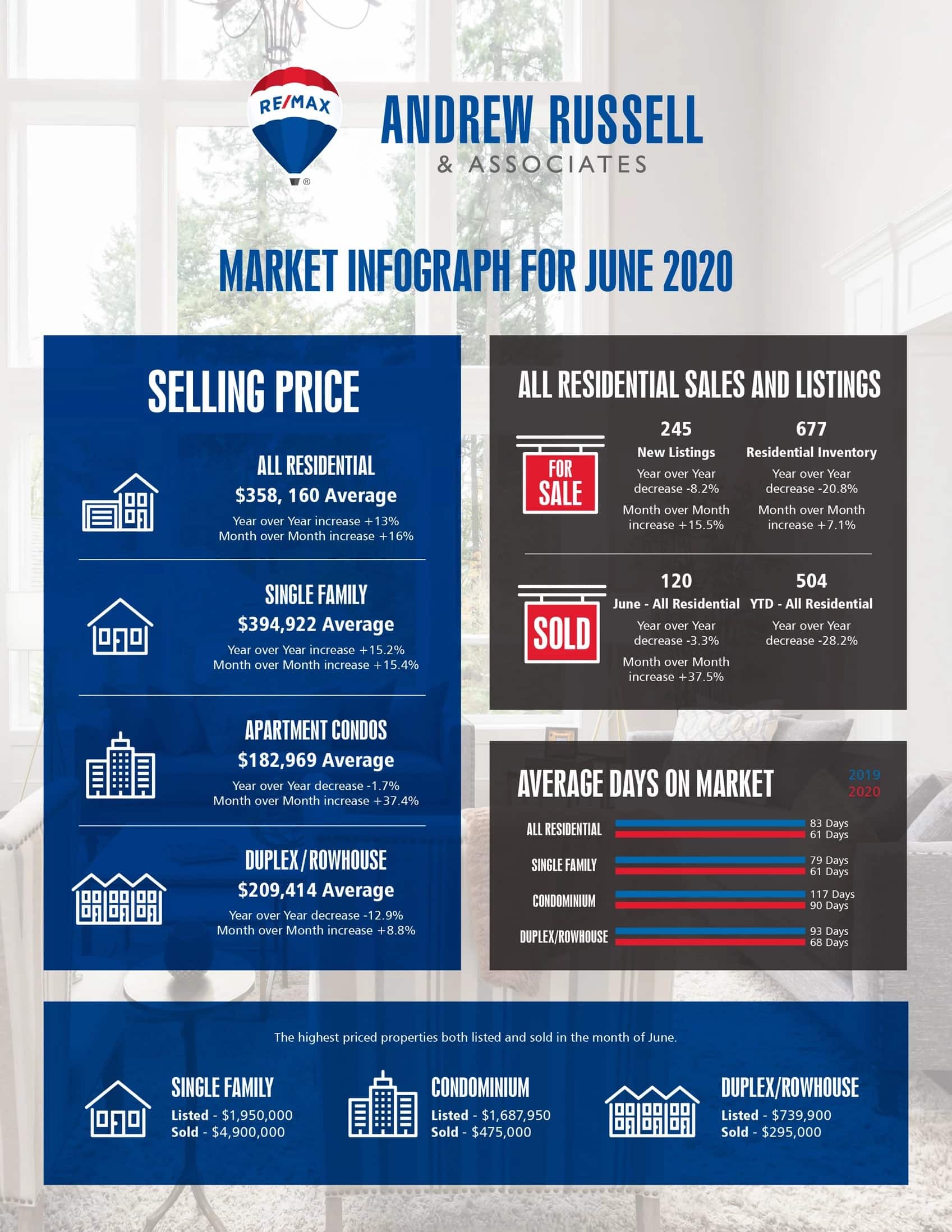

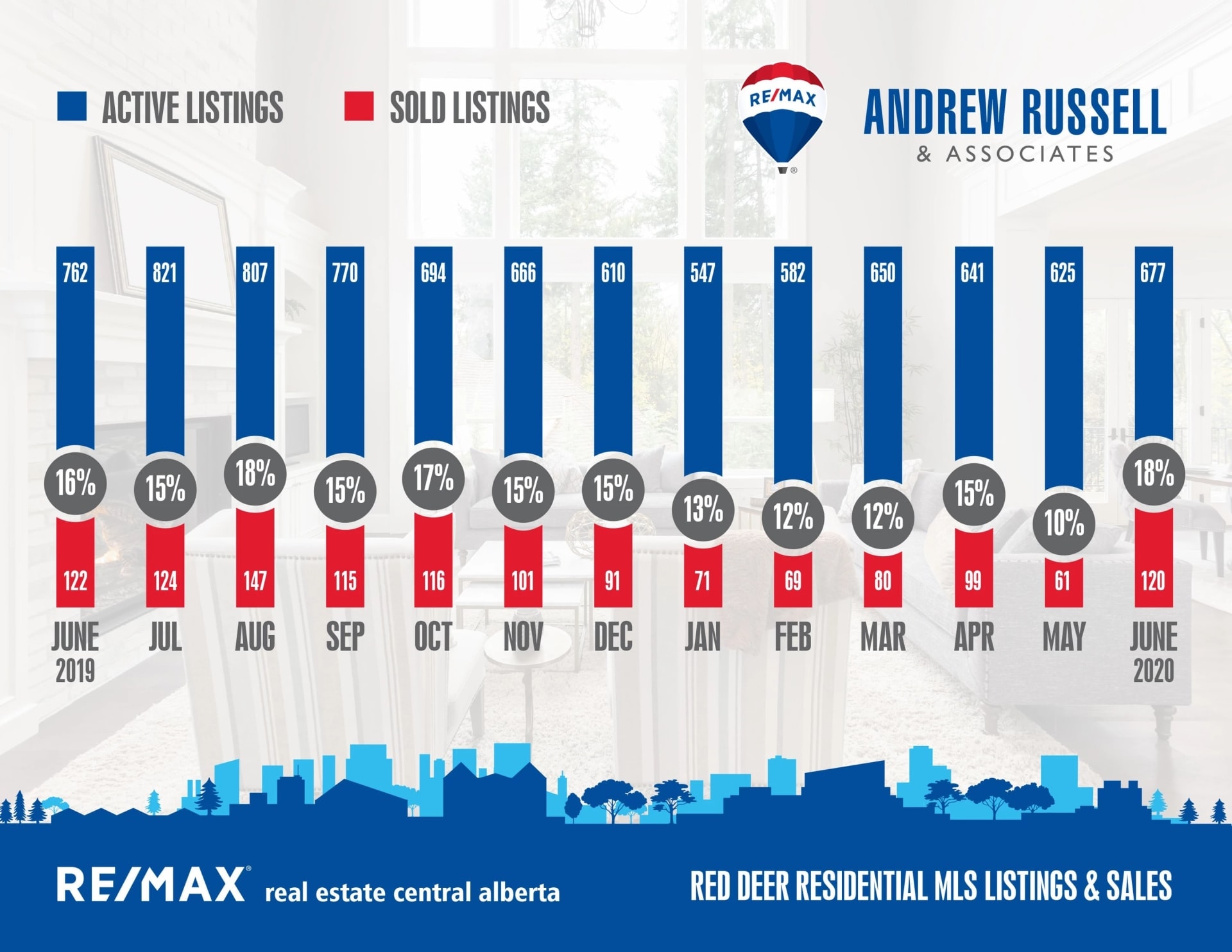

June sales we’re just a few short of returning to 2019 levels in Red Deer, the first time we haven’t seen a significant decrease in sales due to COVID since April. We’ve been extremely fortunate in Alberta as infection numbers continue to stay low, allowing businesses to re-open and life to return to a modified form of normalcy. At this point, I believe it’s still too early to say that market is going to return to normal pace for the remainder of the year. There were a few outlying factors this month that may have contributed to the increase in market activity:

- CMHC announced effective July 1st that they were going to make it harder for buyers to qualify for mortgages. Total debt servicing (percentage of your monthly income put towards monthly payments made on all debt including lines of credit, credit cards, car loans, etc) was reduced from 44% to 42%, and mortgage debt servicing (percentage of monthly income on mortgage payment) was reduced from 39% to 35%. They also raised the credit score requirements from 600 to 680, and you’re no longer able to use a line of credit or personal loan for down payments. Buyers who had a deal submitted prior to July 1st were still able to qualify under the old rules, and so it’s very possible this created some urgency for some buyers to purchase right away if they wouldn’t qualify under the new rules.

- April and May are usually very busy months in real estate, and it’s likely that there was some pent up demand given that people either didn’t want to or may not have been able to buy during the lockdown. Many people had plans to sell and/or buy during the spring market and may not have been able to. When restrictions backed off in June, there was an opportunity to move forward.

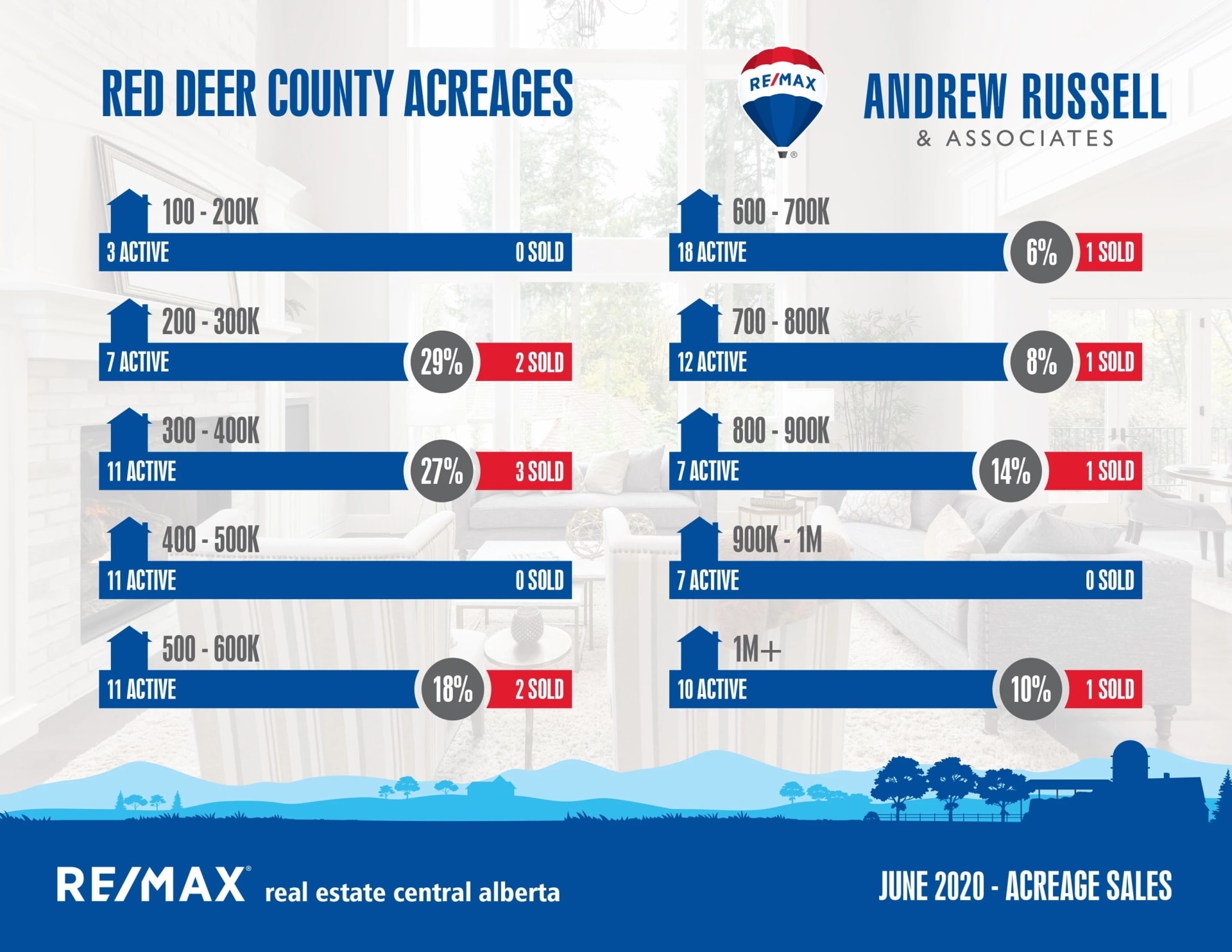

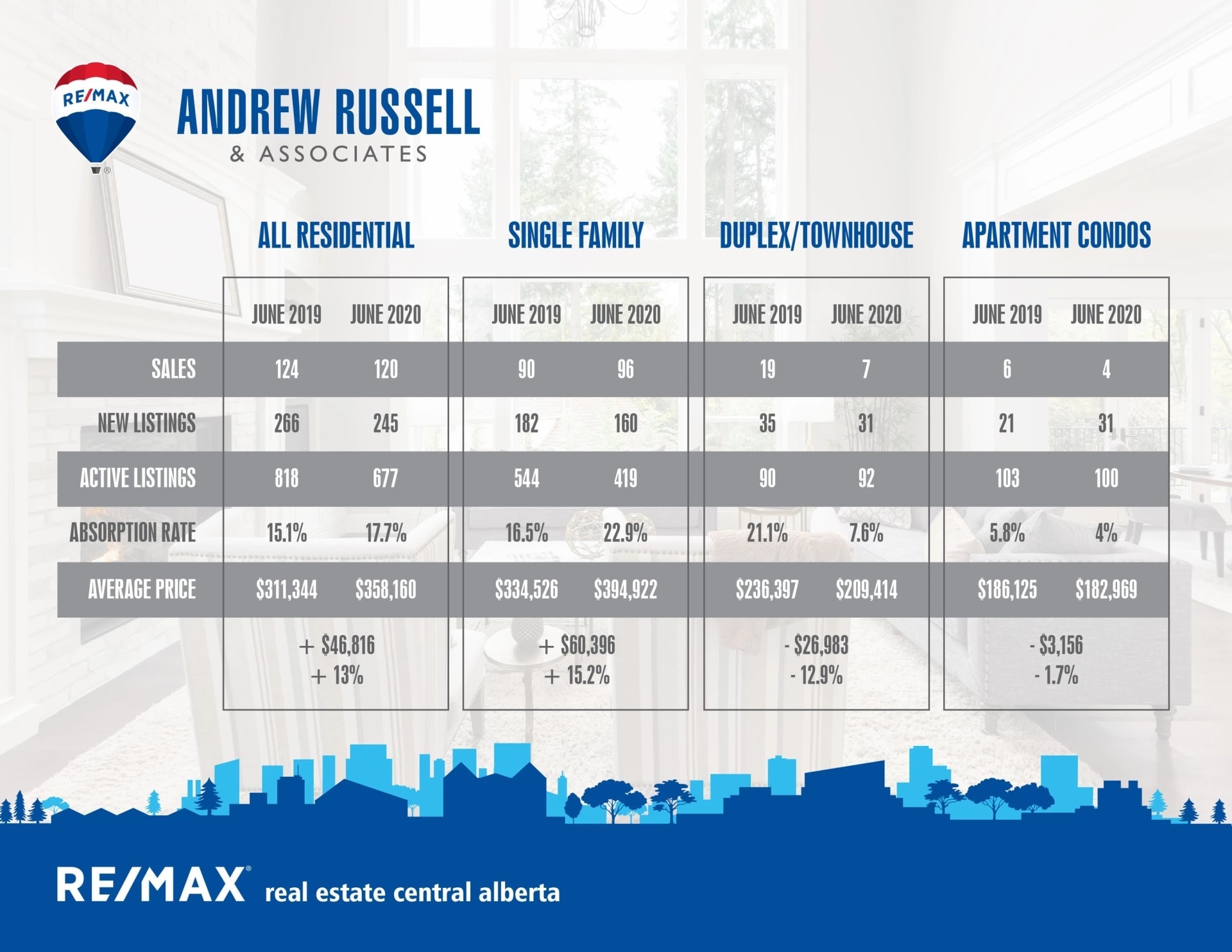

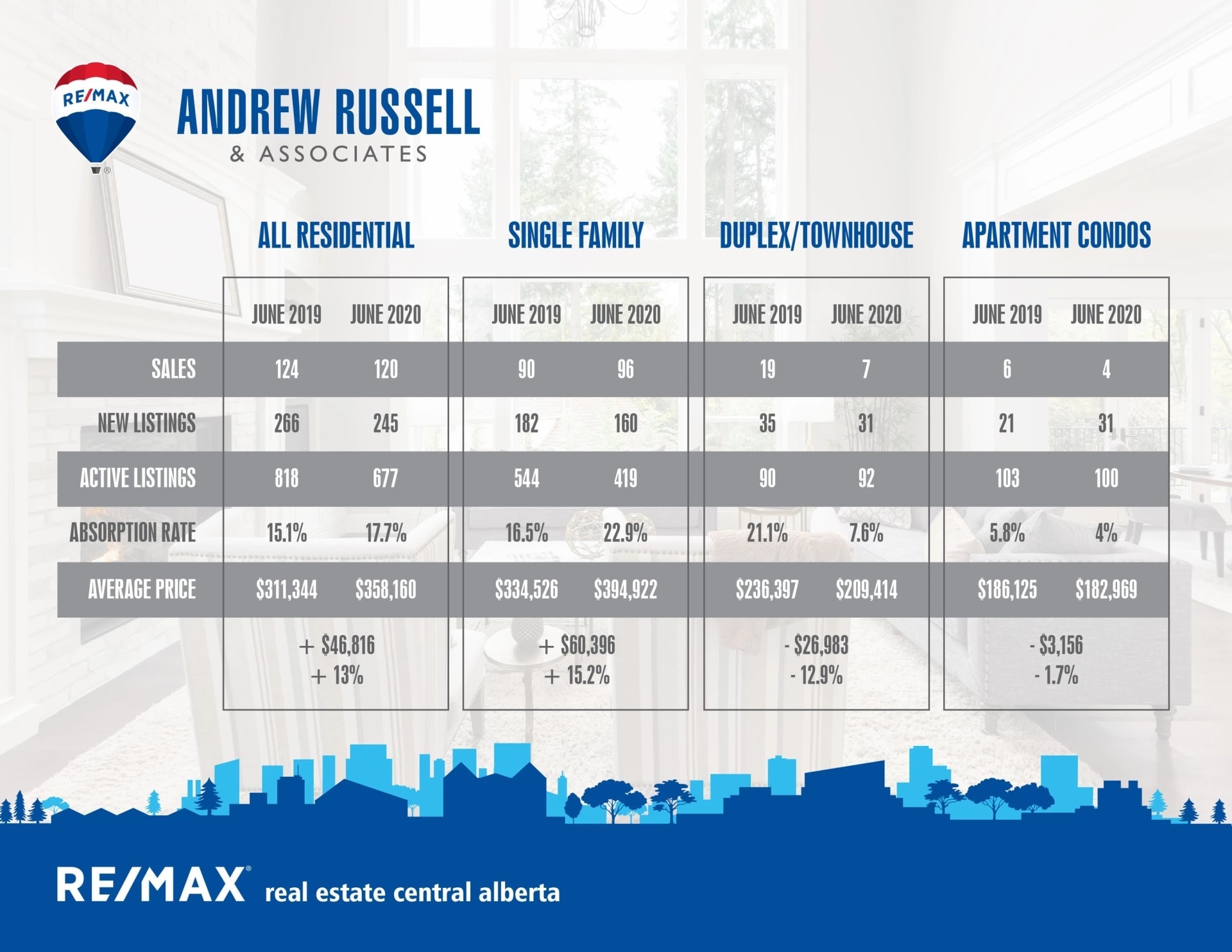

Looking at the graphs, the vast majority of sales were single family homes from $200k – $400k, with the $200-$300k bracket actually hitting seller’s market territory. This remains pretty consistent for what we’ve seen month to month over the last couple of years now, although it’s nice to see the absorption rates jump into the 20% range finally. Despite the high number of active sales, buyers are still pushing for deals and expect sellers to come down from their asking prices. The overall mentality of a difficult economic environment still lingers, despite the increase in sales activity.

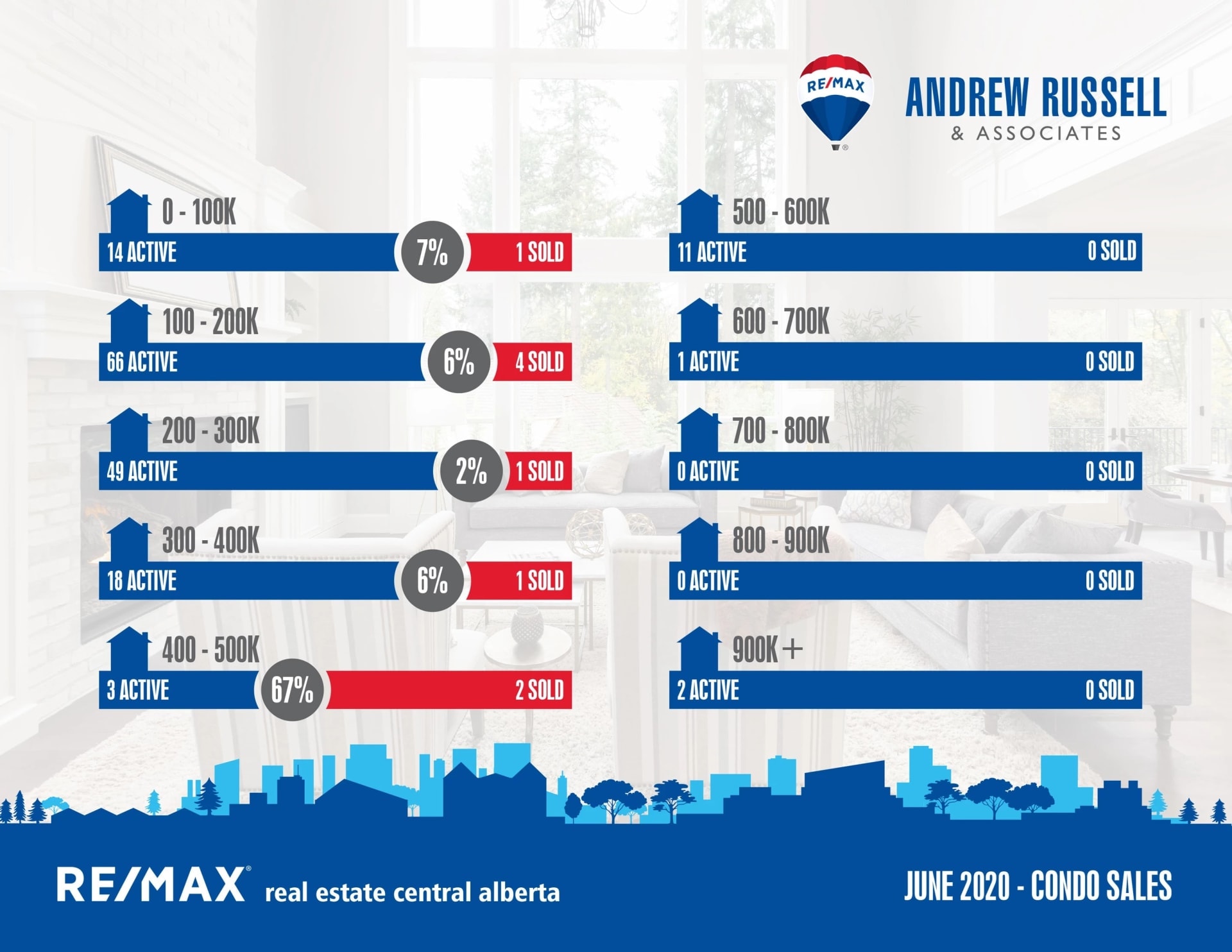

Condo sales continue to struggle, I believe there is fear from buyers over the lingering insurance increases we keep hearing about. I spoke with a rep from Sunreal regarding the incoming increases, and she said while many older buildings will see worse hits, newer buildings will be looking at much more moderate increases. This means condo fees will be going up everywhere, but not by the $300-$500/mo we’ve seen in some of the news stories. She figures a conservative increase on a newer building will be 5-8% approximately, but every individual building will be different.

Historically, August is usually just a touch slower for sales than July. Despite closed borders, COVID doesn’t seem to be stopping domestic travel. Given that people have been unable to travel since March, I wouldn’t be surprised to see July sales fall off a bit as people take holidays around Alberta, BC, and Saskatchwan, and then maybe pick up a bit in August. I am keeping my fingers crossed for July sales to keep pace to 2019, but I’m not holding my breath for it.