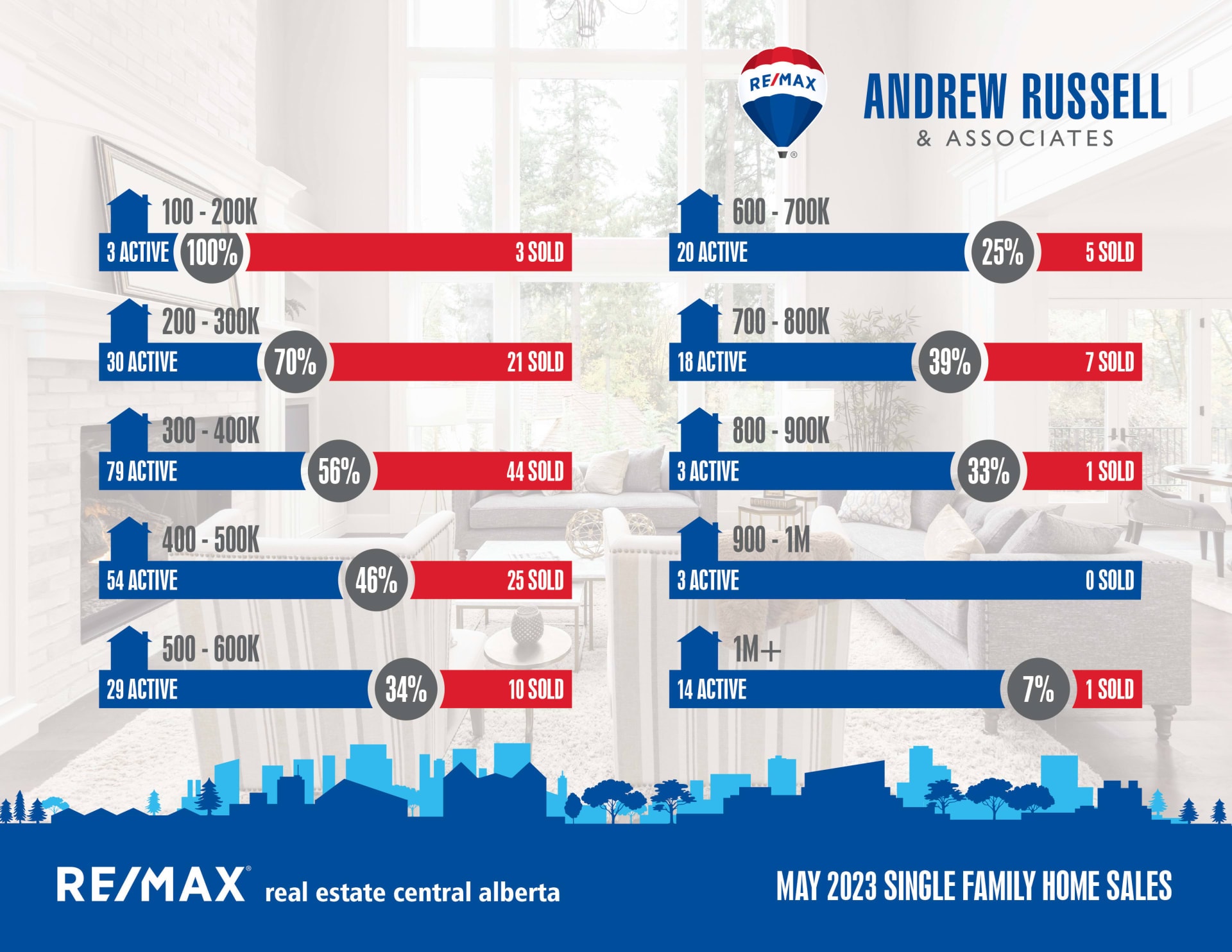

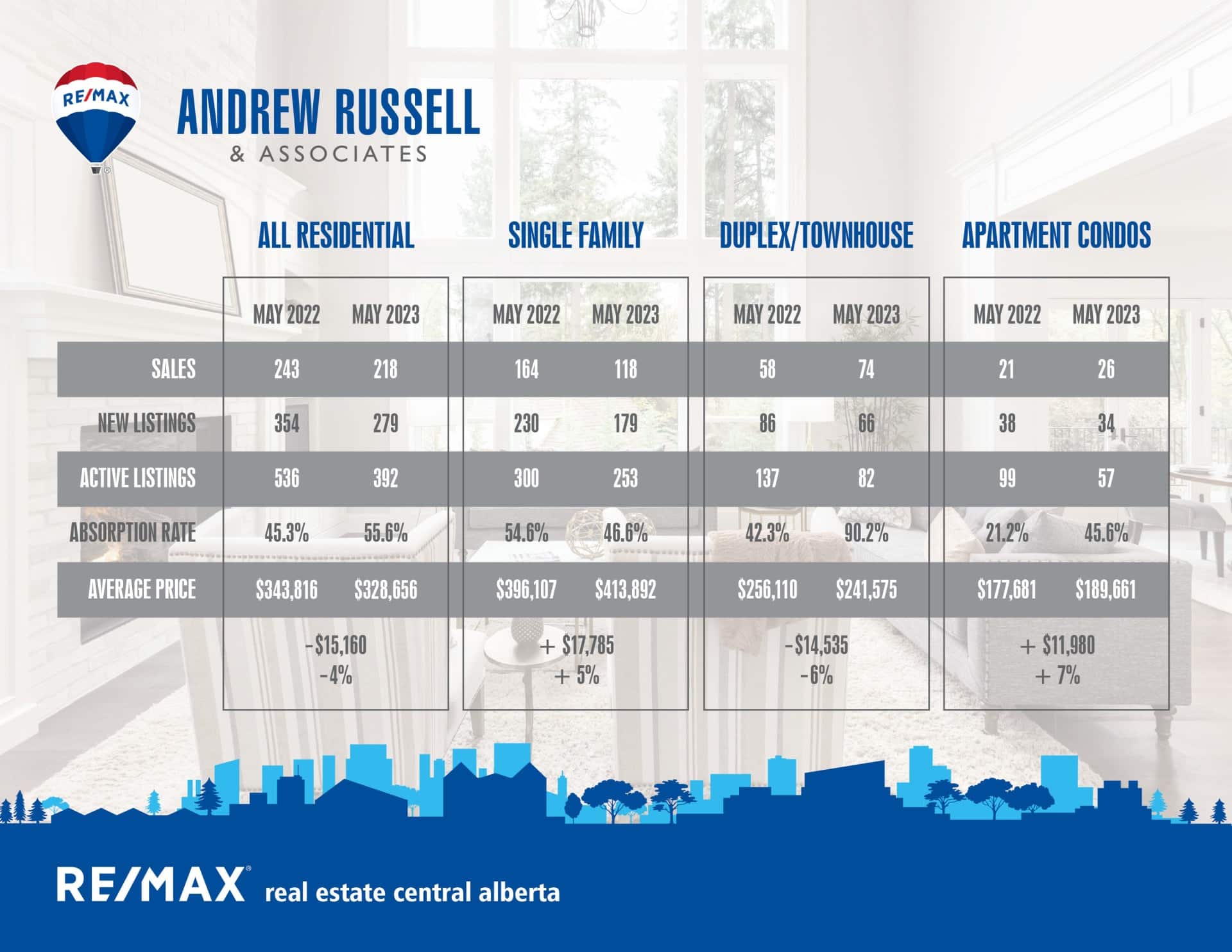

Residential MLS sales in Central Alberta stayed strong in May, posting sales numbers that almost don’t make sense considering the high interest rates and inflation that seems to be plaguing the rest of the economy. Central Alberta sales were up 19.2% compared to April’s, but are down almost 30% year to date compared to the same time in 2022. The concerning issue for the Central Alberta market is the lack of inventory at the beginning of June, down almost 25% compared to June 2022. Most central Alberta markets are experiencing severe shortages of available homes for sale relative to the demand, especially in the lower price ranges. While sales are strong and inventory is low, buyers are still averse to homes they think are priced too high, and there’s still plenty of those properties sitting on the market. In 2022, there was a rush to buy quickly to beat rising interest rates, and buyers were less concerned about overpaying for a home, and more concerned about locking in sooner to get that better interest rate. Because rates are “mostly” stable now, only the people moving on strict timelines are motivated, whereas the others will wait around for the right home to come on the market. It’s also important to note that most properties selling right now are not selling at list price, buyers are expecting sellers to negotiate from their price unless the home is only a day or two on the market.

The Bank of Canada raised its prime lending rate by 0.25% this week in response to persistent inflation and a resilient job market. The banks responded with the same increase in their prime lending rate which has already led to an increase in fixed rates.

The provincial election in Alberta is over and the uncertainty that was clouding our economic future is set aside for another four years. That means investment in Alberta will continue, generating more jobs and more immigration from other countries and more in-migration from other provinces, which in turn will create more demand for housing in our already over-subscribed market. That demand will push prices up in spite of interest rate pressure going the other way. Higher prices will create a favorable environment for new construction which will slowly help the market back to balance.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 53

Sales in May – 28

Likelihood to Sell – 58% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 133

Sales in May – 51

Likelihood to Sell – 40.1% (Seller’s Market)

Penhold:

Current Active Listings – 17

Sales in May – 13

Likelihood to Sell – 79% (Seller’s Market)