July 2022 residential MLS sales in Central Alberta were down 7.5% compared to June, and year to date sales are down 3.62% compared to the same time in 2021. The real story however is how those sales relate to the number of active listings. The relationship between supply and demand is the factor that determines price, and that ratio has moved toward more balanced markets across central Alberta. I have noticed showing activity is slowing down, however that’s not unusual in August as many people are taking holidays in advance of school starting again in September, or are using their weekends to enjoy camping and other outdoor activities.

The concern the past few months has been rising interest rates and how that would affect the market. Higher interest rates effectively translate to higher prices for those buyers who have to borrow to buy, which is the vast majority. Since spring, supply has gone up while demand has gone down, moderating prices and mitigating some of the effects of higher interest rates.

Posted mortgage rates are at 6.25% at some financial institutions but five year fixed rates are being advertised as low as 4.59%, down from 4.99% just a month ago. Fixed mortgage rates are not dictated by Bank of Canada rates, they rely on bond rates which the media doesn’t focus on. While a 4.59% mortgage rate is considerably higher than we’ve experienced in the past few years, it is much better than what was being forecasted.

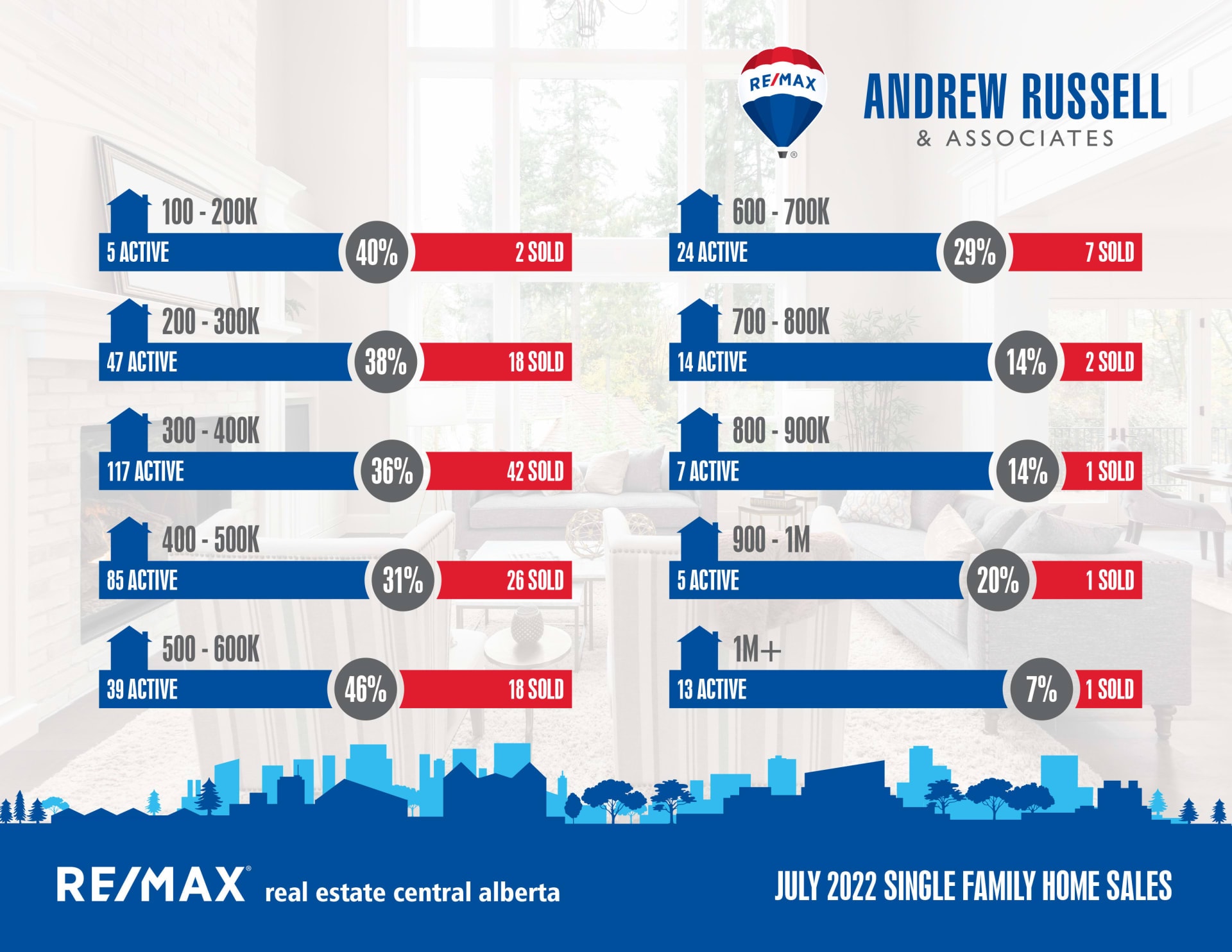

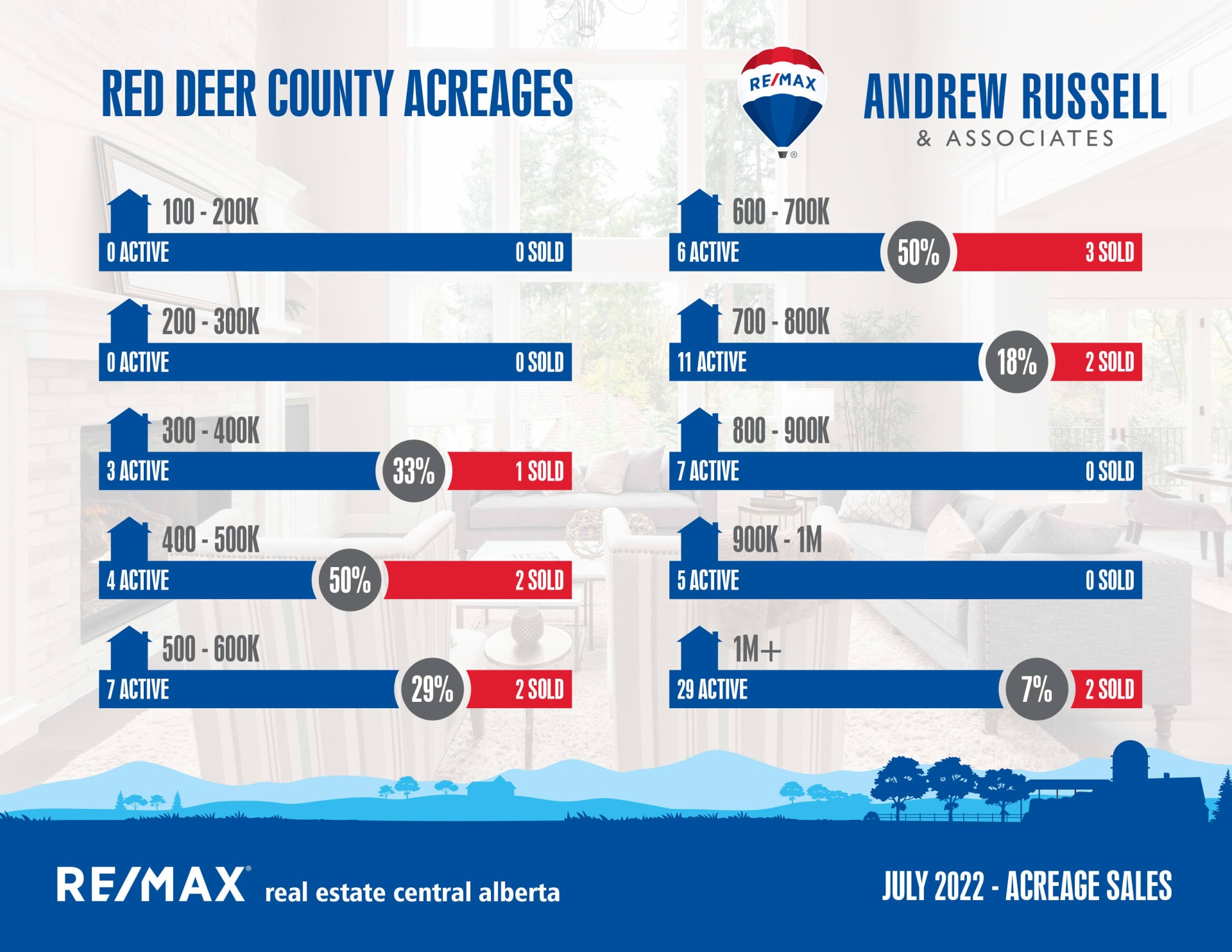

In summary, the real estate market is still moving along nicely, balanced in most central Alberta markets, and favouring buyers in a few. We expect the market to stay strong as the Alberta economy continues to outperform the rest of the country. With that being said, as balance returns to the market, buyers are going to be pickier and want to see negotiation off listing prices, especially on properties over $600,000 where the market has seen a considerable slow down. Now is not the time to try and hold out for an aspirational price that was determined by the market 3 to 4 months ago, as things have changed. If you want to get ahead of the market, rather than potentially chase it down, it’s an important time to consider making sure your pricing is well in line with the market of today, not from the spring.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 72

Sales in July – 26

Likelihood to Sell – 36.4% (balanced market)

Sylvan Lake:

Current Active Listings – 161

Sales in July – 46

Likelihood to Sell – 29% (balanced market)

Penhold:

Current Active Listings – 25

Sales in July – 10

Likelihood to Sell – 39.2% (balanced market)