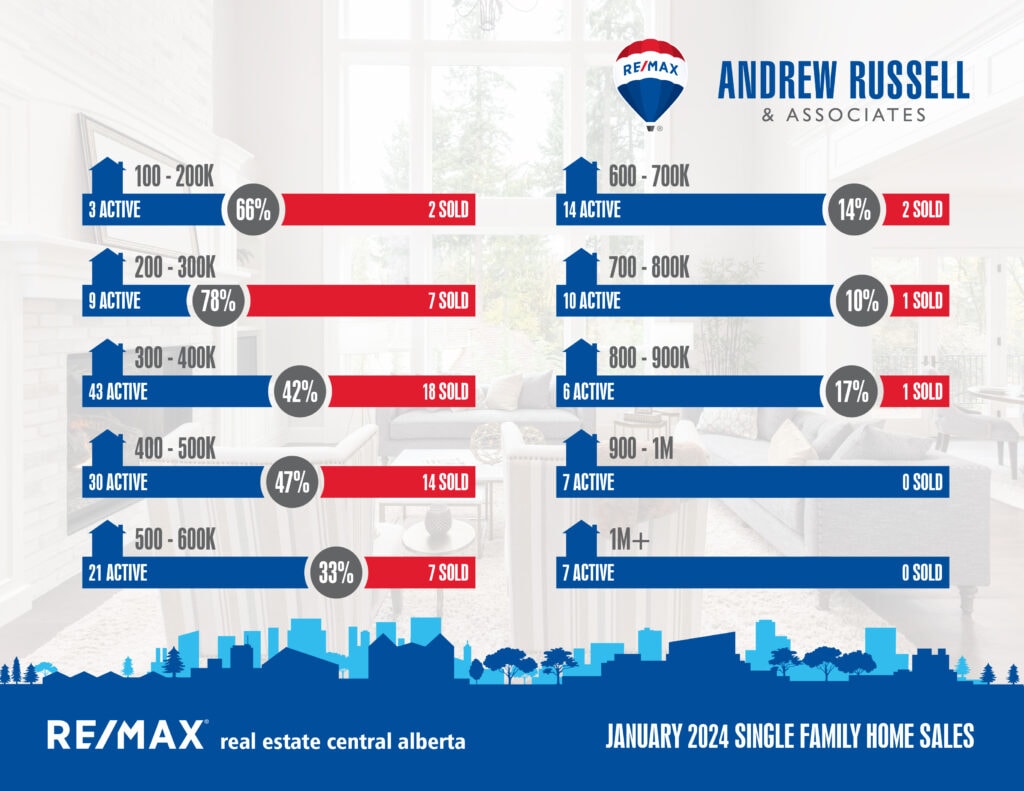

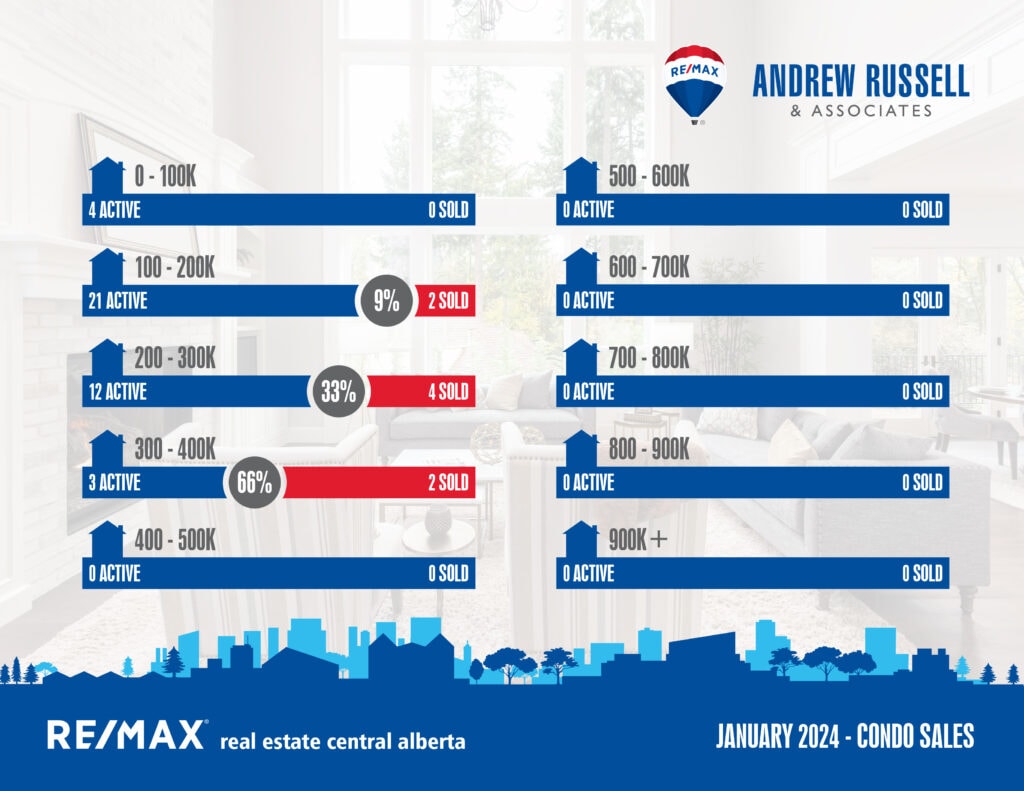

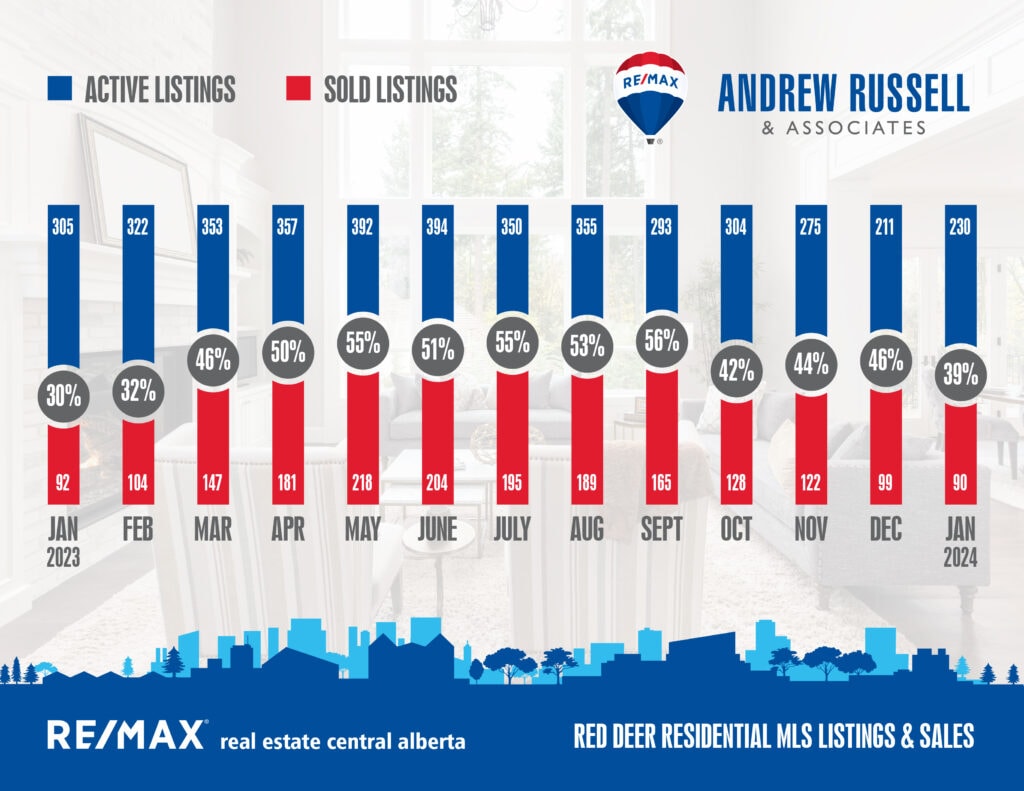

January sales dipped 9 units from December, but that’s expected at this time of year. A week or two of -50 weather never helps buyer activity, but overall it’s been a good start to the year. Low inventory continues to be a problem for buyers, however demand is not at a level yet where people are buying homes they feel are overpriced, as evidenced by a number of homes sitting on the market for longer periods of time. The best properties are still selling quickly, many on the first day or few days on market, as long as buyers feel there is value for the price.

With vacancy rates at zero, rent prices have pushed up to record levels in Central Alberta. We’re now at that the point again where most properties are cheaper to own than rent, even with current interest rates floating around 5%. Current forecasts are predicting rate decreases to start in April, but nobody can say for sure as it will largely depend on what happens with inflation rates. If we do see rates come down, expect market prices to push up even further as demand will increase due to lower rates allowing more buyers to qualify for a mortgage.

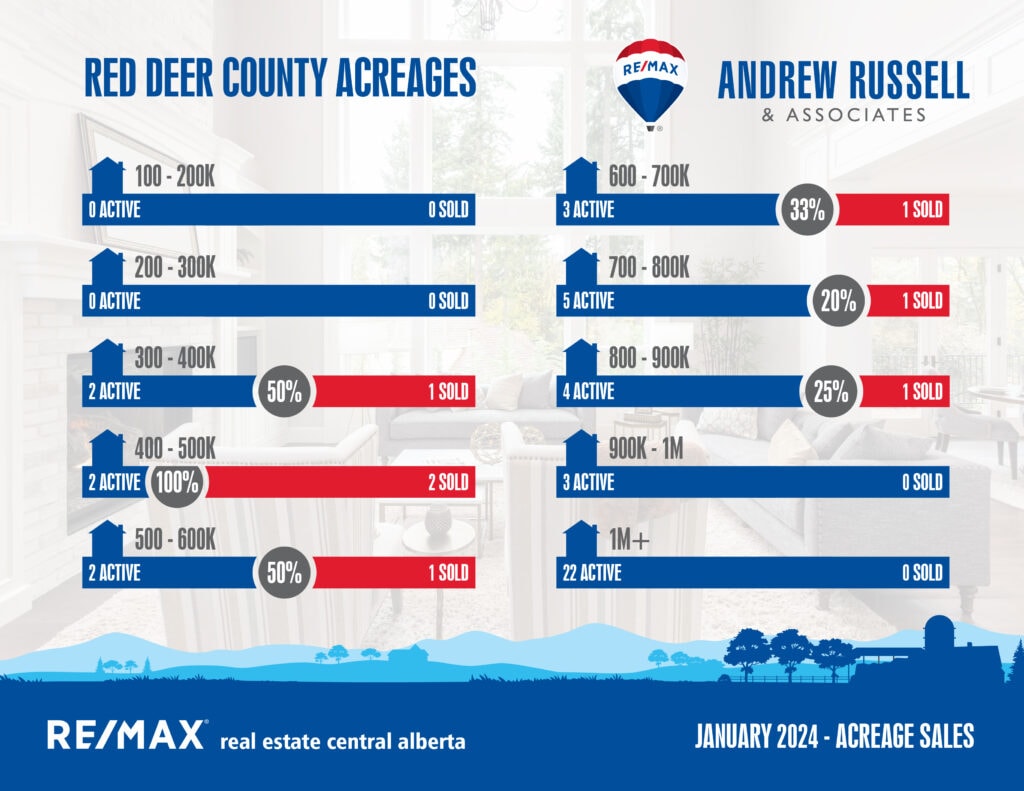

The higher end of the market (600K+) is still lagging a bit, but inventory options for buyers there remain low. I think we will see the higher end of the market see more activity in 2024, as more existing home owners may look to upgrade as their locked in 2% rates come up for renewal, assisted by the equity they’ve earned from their current homes going up in value.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 39

Sales in January – 9

Likelihood to Sell – 23% (Balanced Market)

Sylvan Lake:

Current Active Listings – 94

Sales in January – 33

Likelihood to Sell – 34% (Balanced Market)

Penhold:

Current Active Listings – 11

Sales in January – 3

Likelihood to Sell – 27% (Balanced Market)