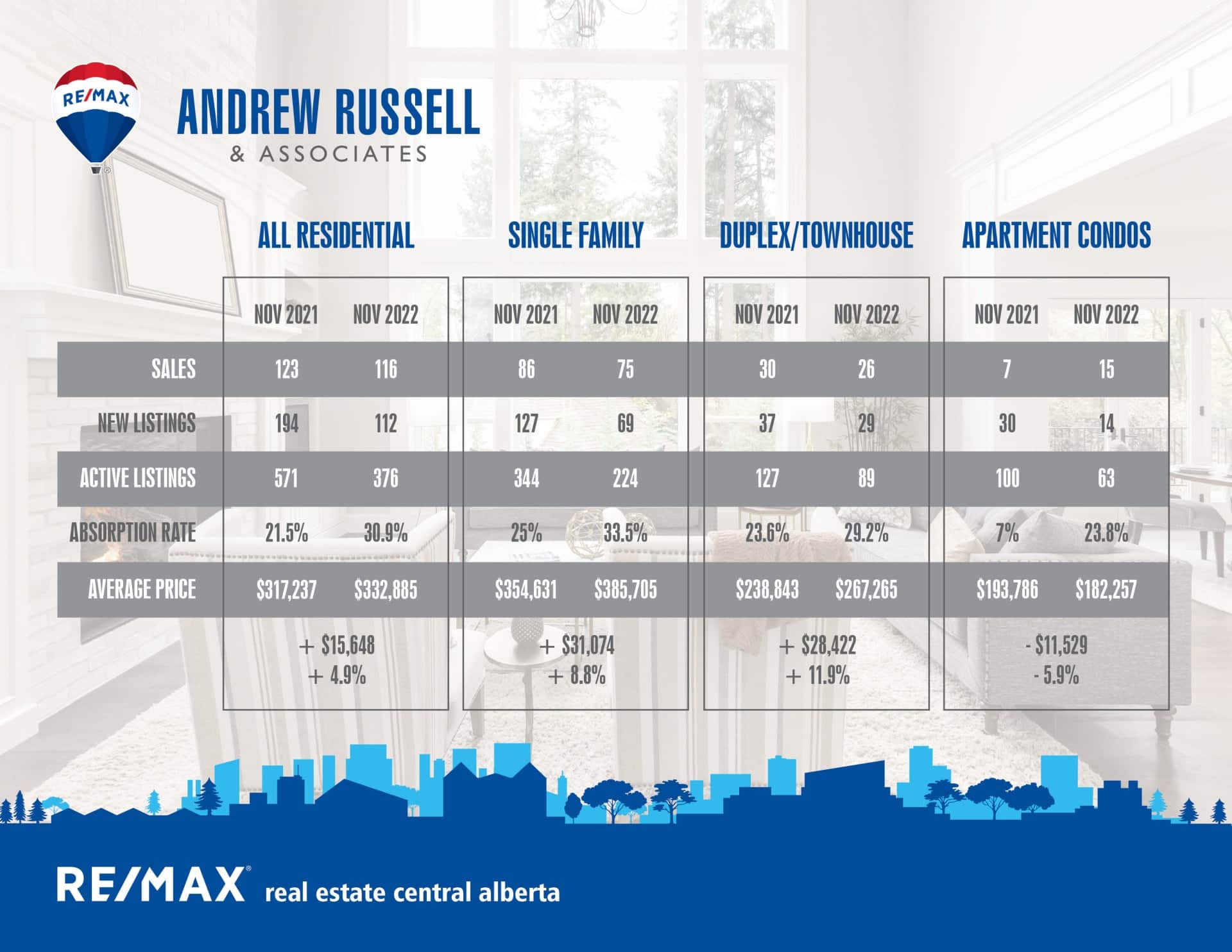

November sales saw an 18% drop from October, however it’s normal for sales to decline month over month as we head into December. The drop can be explained by two factors, 1. The weather this November – below average temperatures and heavy snowfalls (and disastrous road conditions) that discouraged all but the most motivated buyers and sellers, and 2. Diminished supply – not enough homes in the right price ranges to satisfy buyers. There were 376 active listings in Red Deer on December 1st, 2022 compared to 571 active listings in Red Deer on December 1st, 2021. That’s a 33% drop in available homes to purchase.

Low inventory is likely to be a theme in 2023. With the increase in rates, many current home owners will be stretched to re-qualify for their current home, let alone be able to upgrade or increase their mortgage amounts, therefore we’ll see less listings on the market as more people chose to stay put. Combine that with a high volume of people moving into the province from Ontario and BC, and suddenly choices for re-sale homes are few and far between.

If fixed interest rates remain in the 5% range, there’s a good chance we’ll see prices increase in Alberta in 2023. RE/MAX just released their national housing report and are forecasting a 2% – 7% increase in Alberta home prices over the coming year. Current predictions are that we’ll see two more 0.25% rate hikes to prime, and then should see it stabilize for the rest of the year. It’s important to know that the Bank of Canada rate does not necessarily affect fixed rates. Given that so many mortgages in Canada were stress tested to the 5.2% mark over the last 6 to 7 years, and most of those loans are insured by CMHC (aka the Federal Government), I think there’s a good chance that fixed rates will stay in the low to mid 5% range this year.

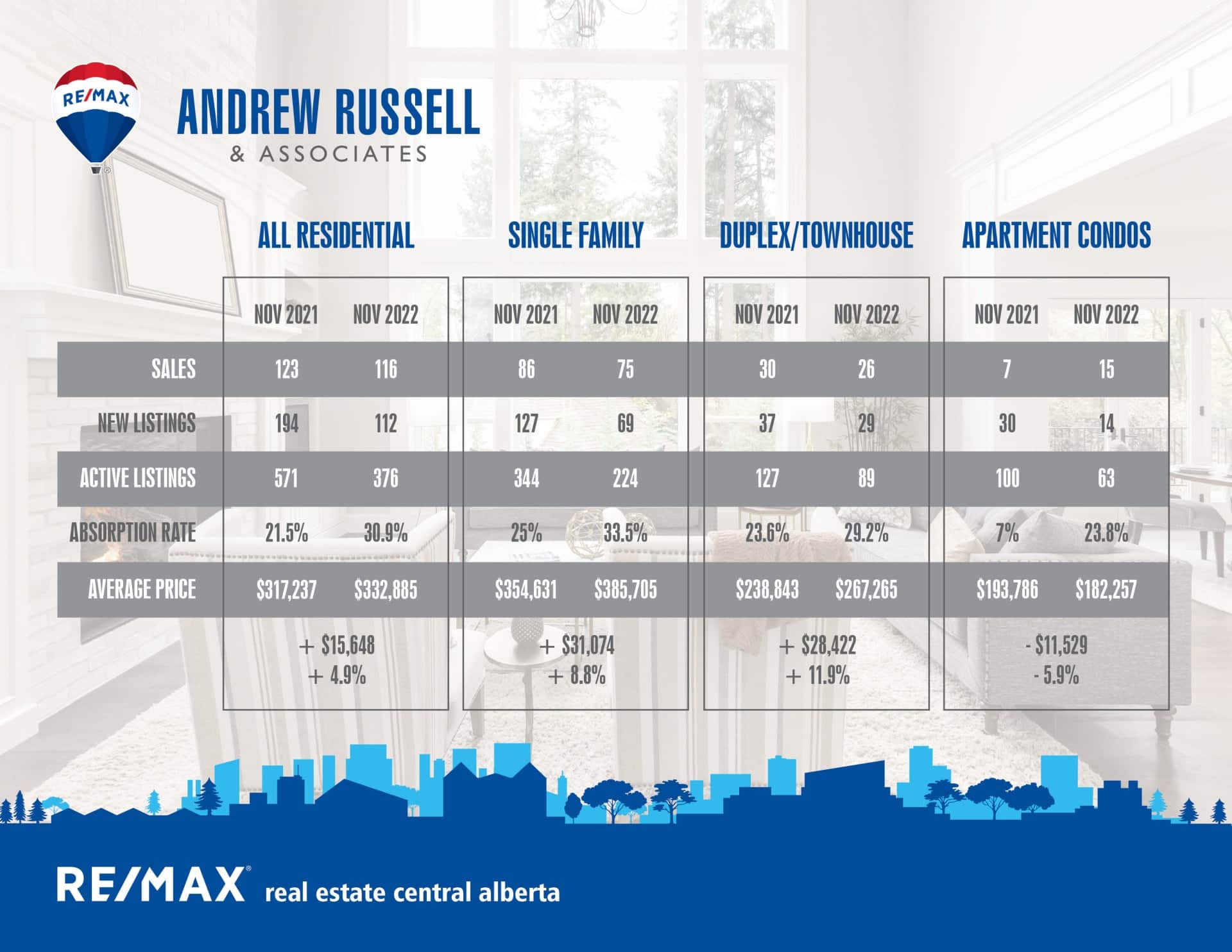

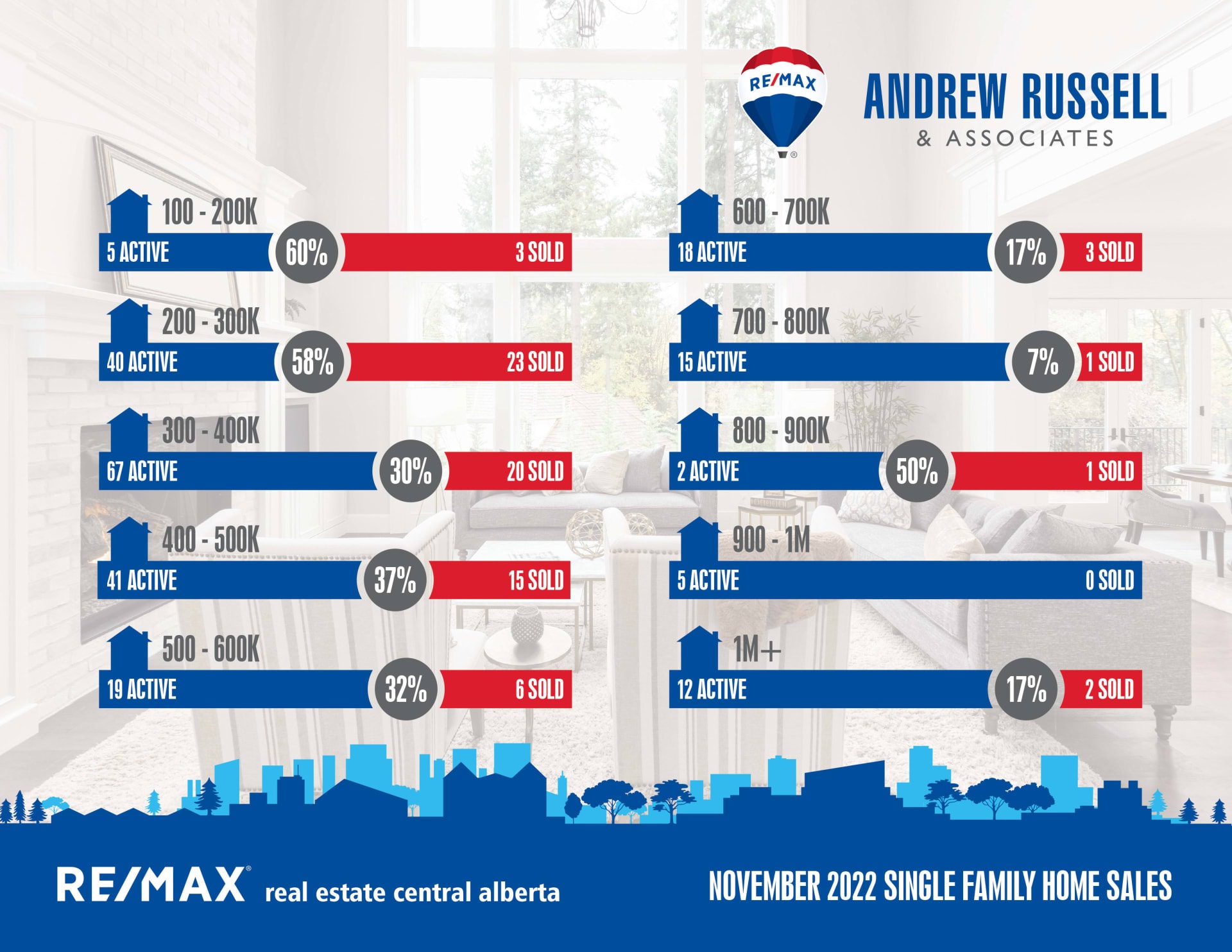

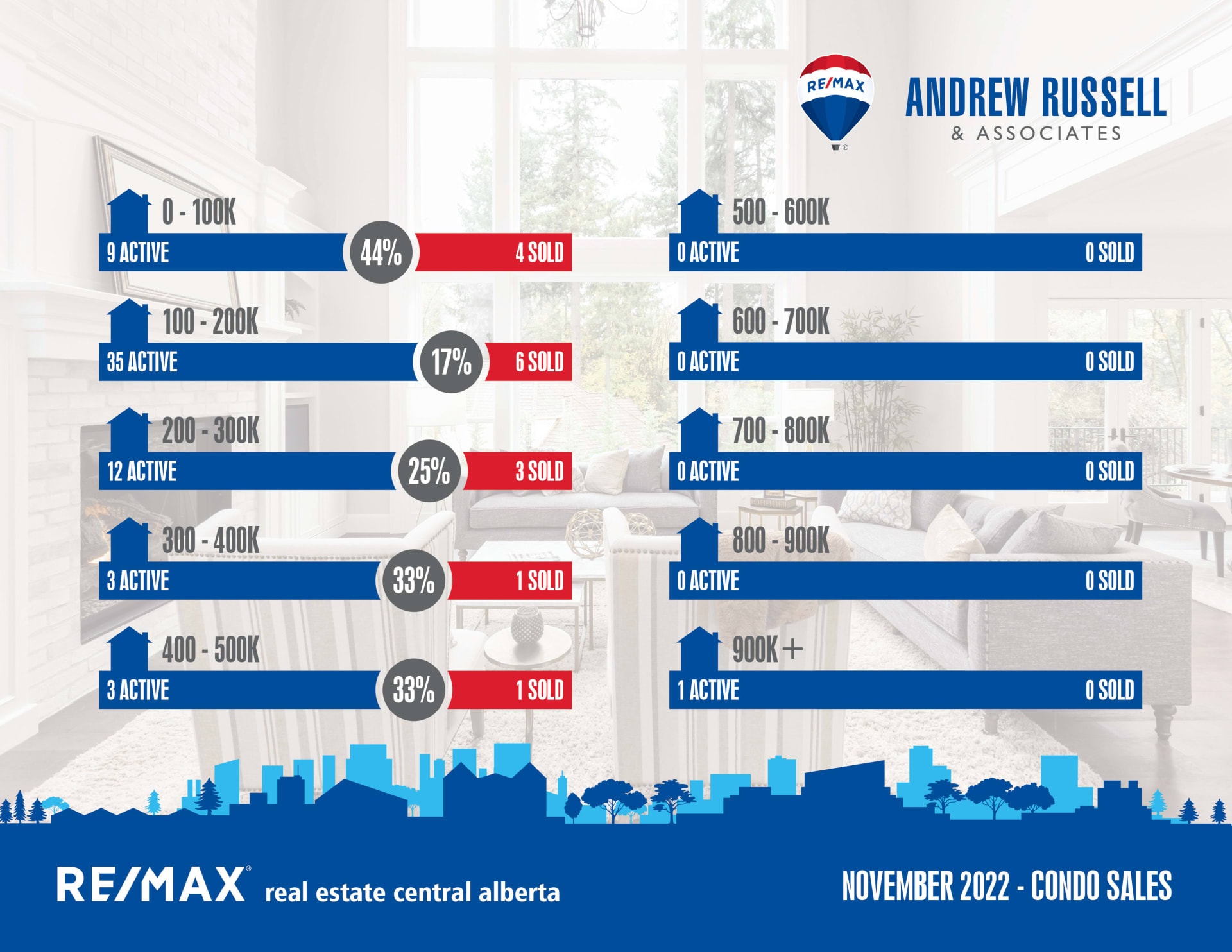

Higher interest rates increase the overall cost of a home for a buyer, because most people who are financing a home use their monthly payment as the bar for what they can buy. A $400,000 home purchased with 5% down at 2.5% interest over 25 years used to cost $1770/mo. That same home at 5% now costs $2299/mo. If $1770 was the maximum monthly payment you could afford, you’re now shopping for homes at $300,000 instead. This explains the strong demand for homes under $500,000, and lower demand for homes at the higher end of the scale. In theory, the higher end market could see prices fall, however cash buyers coming from other provinces may bolster that market as well.

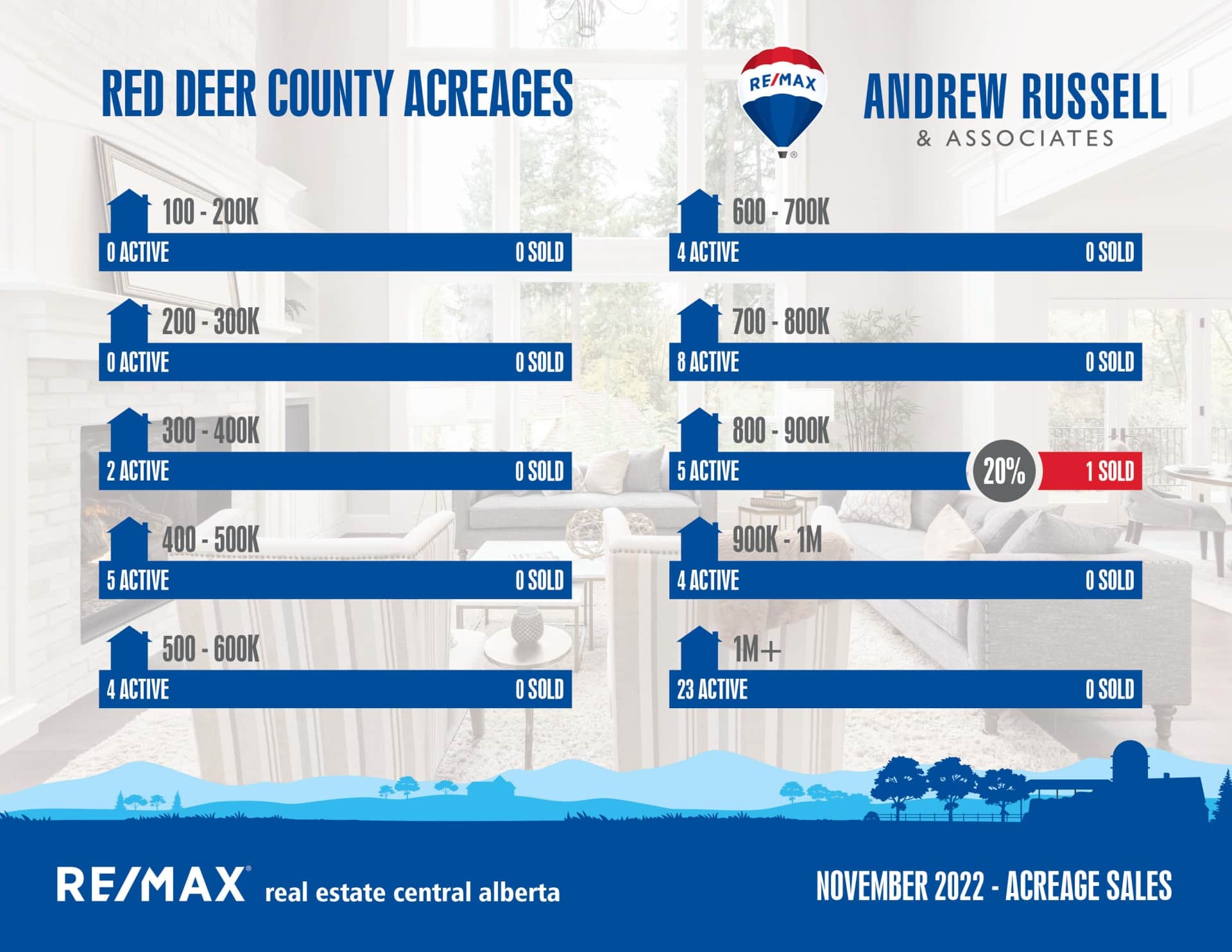

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 43

Sales in November – 13

Likelihood to Sell – 29.6% (Balanced Market)

Sylvan Lake:

Current Active Listings – 100

Sales in November – 24

Likelihood to Sell – 22.5% (Balanced Market)

Penhold:

Current Active Listings – 19

Sales in November – 2

Likelihood to Sell – 10.5% (Buyer’s Market)