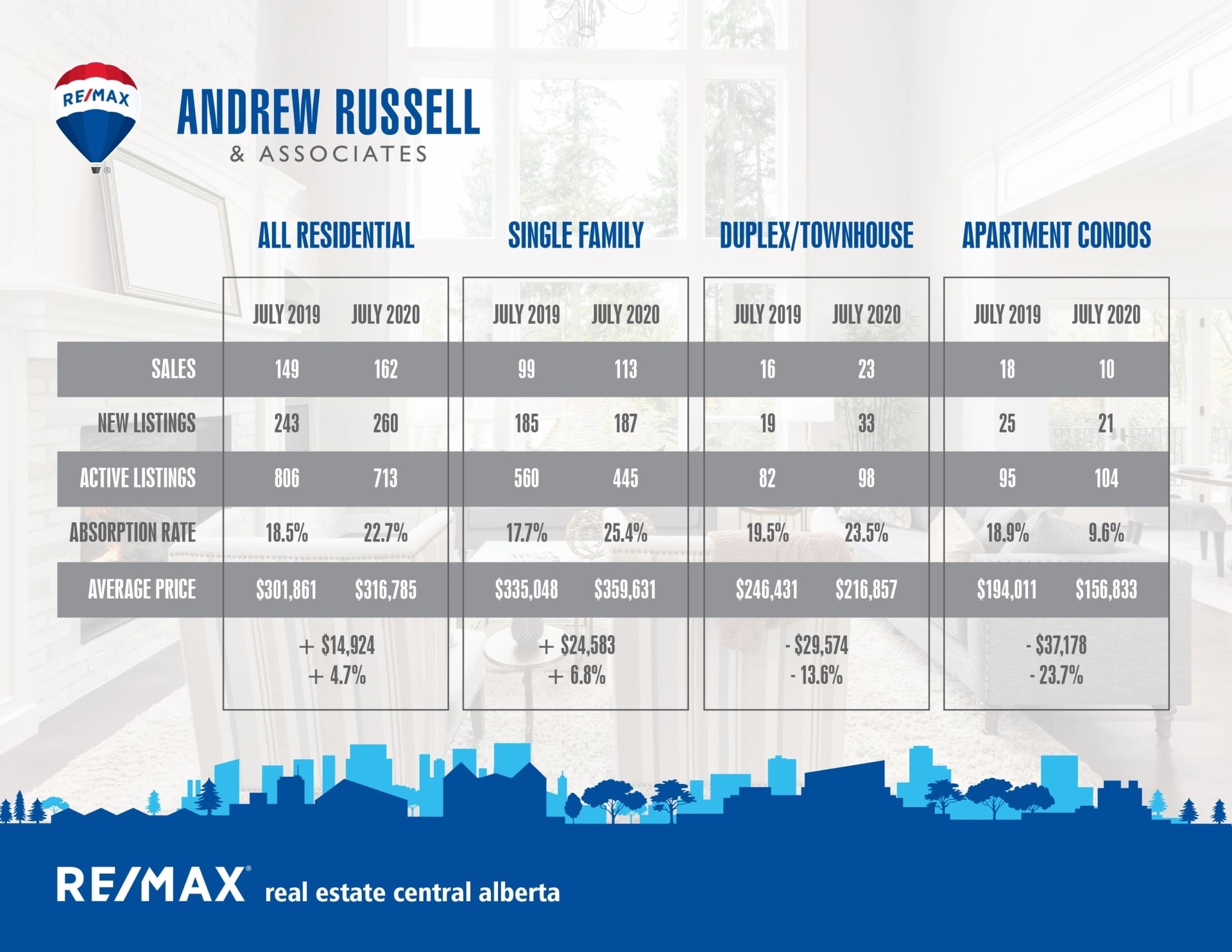

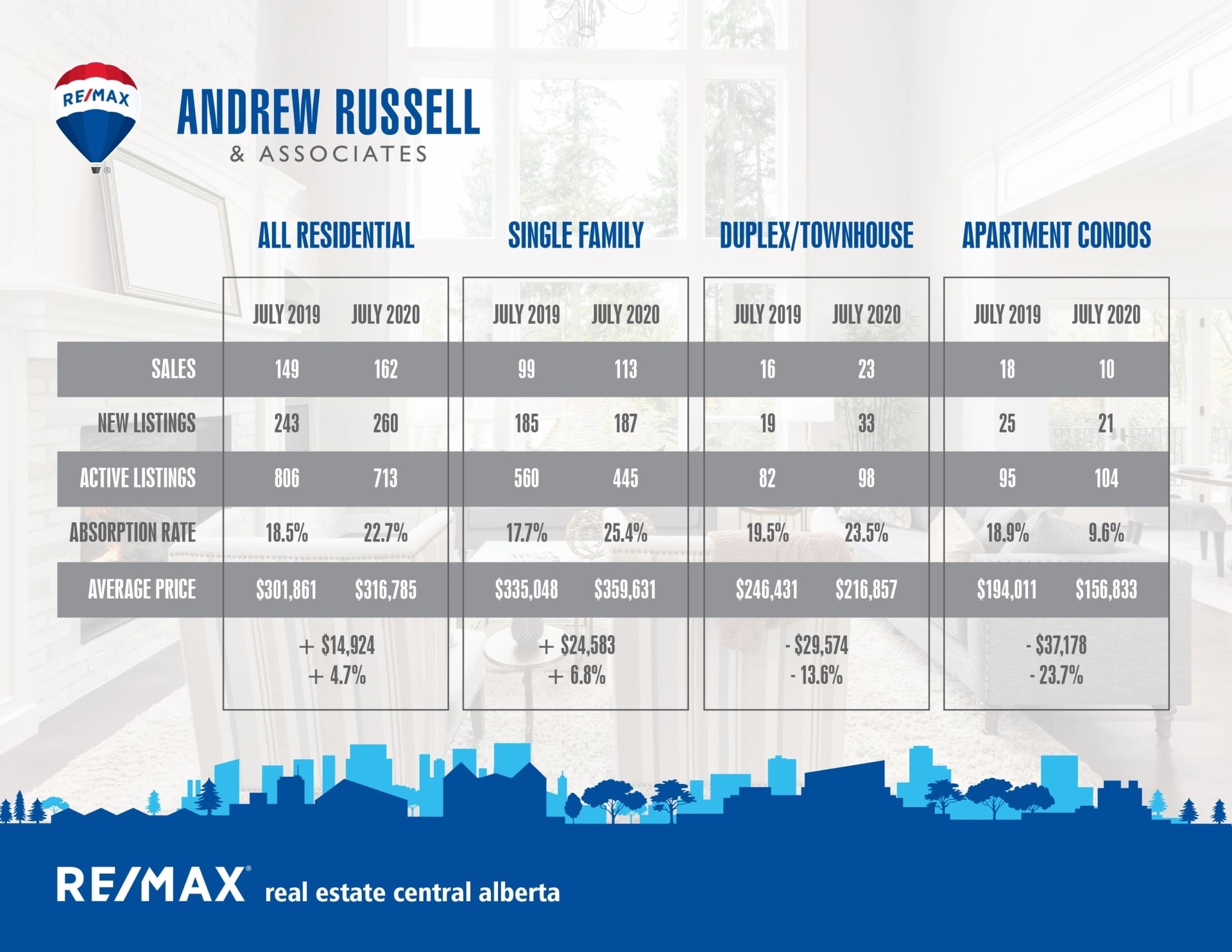

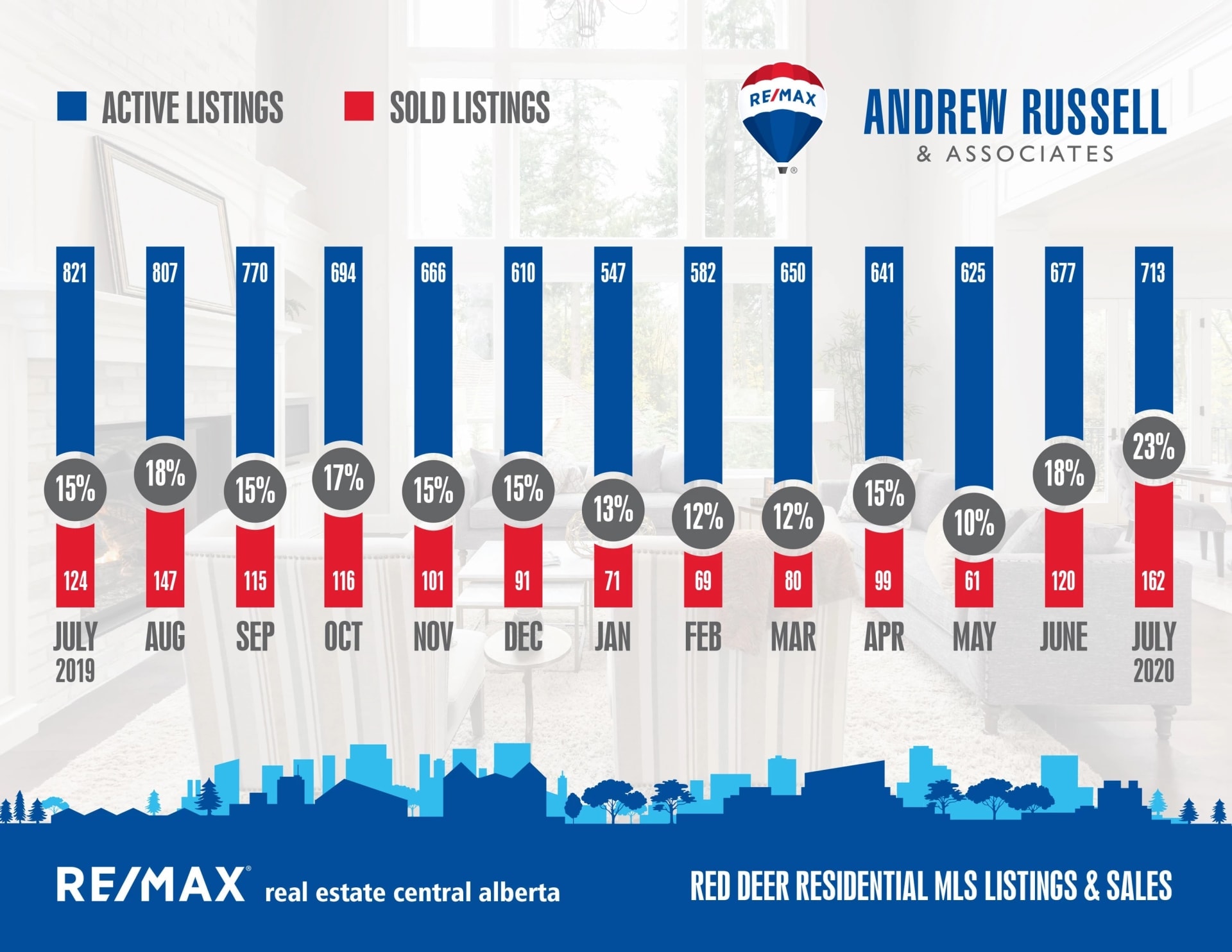

Another overall positive month of market activity! Sales in Central Alberta in July were up 23% compared to July of 2019 while the number of active listings is down almost 29%. Year to date sales in Central Alberta are down almost 10% compared to the same time last year, but with COVID coming into play it was predicted to be much worse. A strong start to the year combined with a good recovery in June and July is rapidly erasing the losses experienced in April and May. Red Deer numbers aren’t quite as impressive, although sales were still up 8% over July of 2019 and listings are down 11.5%. The market has definitely picked up in the last 2 months if you were selling a single family home up to $400,000, while activity over $400,000 has been consistent to what we’ve been experiencing over the past few years.

The $200,000 to $400,000 single family market was a seller’s market in July, the first time we’ve seen numbers beyond balanced market (20-28% absorption rate) since 2014. While I don’t think these numbers are likely to hold up as we move into the fall, these strong sales were likely roll over from the lost sales due to COVID in April and May. If you look at an average household income, most people will qualify to purchase a home up to $400,000 which is what keeps that market moving so steadily. Unfortunately I’ve personally seen a record number of people leaving Central Alberta this year for job opportunities elsewhere, mainly Calgary or Edmonton (although I’ve had many clients move to BC and Ontario as well as the East Coast) which means we’re losing a lot of our move up buyers who would typically buy in the $400,000+ range. When incomes are on the rise and job opportunities are plentiful, people don’t hesitate to spend on higher end homes, however with the current uncertainty in the economy I’m finding many buyer’s would rather play it cautiously.

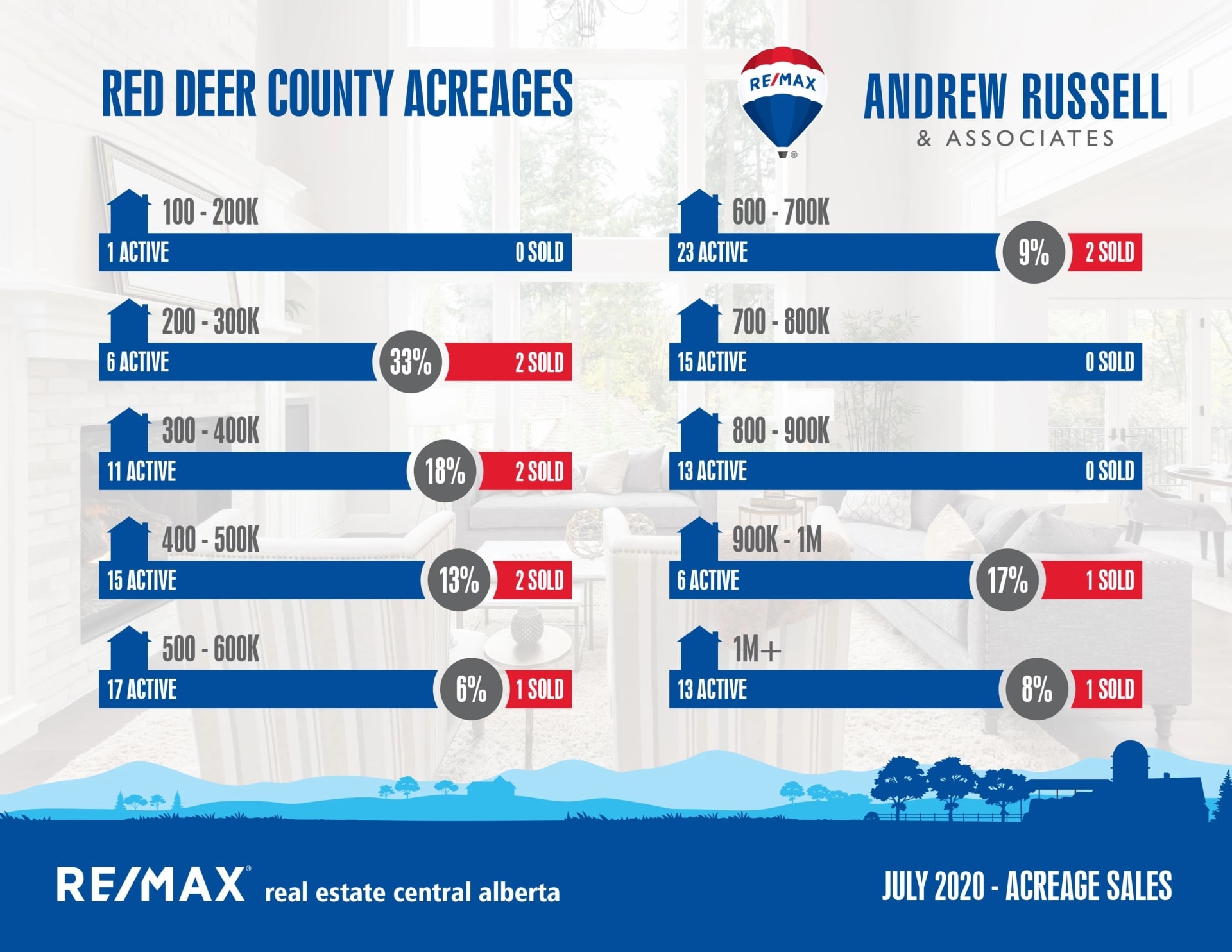

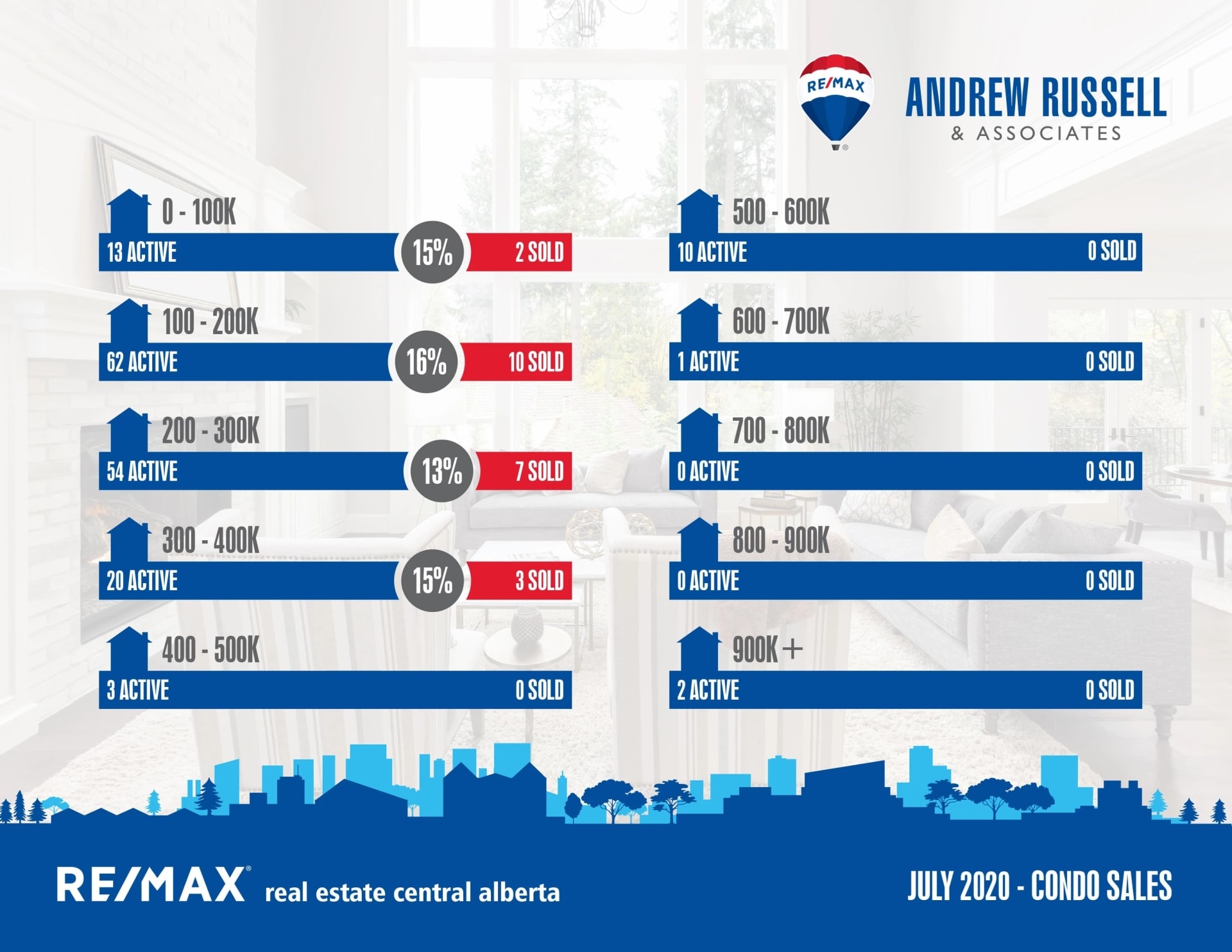

Looking at the graphs, most of the increase in sales came in that one segment (Single Family Homes up to $400,000) of the market. Condo sales were down from 2019, and acreage sales were on par. When demand goes up and supply goes down, prices are expected to go up, but it’s a little early to make that declaration until we see the trend continue for several months. Prices certainly haven’t fallen as drastically as CMHC recently predicted and as long as our recovery holds, they should hopefully stay stable. There are plenty of good reasons for first time buyers to enter the market, and great reasons for people living in those starter homes to move up. Five year mortgage rates are hovering around 2% and there are still plenty of great homes on the market at prices well below the peak of 2014.

Here’s a snapshot of surrounding communities:

Blackfalds:

Current Active Listings – 104

Sales in July – 19

Likelihood to Sell – 18% (buyer’s market)

Sylvan Lake:

Current Active Listings – 214

Sales in July – 35

Likelihood to Sell – 16.3% (buyer’s market)

Penhold:

Current Active Listings – 35

Sales in July – 3

Likelihood to Sell – 8.5% (buyer’s market)