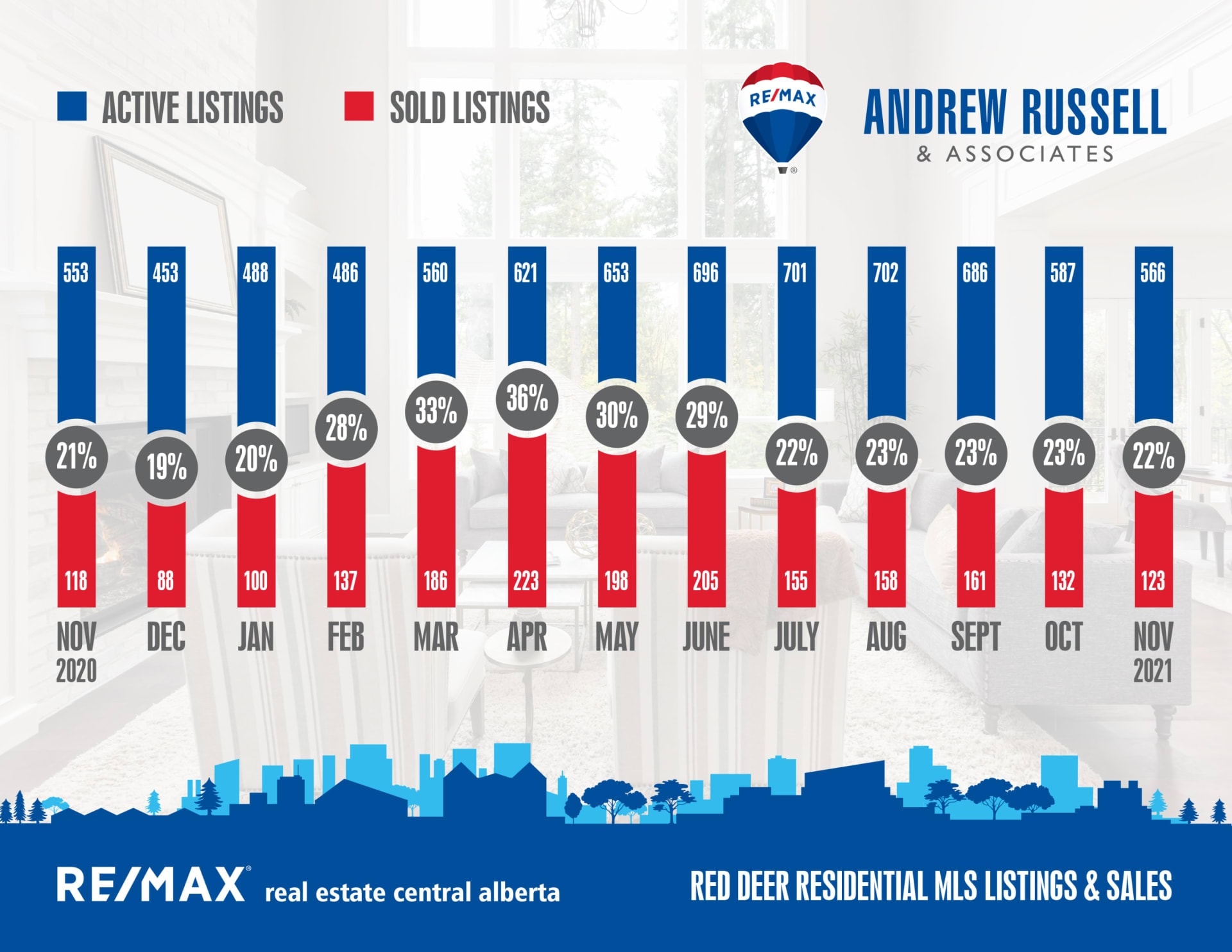

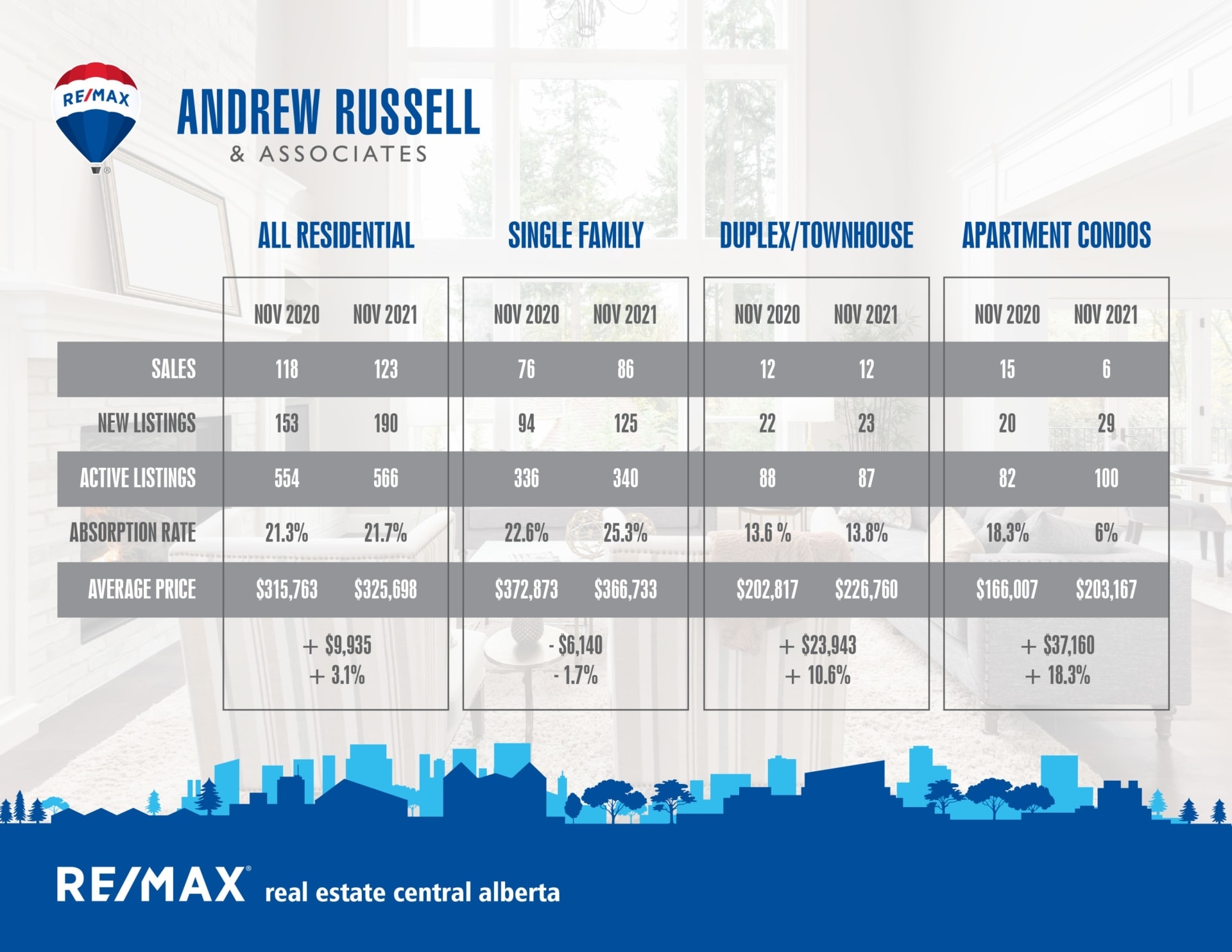

Another steady month for real estate in Central Alberta. Listings and sales in Red Deer both dropped slightly, with the market selling 22% of the inventory in November. We’ve consistently seen about 22-23% turnover every month now since July, a nice steady pace and balanced market for buyers and sellers.

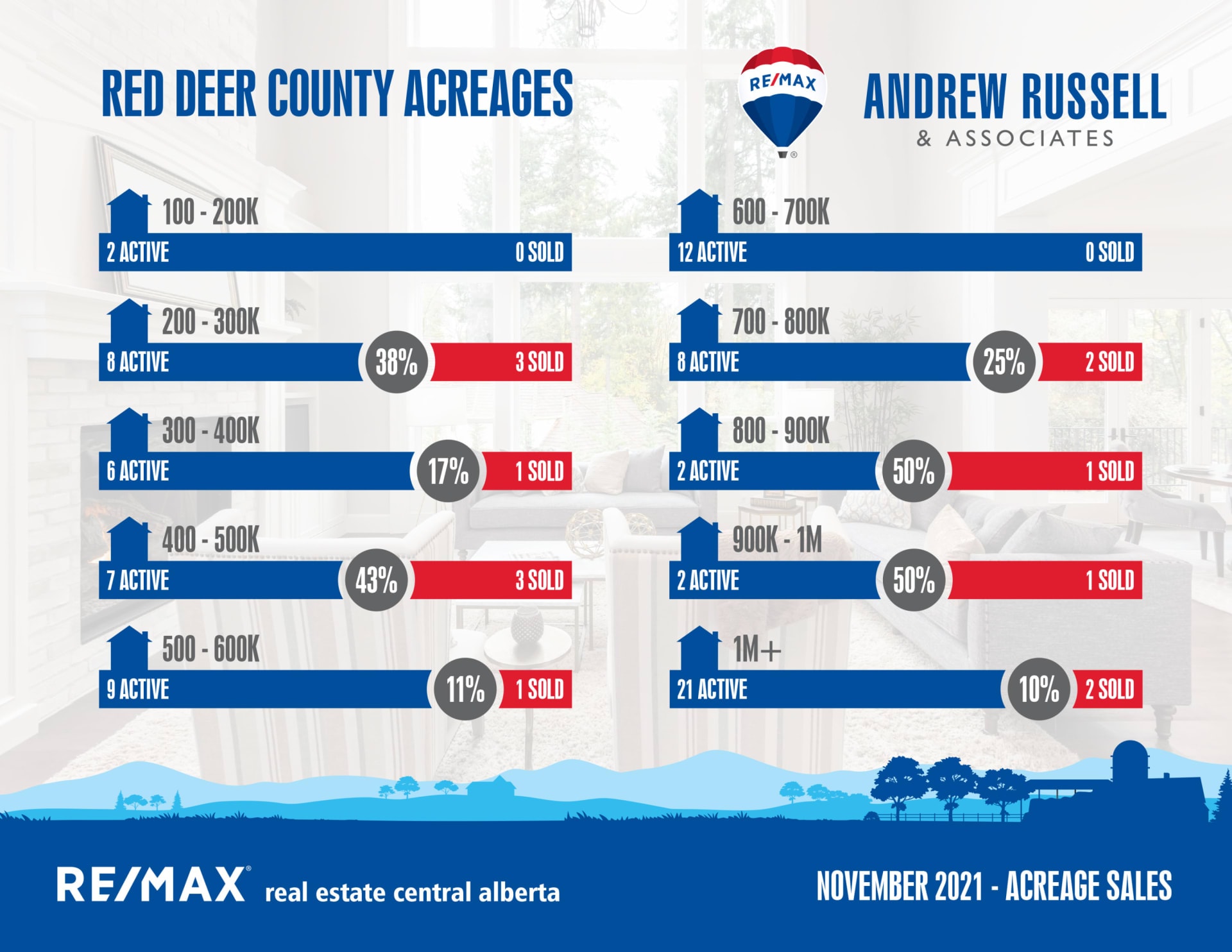

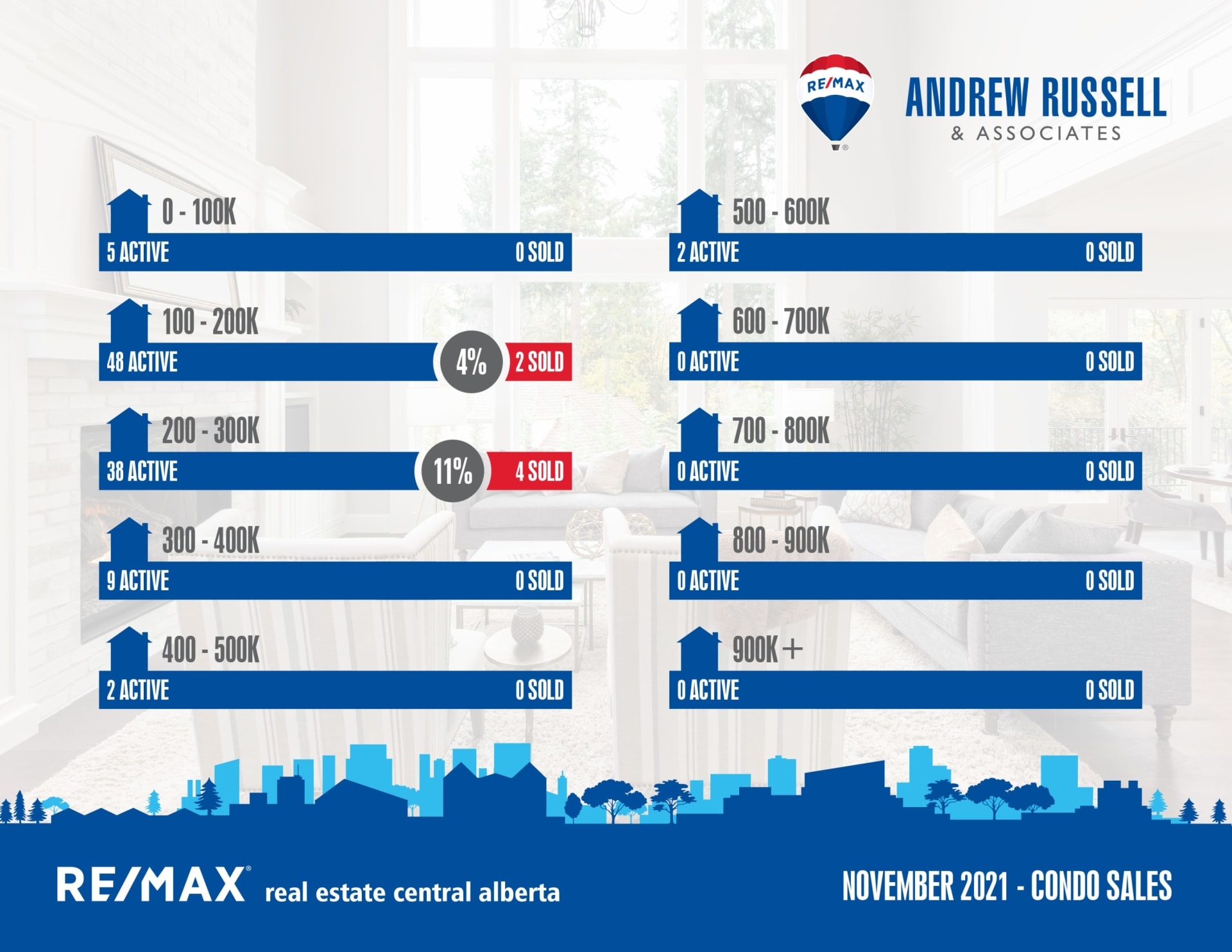

Housing categories have also been consistent, with single family sales under $600,000 still making up the bulk of the market activity. Sales over $600,000 have almost completely dropped off, with only 2 sales last month, however I believe some of these buyers are opting to custom build new homes instead given the limited inventory available at these price points, which then won’t register in our MLS sales. Acreages had a fairly active month for this late in the year, likely due to our mild fall and winter so far, while apartment condos continue to lag with only 6 sales despite 100 active listings for sale.

Fixed interest rates are on the rise, with many 5 year fixed rates now pushing up around 2.5 – 2.7% for most buyers. Historically, these are still amazing rates, but if you were looking at rates of 1.9 – 2% a couple of months ago, it seems like a steep increase. The bank of Canada announced that prime rate will continue to stay the same for now, although I expect to see increases there as we move into 2022, which will impact variable rates. Most banks are still offering prime minus 1 or 1.25% on variable rates, which would leave a buyer with a mortgage rate of 1.2 – 1.45%, something that was unheard of prior to COVID.

My forecast for 2022 is another stable and active year, although I’m not sure if we’ll see the same level of spring activity that we had in 2021. While travel is still somewhat limited and inconvenient, the world is much more open and available than it was a year ago. The surge in our market was largely caused by people not being able to go anywhere or do anything, and I don’t expect this to be the case next year. I do believe Alberta’s economy is moving in the right direction, however to see real estate prices increase we need demand to increase. In order for prices in Central Alberta to move up the same way that they have been in the larger cities, we need to create jobs that will bring people into our community. Calgary has been doing a good job of this, driving up demand for real estate and spurring growth in the bedroom communities like Airdrie, Cochrane, Crossfield, and Carstairs, however jobs in Calgary don’t equate to increased demand in Red Deer. Our increases in 2007 and 2014 were pushed by high paying oil jobs, but I’m not sure we can rely on that industry alone to drive people to Central Alberta anymore.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 87

Sales in Nov – 25

Likelihood to Sell – 30% (balanced market)

Sylvan Lake:

Current Active Listings – 123

Sales in Nov – 20

Likelihood to Sell – 17.7% (buyer’s market)

Penhold:

Current Active Listings – 27

Sales in Nov – 3

Likelihood to Sell – 11.5% (buyers market)