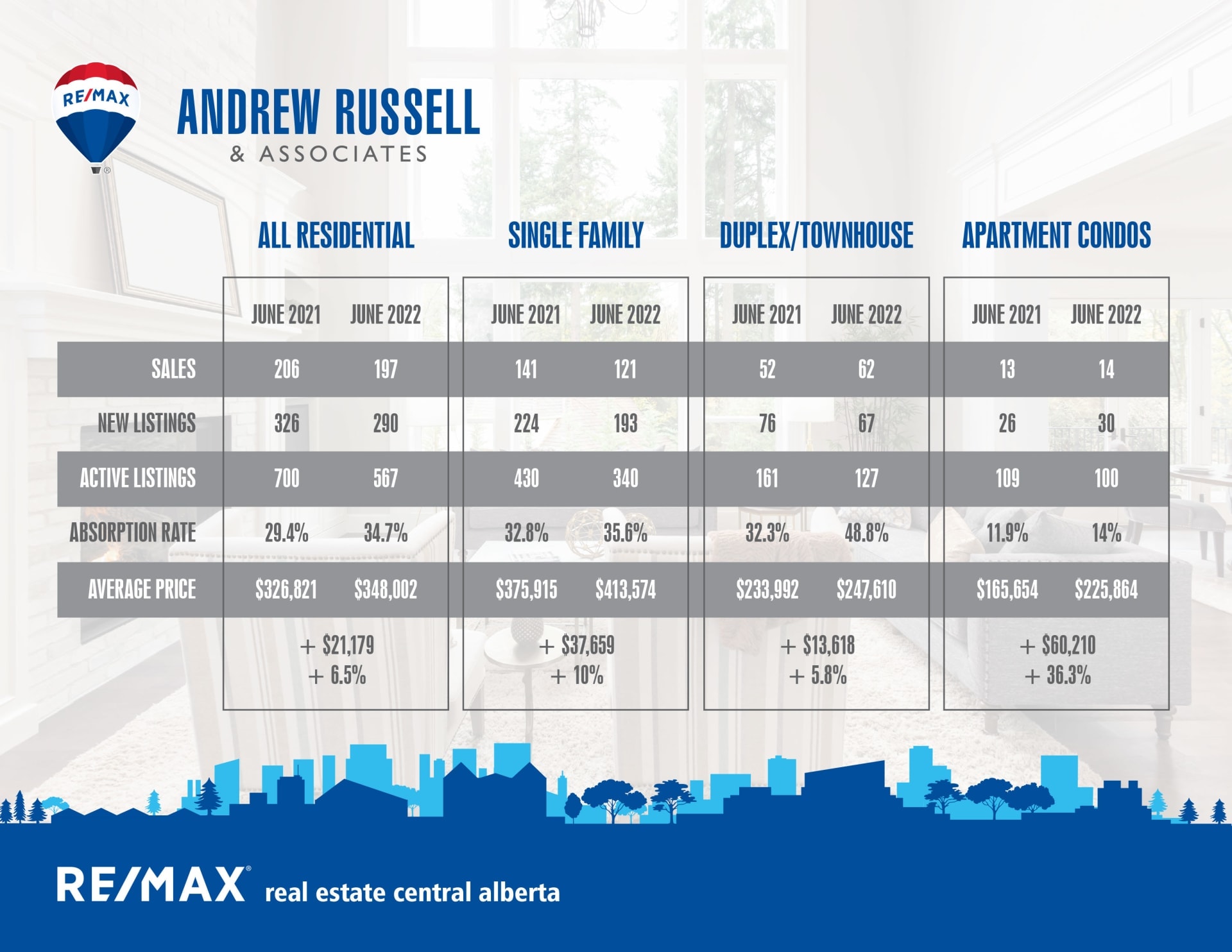

As you can see from the attached graphs, the market has cooled and has returned to a balanced level. The shift was very quick, one of the quickest market transitions I’ve seen in 16 years. Activity has historically slowed in June as families focus on the end of the school year, graduation and summer holidays. This year the slowdown has been exacerbated by rising interest rates and consumer concerns about rising prices for everything from gasoline to utilities to groceries. Properties generally aren’t selling on the first day or first showing anymore, and buyers are showing more willingness to wait, versus the panic buying that was happening earlier this year.

Persistent speculation about continued inflation and the potential for a recession in 2023 aren’t good for consumer confidence, so we expect the real estate market to moderate in the second half of the year. That will be an ideal opportunity for home buyers who can manage those high interest rates to negotiate in a market that is more relaxed and more friendly. And, we don’t expect prices to moderate because most local markets are still well in balance. Don’t get hung up on the negative media on a federal level, most of it is focused on the Vancouver and Toronto markets. Prices in Alberta will not plummet as they have in those markets.

Central Alberta real estate prices have finally recovered back to 2014 and 2015 levels. In spite of the recent upward price trend, homes here are very affordable compared to many other parts of the country. Oil prices are forecasted to stay high which means the Alberta economy will stay strong, offsetting those rising interest rates and inflation. We are confident the Alberta housing market will survive nicely.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 69

Sales in June – 24

Likelihood to Sell – 34% (balanced market)

Sylvan Lake:

Current Active Listings – 144

Sales in June – 55

Likelihood to Sell – 36% (balanced market)

Penhold:

Current Active Listings – 18

Sales in April – 11

Likelihood to Sell – 51% (seller’s market)