There has been considerable attention recently to the national housing situation, both in the news, Provincial Legislatures and the Federal Parliament. Millions of new immigrants are arriving in Canada without correlating housing starts. It’s not hard to understand why there is such a shortage of housing inventory across the country. Alberta is experiencing a similar situation, welcoming new immigrants from around the world, but also large numbers of people from other provinces.

There were 14,014 housing starts in Alberta between January and June of this year, down by 17.6% compared to the same time last year. The average family size in Alberta is 2.6 persons. The number of new homes constructed in the first 6 months of this year will accommodate 5,390 families. The population of Alberta grew by 51,718 in the first quarter of 2023 alone (19,891 families). No wonder we have such an imbalance in supply and demand and an ever tightening rental market here.

I’ve personally noticed an interesting shift in the market over the last month that will further increase rental prices. Many landlords are looking to sell off their rentals right now, as the price of rent versus the carrying costs of ownership no longer align with current interest rates. As mortgages are coming up for renewal, landlords are looking for their opportunity to get out of the market. As these properties sell and rental supply decreases, it’s going to push rent prices up further until it financially makes sense to keep these properties, or until interest rates drop.

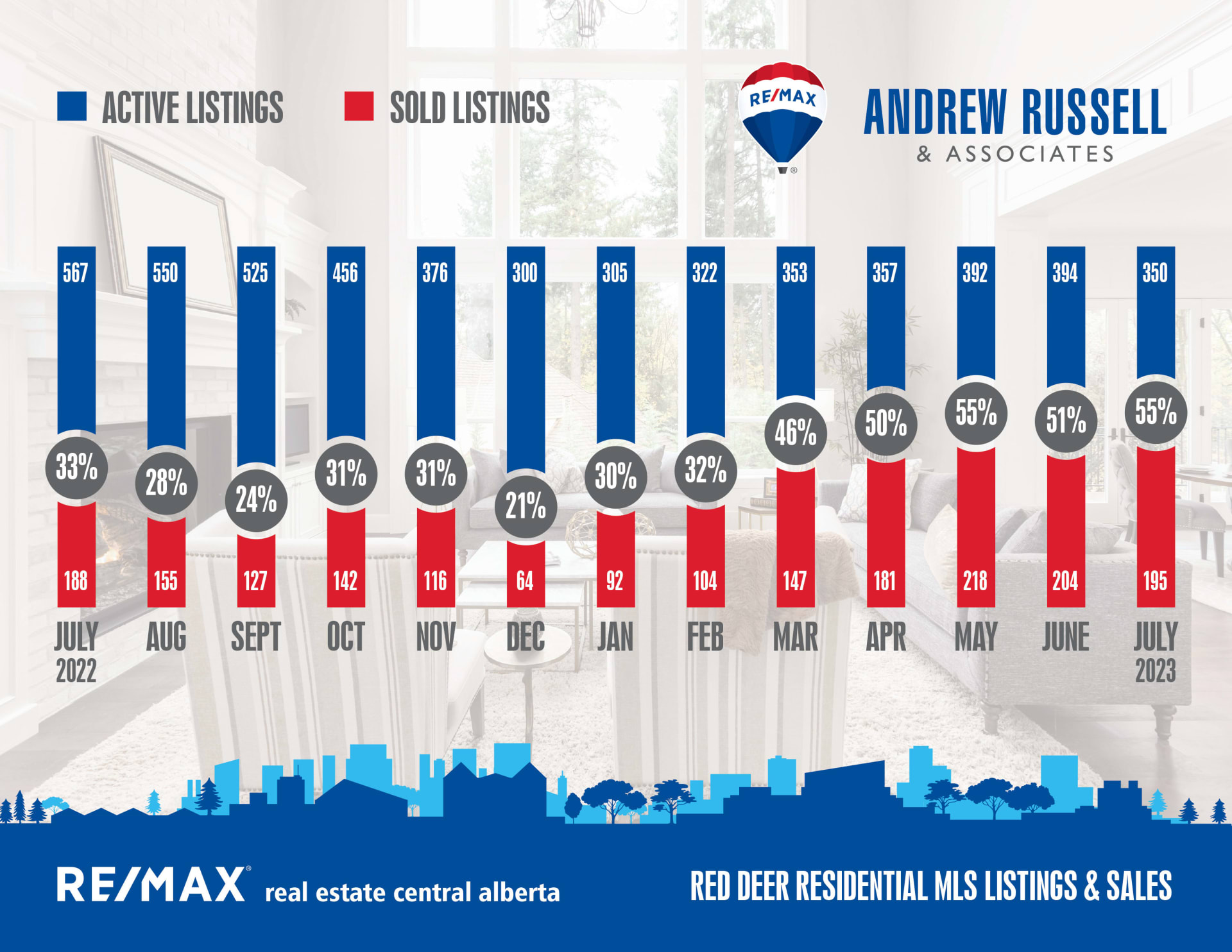

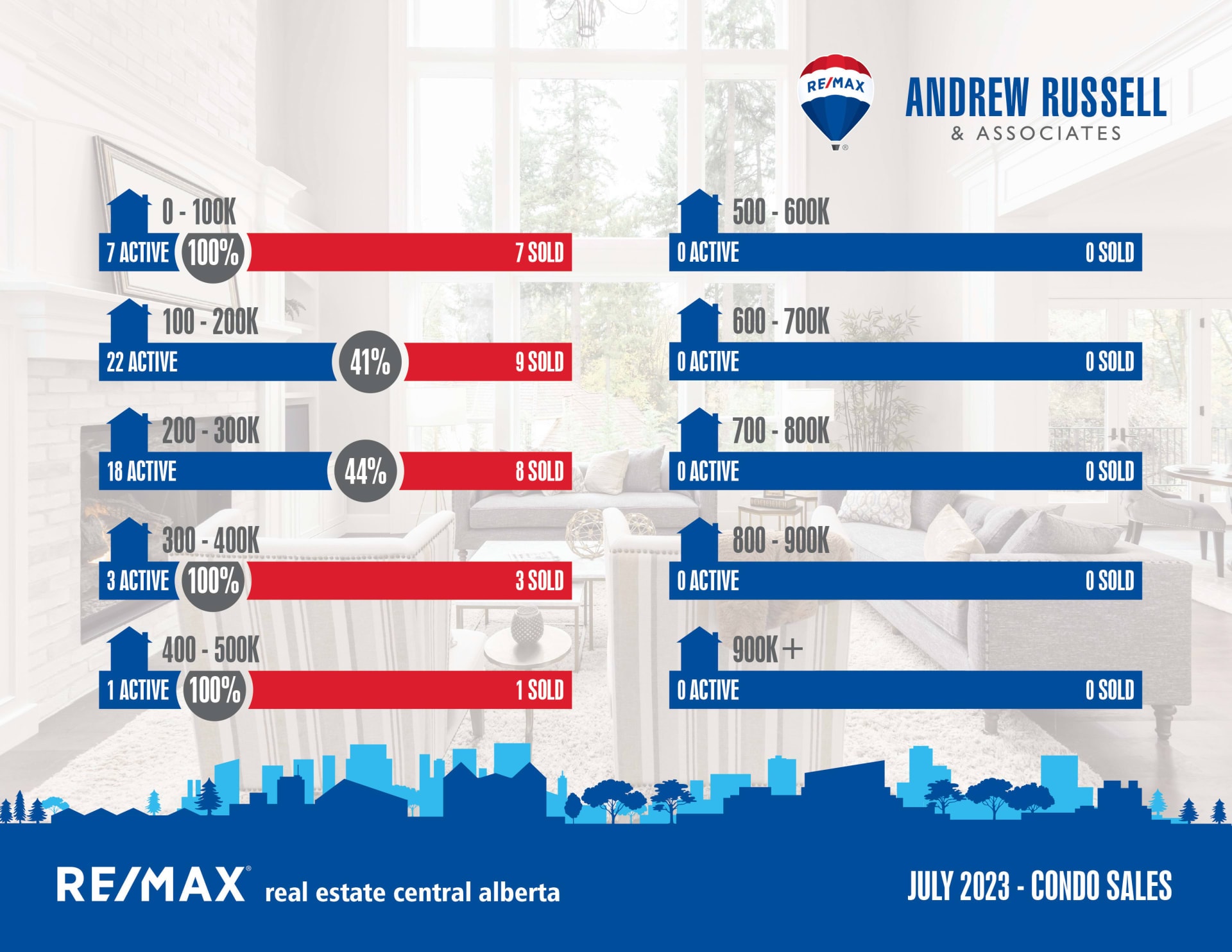

Looking at the stats, the market under $500,000 is still considerably hot, but buyers want turn key, move in ready properties. Properties needing repairs and renovations are not nearly as in demand and will generally sit on the market, as access to money to complete these renovations is simply too difficult to get (loans or lines or credit) or too expensive (interest rates exceeding 10% typically). We’re in a market right now where it actually makes sense financially to complete your renos ahead of time as you’ll typically get the money back for most items when you sell.

The higher end price points continue to be less in demand, with the 500-700k range currently in balanced markets, and 700k and higher in buyer’s markets. There have only been 3 sales in Red Deer over $1,000,000 year to date, with 13 listings currently active in the price point. Alternatively, acreages in Red Deer County have seen 5 sales over 1M year to date, with 39 listings currently active.

I believe we are done with interest rate increases for the rest of the year, and could still possibly see rates come down in 2024 based on current forecasts. Despite rates, demand for property will be strong for the foreseeable future simply due to immigration. As Canada’s population continues to grow, we will need substantially more housing, which takes time. Our population is currently growing faster than we can build, which means values will continue to increase until supply and demand can come into balance.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 55

Sales in July – 42

Likelihood to Sell – 76% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 144

Sales in July – 51

Likelihood to Sell – 35% (Balanced Market)

Penhold:

Current Active Listings – 15

Sales in July – 8

Likelihood to Sell – 53% (Seller’s Market)