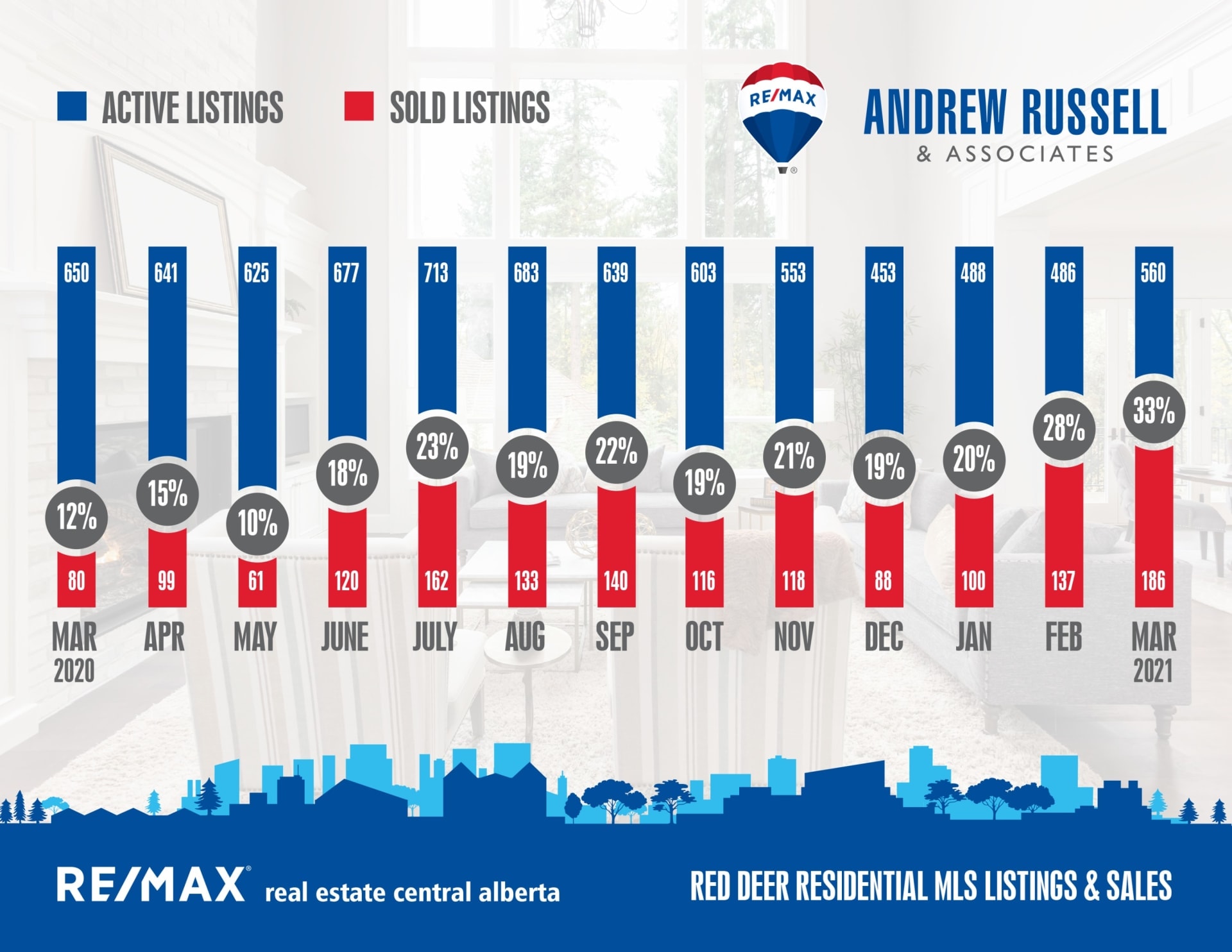

Spring has sprung and we just had our best month of sales since 2015! If you’re a seller, this has been a welcome change of pace for what has been an otherwise totally depressed real estate market for the last 6 years. If you’re a buyer, things can be a little stressful as good properties are selling very quickly and are in short supply. While things have finally improved in Central Alberta, we haven’t even touched the pace that you’re hearing about in provinces like BC or Ontario. We’re currently sitting in a very nicely balanced market, where as places like Vancouver and Toronto are in heavy sellers market’s with almost no available inventory and multiple offers coming in hundreds of thousands of dollars above asking price on many homes. While the average home under $500,000 has finally seen prices start to push up, at this point we’re dealing with about $10,000 – $15,000 of increase on an average home, not the six figure changes you’re hearing about in other provinces.

The common question these days is what’s fueling all of this? It’s a combination of COVID boredom, low interest rates, and possibly some light at the end of the tunnel for Alberta’s economy. The price of oil is climbing and it seems like jobs are starting to re-appear in Alberta with new tech companies moving in and even a large movie production studio setting up shop in Calgary. While many people have felt the impact of the struggling economy, many others have thrived through it, and while they could have afforded to buy new homes, most people operate a little more conservatively in shrinking economies and opt to hold on to their money instead of spending it. When things start to turn around as they have in the last few months, people feel more confident about spending and will proceed to do so, which is why we’ve seen such an increase in demand.

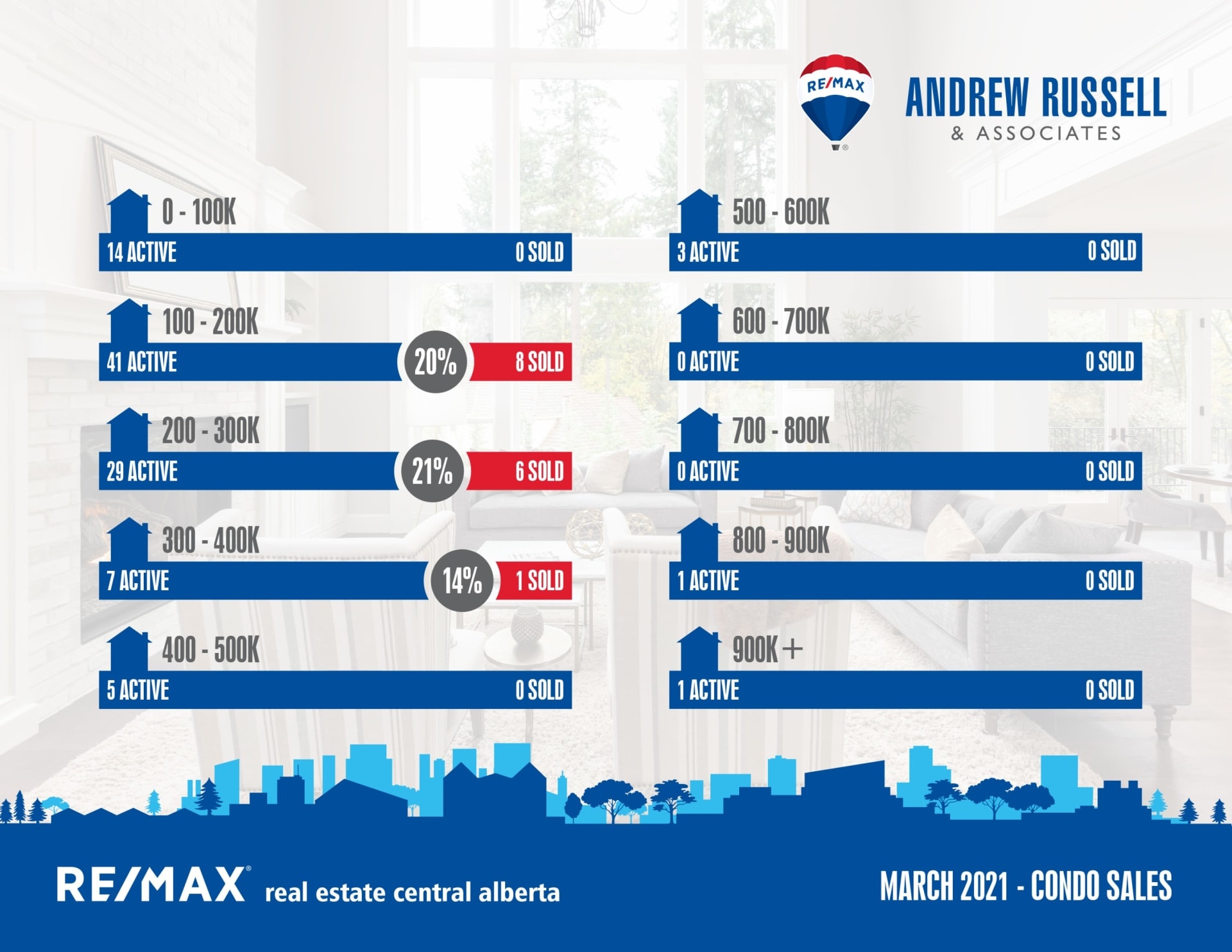

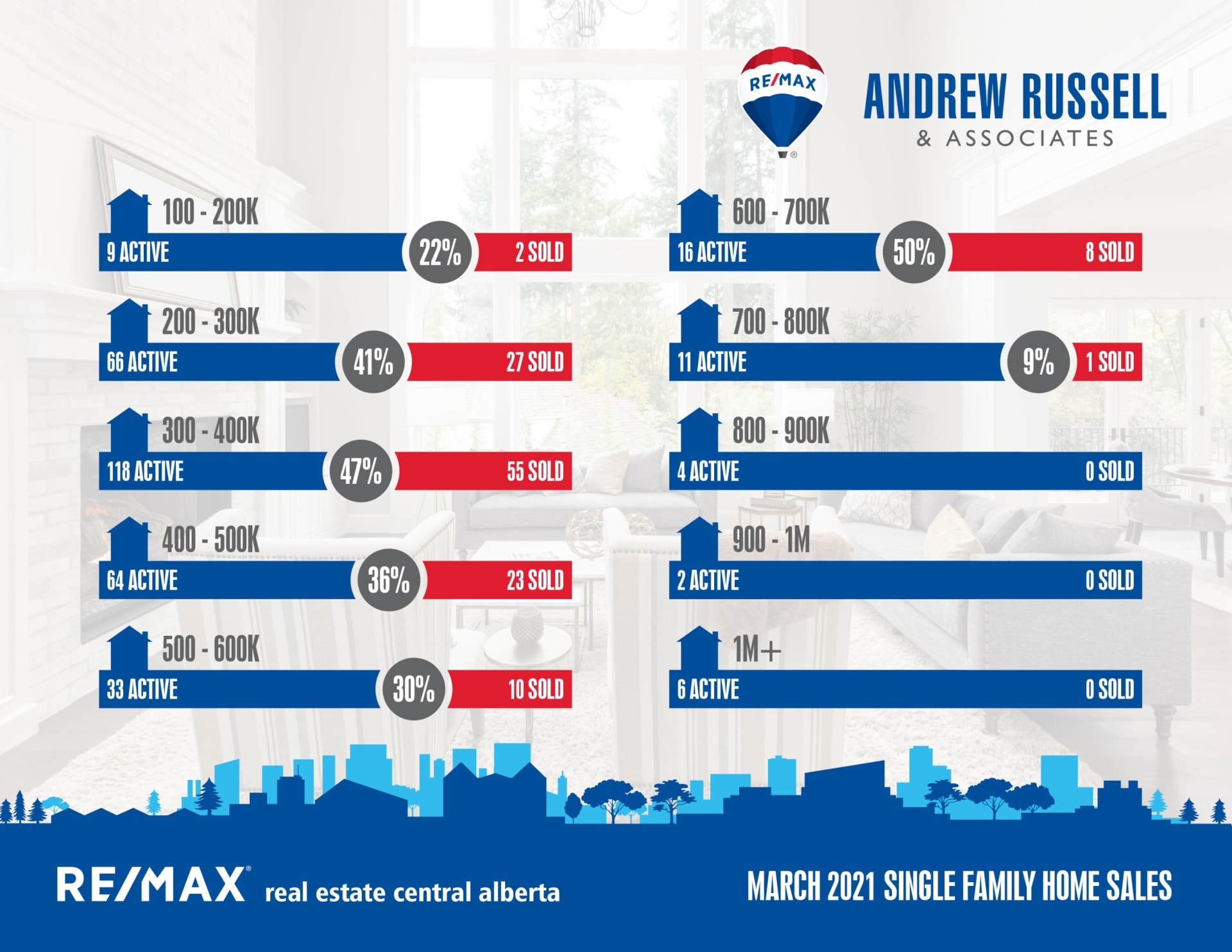

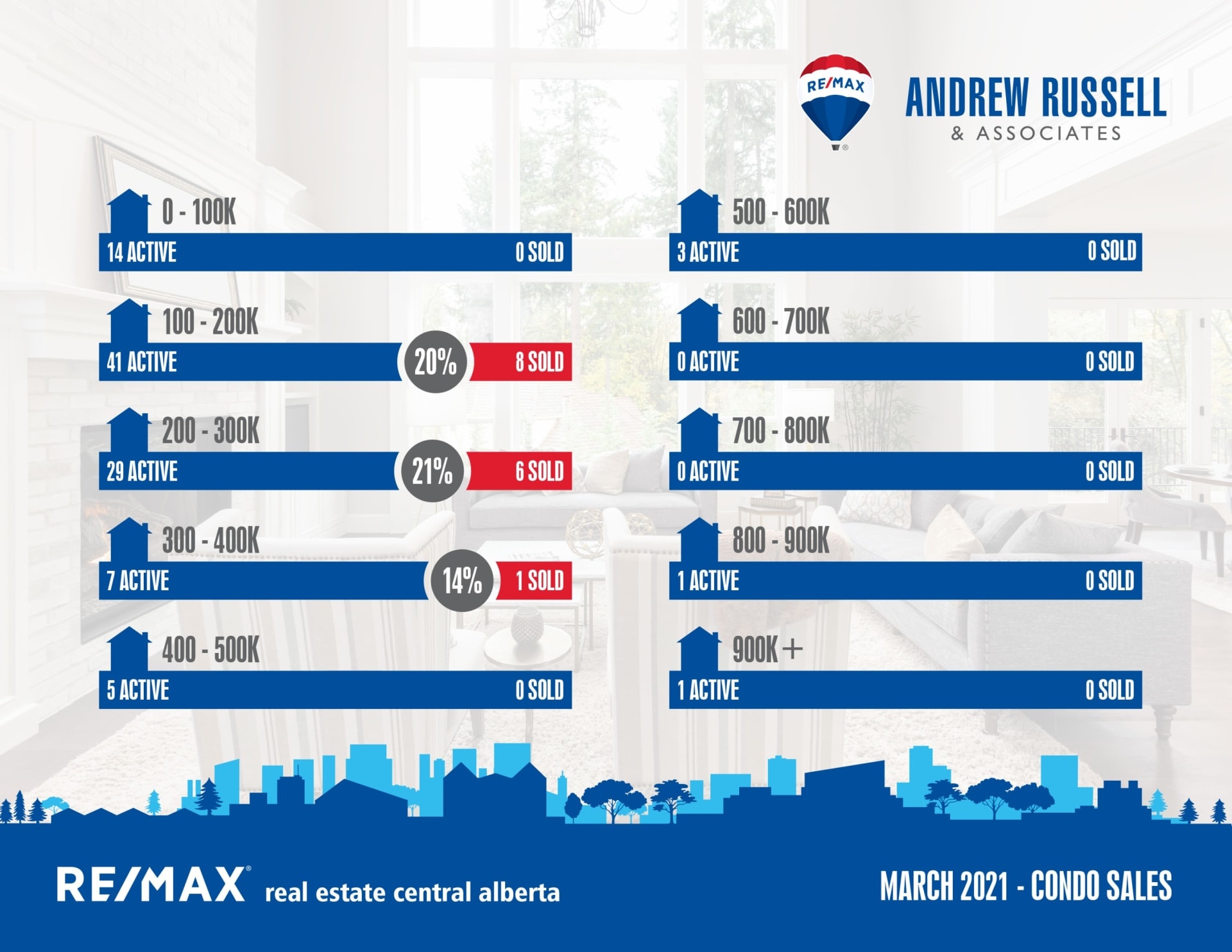

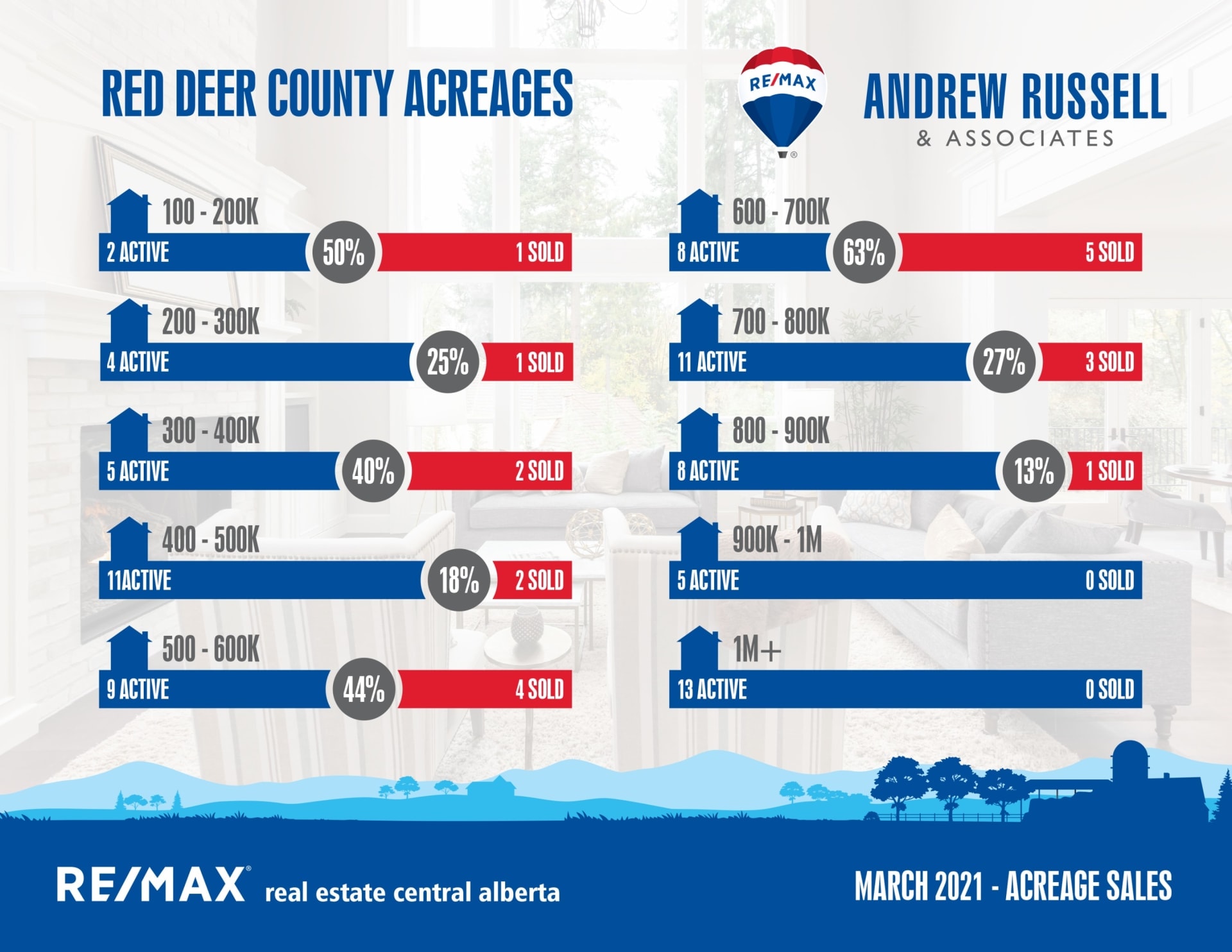

Demand for every type of property other than condos has increased, but most specifically acreages and single family homes under $600,000. Luxury markets (600k+) are seeing more showing activity, but sales activity has only increased in the $600-$700k range so far. The luxury ranges will be the last to see any price increase if any, as regardless of market status, it’s still a smaller demographic of people who can afford these properties and therefore demand levels are always less.

Surrounding community snapshot:

Blackfalds:

Current Active Listings – 71

Sales in March – 39

Likelihood to Sell – 51.3% (seller’s market)

Sylvan Lake:

Current Active Listings – 157

Sales in March – 51

Likelihood to Sell – 35.5% (balanced market)

Penhold:

Current Active Listings – 24

Sales in March – 10

Likelihood to Sell – 40% (seller’s market)