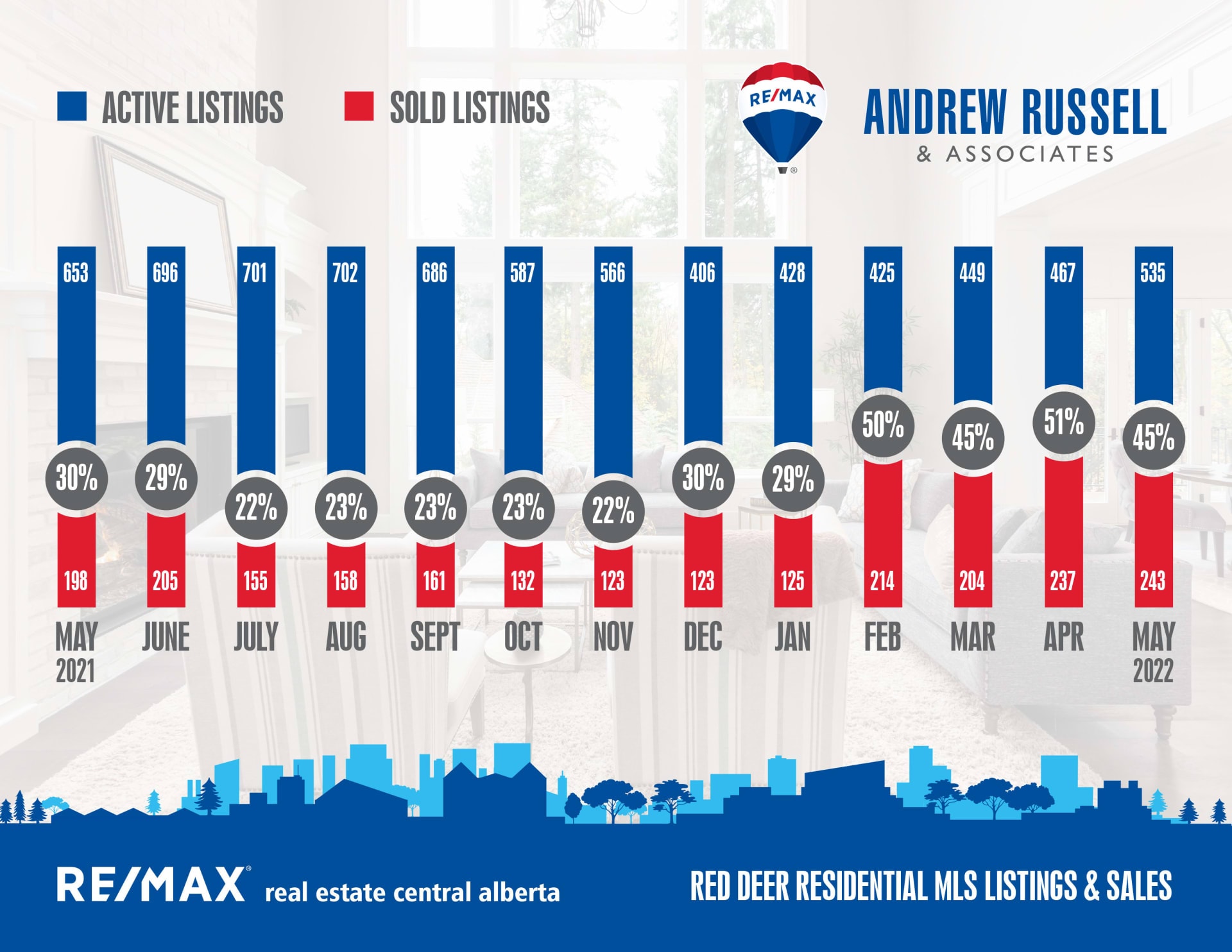

Another great month for real estate in Central Alberta! With that being said, the tides are turning, and while the stats don’t show it yet, rising interest rates are beginning to cool the market. On June 1st the Bank of Canada increased its prime rate by 0.5%, and we’re hearing that it’s going to increase another 0.5% at their next meeting in July. Given that inflation is still drastically higher than they had hoped, it’s very possible they’ll continue to increase those rates through the year.

Vancouver and Toronto markets have already shifted, with some now reporting that prices are dropping. For perspective sake, it’s important to remember that a lot of these markets were going up at a rate of $10,000 to $100,000+ per month for a period of YEARS (not months) and that the average price of a home in some locations is still easily 3 – 5x higher than ours. Central Alberta prices for most properties have returned or surpassed our previous high from 2014, and while I think it’s unlikely we’ll see prices drop (largely due to inflation alone) at any point, I do believe they’re likely to stagnate and hold. In my opinion, many properties sold in the last 3-4 months have sold over market value simply due to buyer desperation and lack of inventory, which has set precedents for pricing and allowed other sellers to push for the same. As demand comes down, and the number of listings increase, prices will begin to level off. We’re no longer in a market where it’s feasible to try a listing price $20,000 – $30,000 higher than market value.

While interest rates in the 3,4, and 5% range seem high compared to what we’re used to, they will become normal in a period of time as buyers adapt. As long as there are jobs, a good economy, and a low cost of living in Alberta, it will still be an attractive place for Canadians and will continue to attract new families. I do expect activity will continue to stay strong over the summer as buyers with rate holds look to make purchases prior to those holds expiring.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 67

Sales in April – 44

Likelihood to Sell – 64.7% (seller’s market)

Sylvan Lake:

Current Active Listings – 128

Sales in April – 66

Likelihood to Sell – 48.5% (seller’s market)

Penhold:

Current Active Listings – 18

Sales in April – 12

Likelihood to Sell – 66.7% (seller’s market)