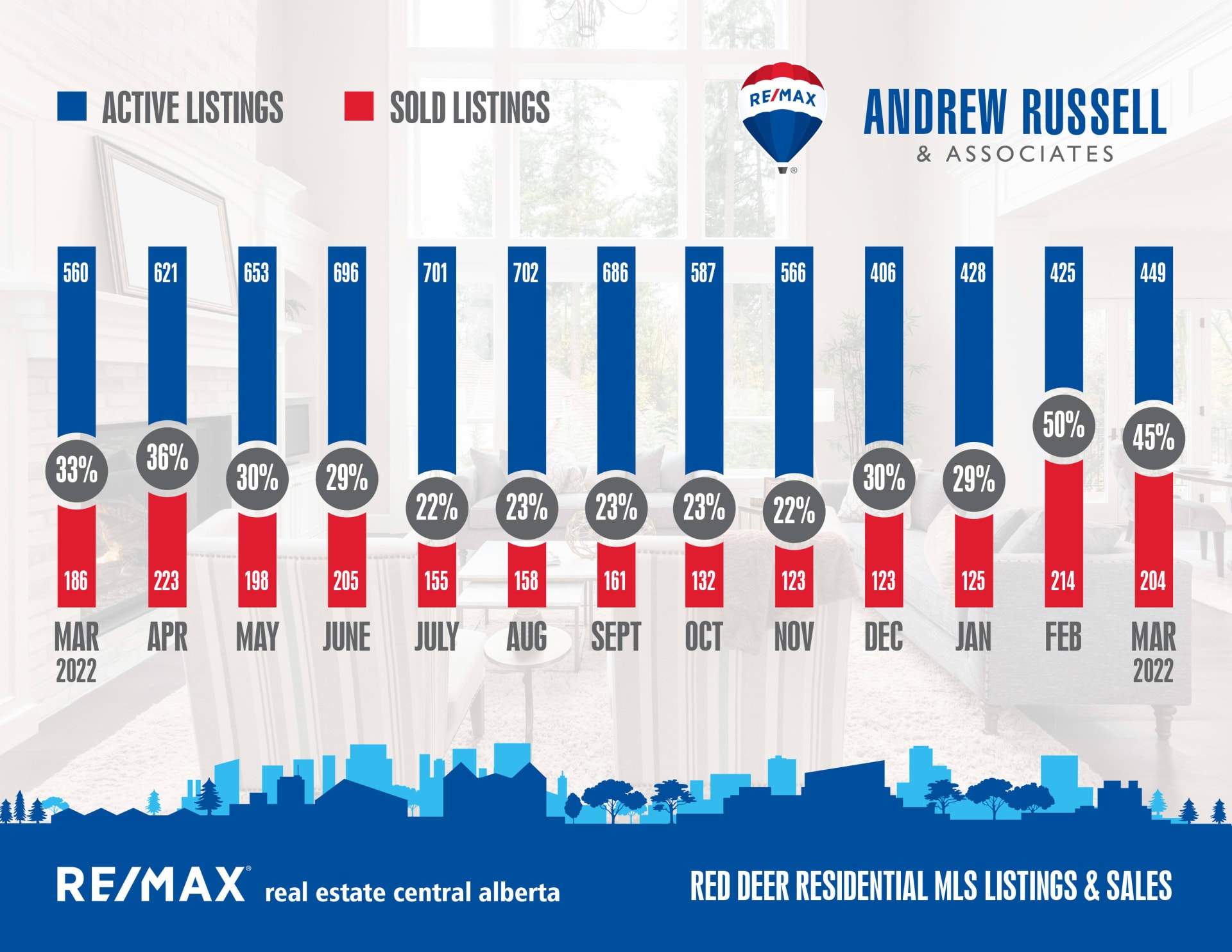

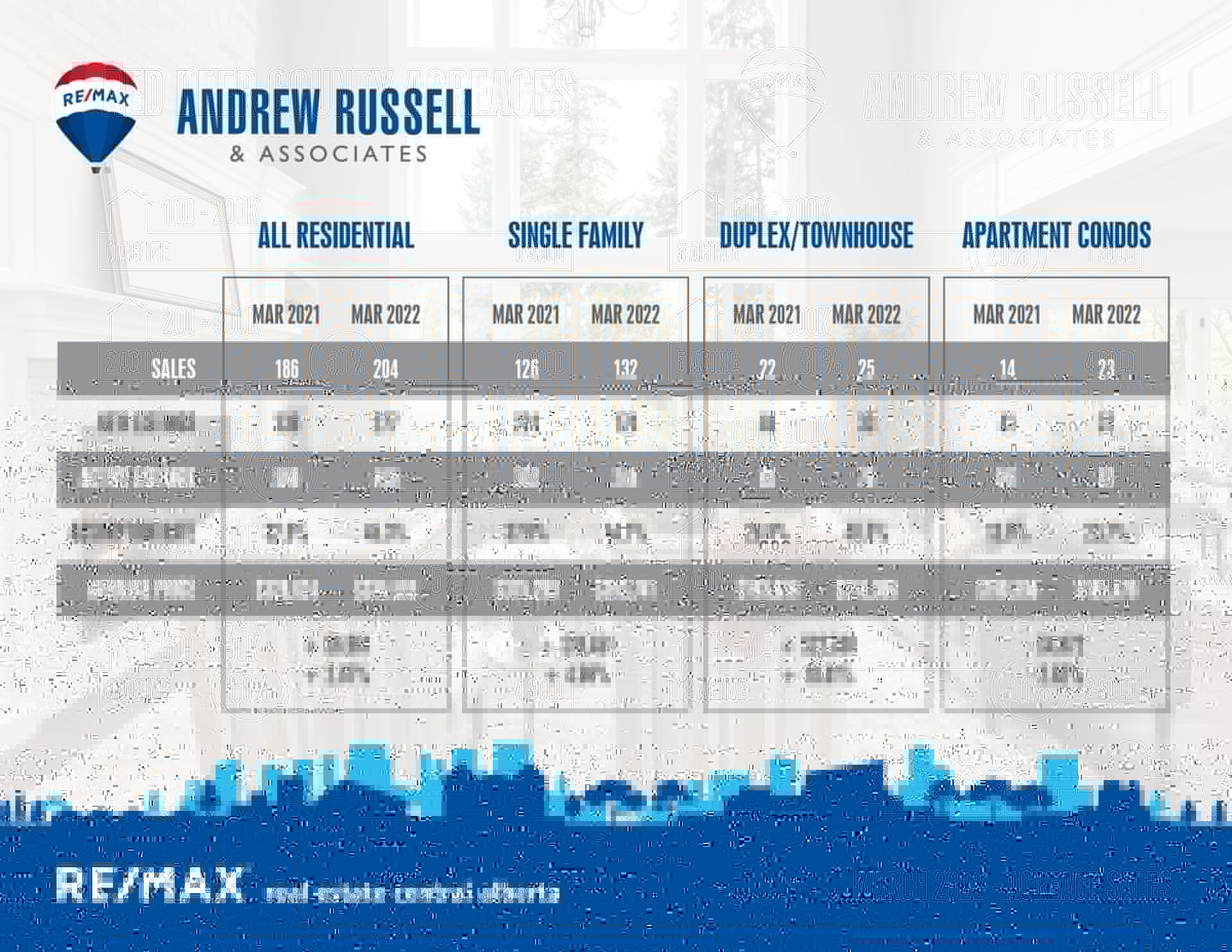

The March stats are in and the numbers are nothing short of staggering given the state of the real estate market just two short years ago. What started as a “COVID bump” in June of 2020 has turned around into a massive influx of buyers and investors buying up homes in Alberta thanks to low pricing and a turnaround in the provincial economy. While the sharp increase in the price of oil is a contributing factor, it’s not the only factor as it seemingly was during previous booms in 2006-2007 and 2014.

Alberta’s economy is creating jobs at a solid pace, and a low overall cost of living compared to BC and Ontario seems to have people relocating despite a less desirable climate. Many investors are purchasing property with the hopes Alberta will see increases similar to BC and Ontario, and while I don’t believe that’s likely to happen, there’s absolutely upward potential for home prices given what’s currently happening with inflation and overall cost of goods and services. The price of rent will also continue to drive upward, especially as interest rates rise and less people qualify to purchase homes.

Interest rates are a big topic of conversation right now. The Bank of Canada is set to make their next rate announcement on April 13 and reports are stating that they’re considering an increase of 0.5% to prime rate, a substantial increase that will add 0.75% total increase to the prime rate in just over a month’s time. It’s highly likely we will see fixed rates in mid 4% range in the very near future, which should have a cooling effect on the market. For reference, in 2021 fixed rates could be had around 1.99% for many buyers. On an average $360,000 purchase with 5% down over 25 years, a monthly payment would be $1,504. At 4.5%, that same payment is now $1,969. The last 13 years have seen the lowest interest rates in Canadian history, and it’s important to note that before 2009, the Bank of Canada had never posted a prime rate of less than 4%.

Alberta is currently slated to outperform the rest of the country in terms of GDP this year, and we currently have a lot of buyers coming to the province who don’t need mortgages, so there’s a good chance the rising rates will have a lesser impact on Alberta markets than some of the other provinces. I don’t anticipate we’ll see prices drop at all in our province despite the rising rates, meaning that real estate is still likely cheaper right now than it will be in the years to come.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 62

Sales in March – 44

Likelihood to Sell – 70.4% (seller’s market)

Sylvan Lake:

Current Active Listings – 104

Sales in March – 77

Likelihood to Sell – 67.5% (seller’s market)

Penhold:

Current Active Listings – 19

Sales in March – 5

Likelihood to Sell – 23.8% (balanced market)