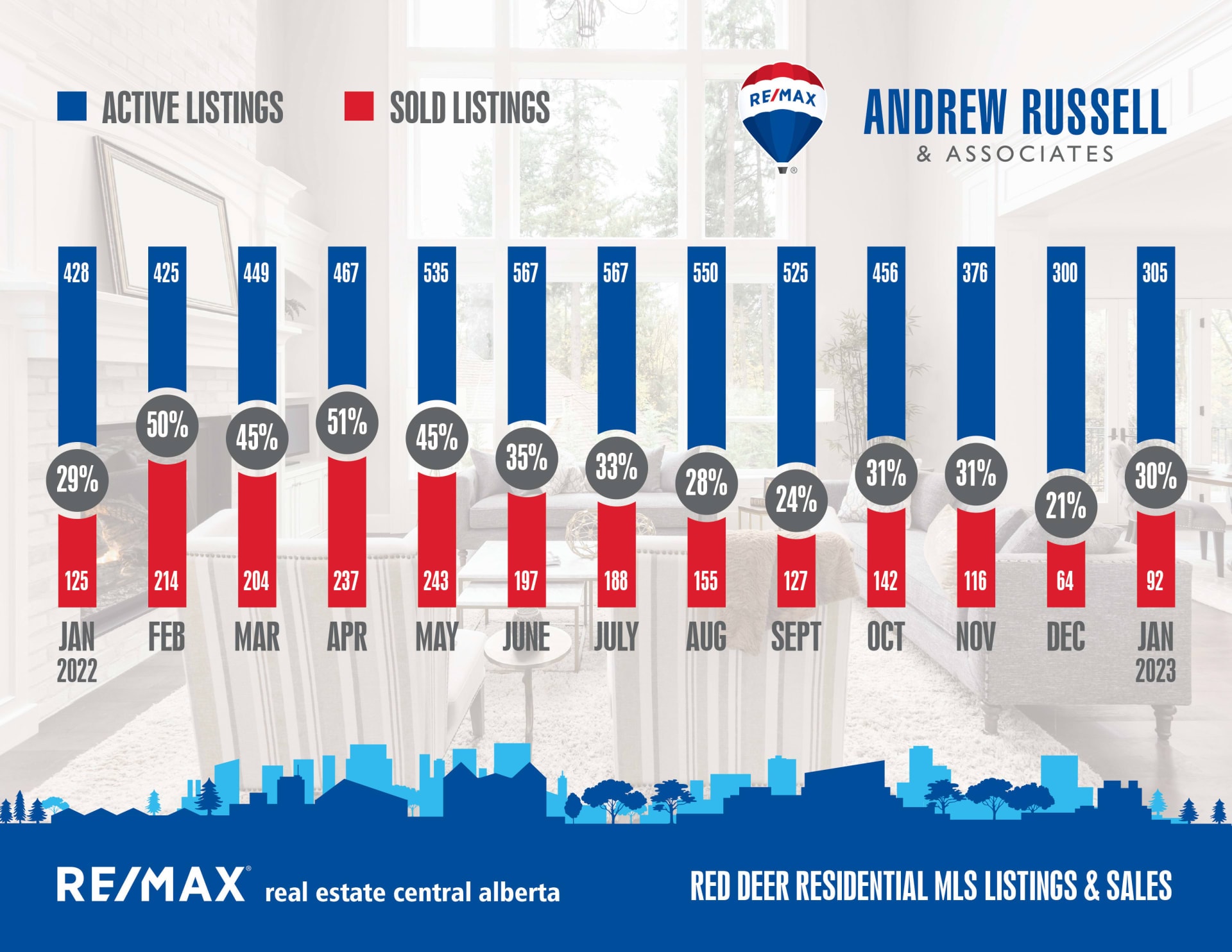

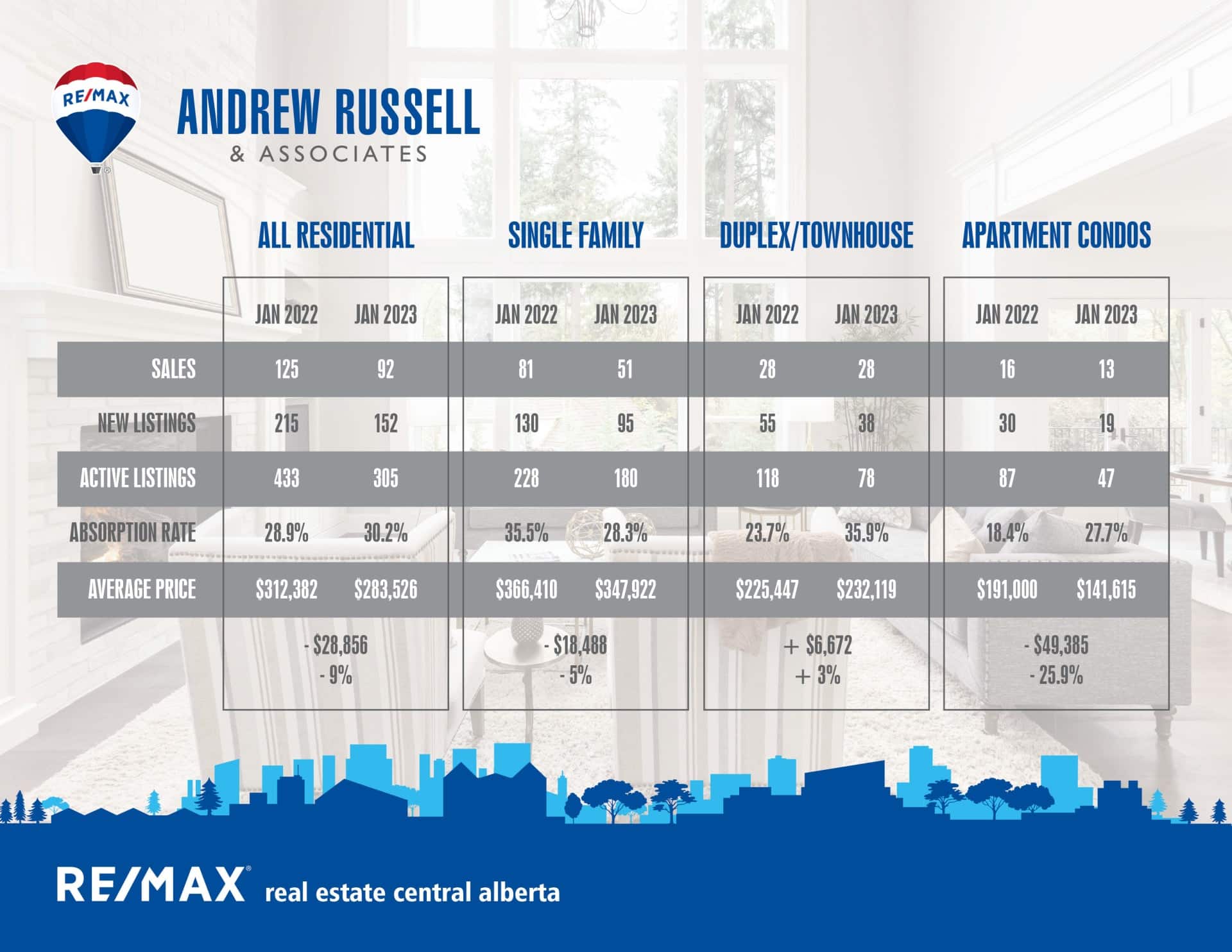

January 2023 started off a little slower than January of 2022, however sales jumped up from December by 30% which is an encouraging sign. Markets across Alberta are sitting with record low levels of inventory right now, largely a result of two things:

- Buyers are moving in from other provinces at high rates and purchasing available homes.

- Interest rates are stopping people from moving up into larger, more expensive homes, therefore they aren’t listing their existing homes for sale.

Realistically, we’re not likely going to see much increase in supply this year as the population of Alberta is expected to continue climbing. While home builders will see an increase in building activity to house the new population, cost of building and lack of trades are slowing down progress for new construction.

The Bank of Canada raised their rates another .25% in January, as expected, and stated their plan is to hold tight on further increases for now. They’re now playing a wait and see game, as inflation is usually 6 months behind, so they’re going to allow the new rates some time to take effect and re-evaluate in the summer months. If inflation is not actively dropping, we’ll likely see further increases, however forecasts right now seem positive that things are trending in the right direction.

Longer fixed rates actually came down after the Bank of Canada announcement, as some lenders are offering 5 year rates at 4.59% now. They’re doing this because they’re forecasting that rates could drop by 2024, so the 1 and 2 year rates are still sitting at over 6%. If you can handle some fluctuation, variable rates are still probably the best option for the longer term.

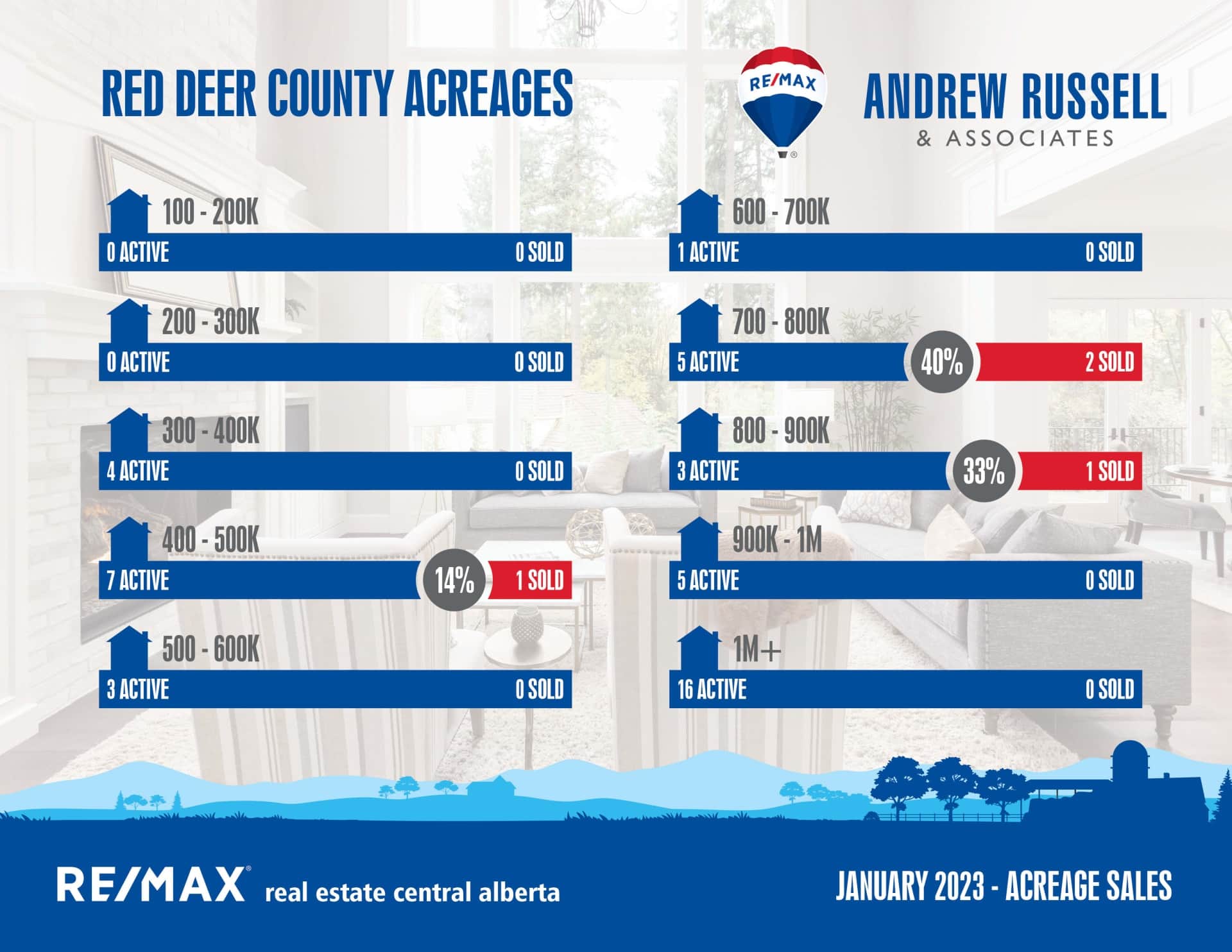

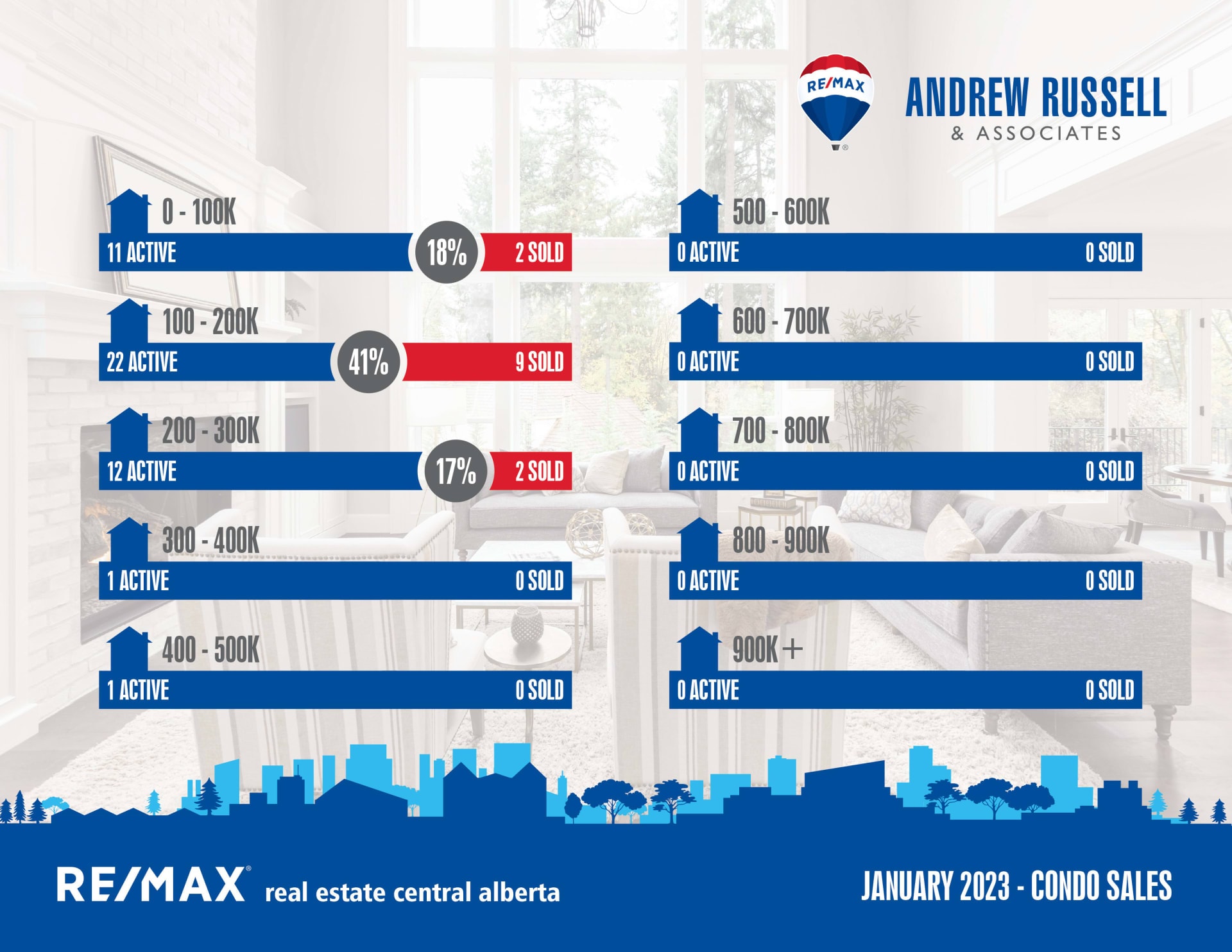

Looking at the graphs, single family activity under $500,000 is very active, while activity over $500,000 is almost non-existent, with only 4 sales posted in the 500-600k and 600-700k range in January. The 200-300k market sold 75% of its inventory, showing how hot demand is for more cost effective properties. The way things are going, it’s likely we’ll see prices push up for homes under $500,000. I’m optimistic the higher end market will improve as we move into spring/summer, however it’s much less likely we see increases in price on more expensive homes at this point.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 34

Sales in January – 6

Likelihood to Sell – 19.4% (Buyer’s Market)

Sylvan Lake:

Current Active Listings – 92

Sales in January – 21

Likelihood to Sell – 23.3% (Balanced Market)

Penhold:

Current Active Listings – 19

Sales in January – 3

Likelihood to Sell – 17.1% (Buyer’s Market)