Spring finally feels like it’s here and we’ve seen a bit a blip in the market over the first 10 days or so of April. I’ve noticed things are calming down a bit, and I’m not fully sure yet if this is a result of escalating prices or if the looming federal election has people feeling concerned or hesitant to move forward. We’ll obviously have a better idea around this time next month on how things should look for the remainder of our spring/summer markets.

Here are some quick points for the Red Deer market:

Overall Market Trends

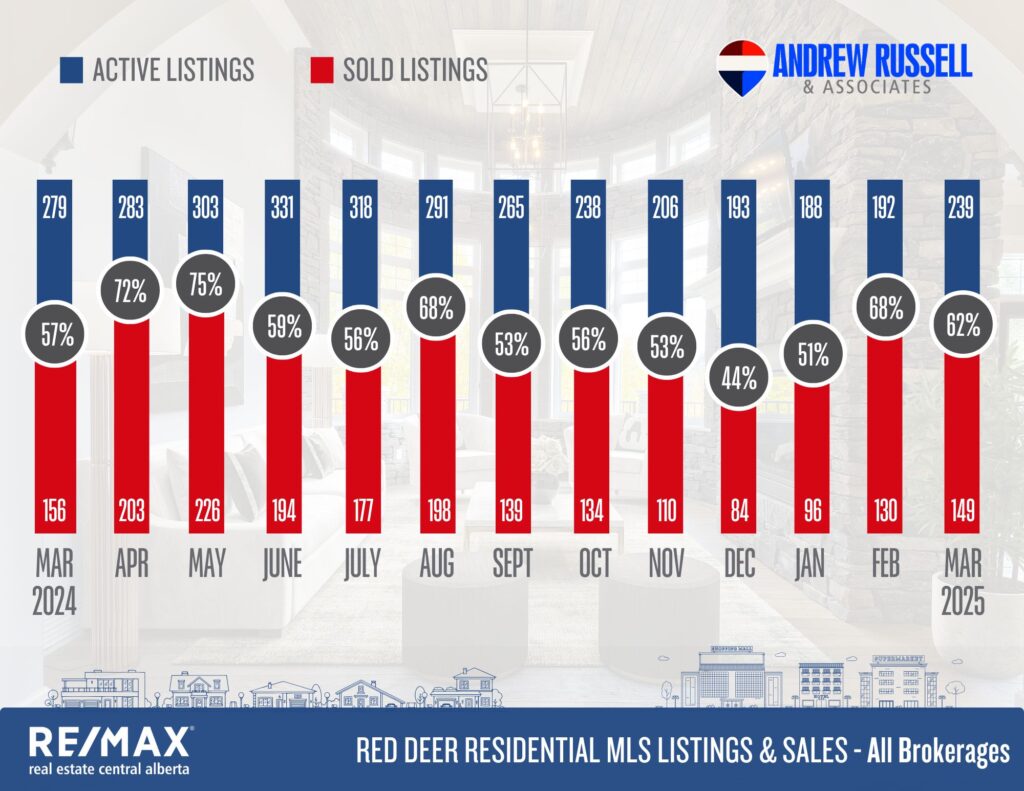

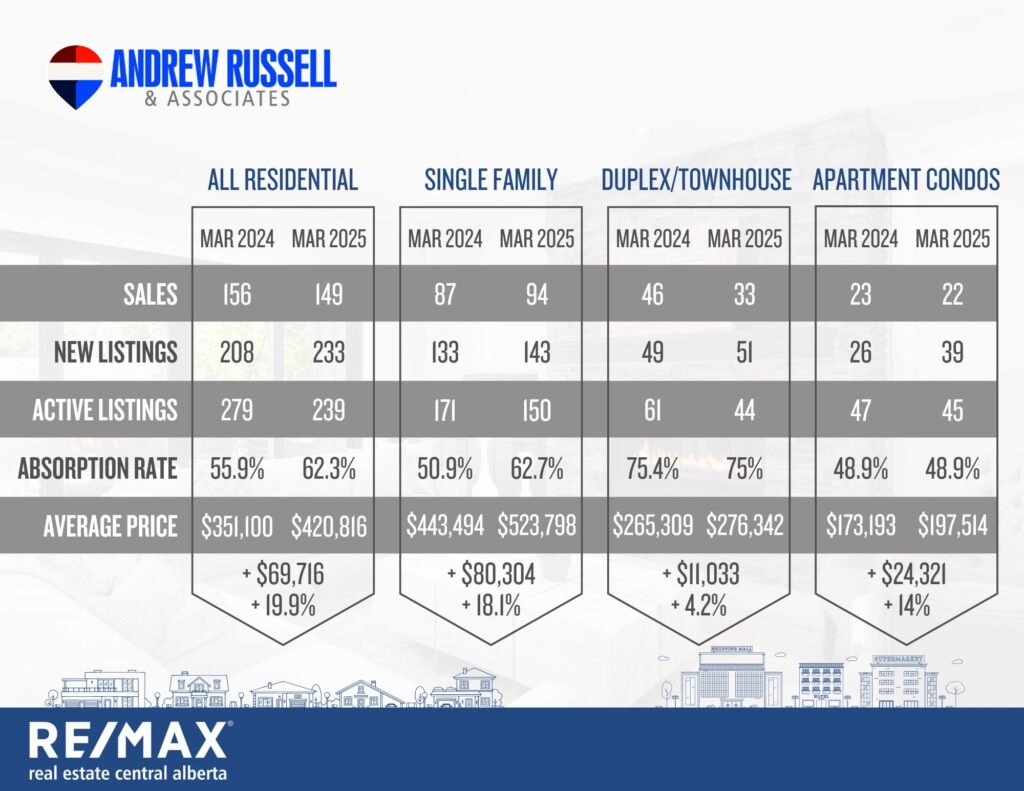

✅ Sales Activity: The overall residential market saw 149 sales in March 2025, down slightly from 156 sales in March 2024.

✅ New Listings: Increased significantly to 233 in March 2025 from 208 in March 2024, indicating an uptick in seller activity.

✅ Active Listings: Dropped from 279 last year to 239 in 2025, suggesting increased demand or faster absorption.

✅ Absorption Rate: Improved from 55.9% to 62.3%.

✅ Average Home Price: Rose by 19.9%, reaching $420,816 compared to $351,100 last year.

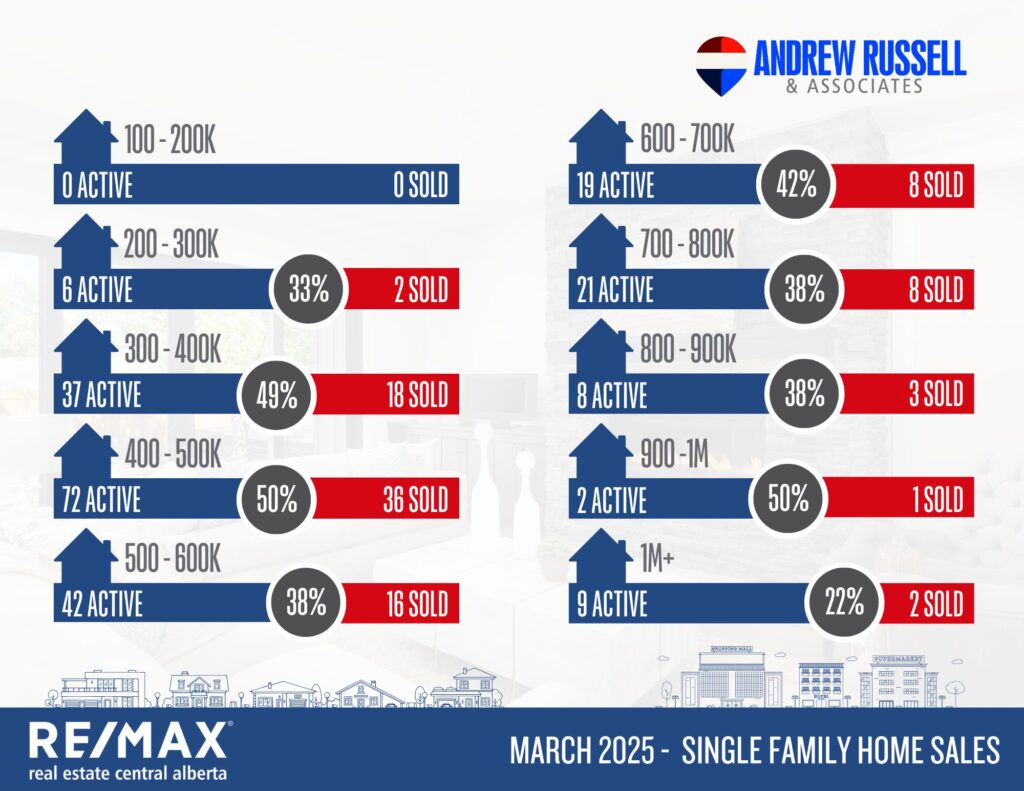

Single Family Homes

???? Sales Performance: Increased slightly from 87 March 2024 to 94 this year.

???? New Listings: Increased from 133 to 143, suggesting more inventory entering the market.

???? Absorption Rate: Saw a significant improvement, rising from 50.9% to 62.7%.

???? Price Growth: Average price surged by 18.1%, from $443,494 to $523,798, showcasing a robust appreciation in property values.

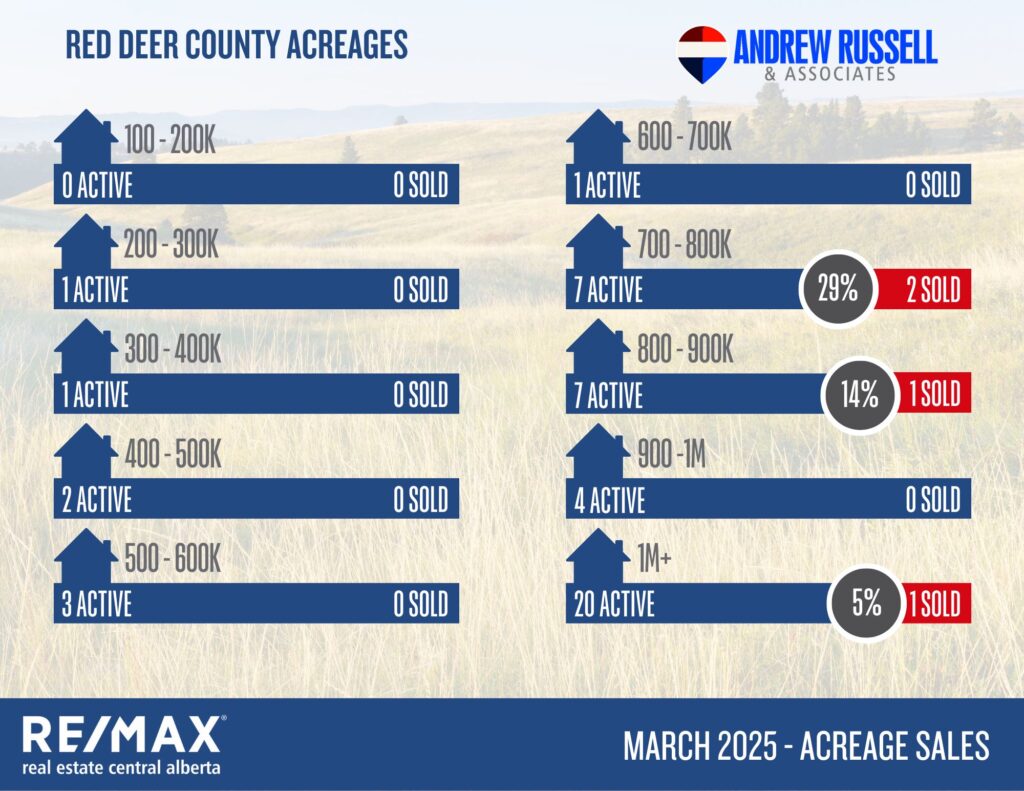

Acreage Market

???? Overall Sales: The acreage market remained sluggish, with very few sales which is typical for late winter and early spring months.

???? High-End Sales: Only 4 sales occurred in the $700K-$1M+ range, while lower price ranges saw no sales activity.

???? Absorption Rates:

29% in the $700K-$800K segment (2 out of 7 listings sold).

5% in the $1M+ segment (1 out of 20 listings sold).

???? Lower-Priced Acreages: Showed no sales movement, indicating buyer hesitancy or a mismatch in pricing expectations.

Market Supply & Demand Trends

???? Inventory Decline: Active listings have steadily declined from a peak of 331 in July 2024to 239 in March 2025, reflecting a tightening market.

⬆️ Current Market Strength: March 2025’s absorption rate of 62% indicates that demand remains strong relative to supply.

⬆️ Sustained Price Growth: With fewer listings and high absorption rates, home prices have continued their upward trajectory, benefiting sellers.

What This Means for Buyers and Sellers

For Buyers:

✅ Higher Prices: Expect increasing costs, especially in the single-family home market.

✅ Tighter Inventory: Acting quickly on desirable properties is key.

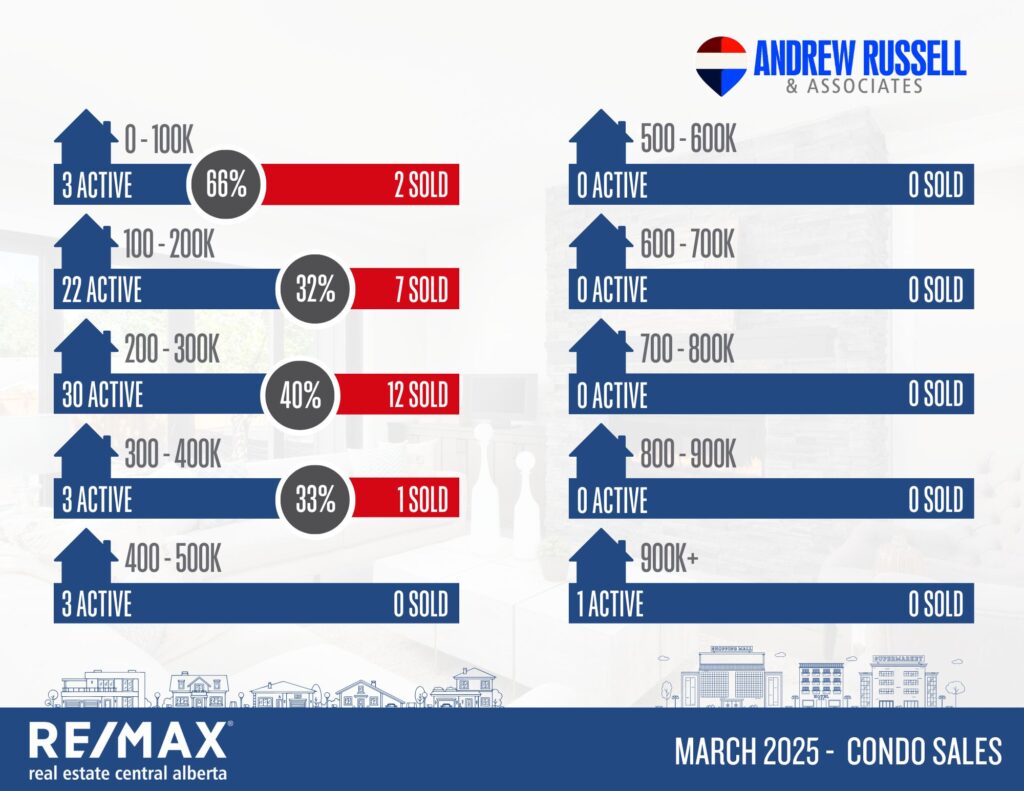

✅ Luxury Market Opportunities: More options available in the $600K-$1M range, where absorption rates are lower.

✅ Acreage Buyer Advantage: Negotiation opportunities as many listings remain unsold.

For Sellers:

✅ Strong Selling Conditions: Rising prices and high absorption rates favor sellers.

✅ Best-Selling Price Ranges: Homes in the $300K-$500K range move quickly.

✅ Acreage Pricing Adjustments Needed: Sellers may need to tweak pricing or improve marketing strategies.

✅ Spring Surge: The next few months are crucial for listing before seasonal demand fluctuates.

The Red Deer real estate market remains strong with rising prices and solid absorption rates, particularly in the single-family home sector. Buyers must act fast in competitive price ranges, while sellers can capitalize on increased demand. Acreage sellers may need to adjust expectations as demand remains slow in that segment.

Surrounding Community Stats:

Blackfalds:

Current Active Listings – 43

Sales in March – 34

Likelihood to Sell – 79% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 78

Sales in March – 34

Likelihood to Sell – 44% (Buyer’s Market)

Penhold:

Current Active Listings – 8

Sales in March – 8

Likelihood to Sell – 100% (Seller’s Market)