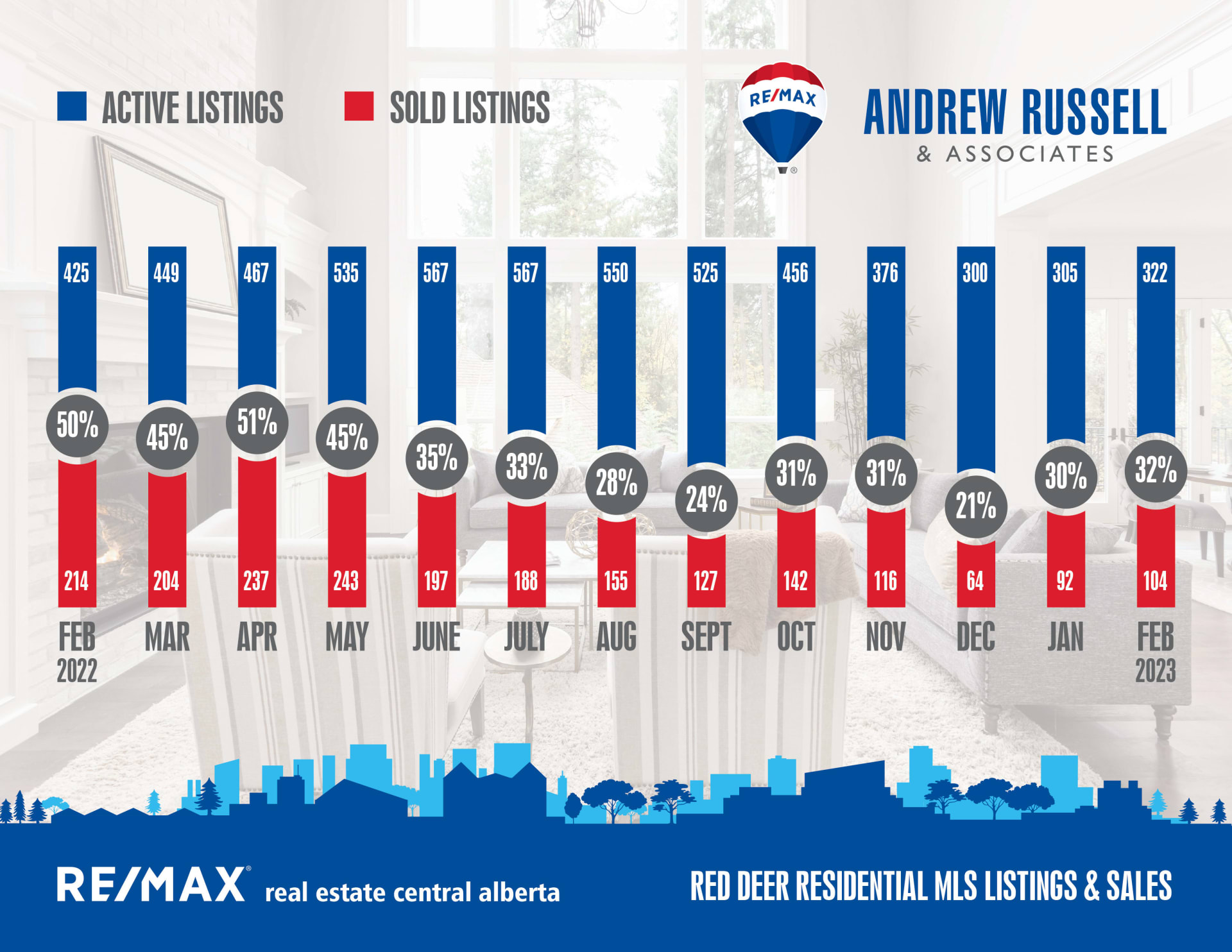

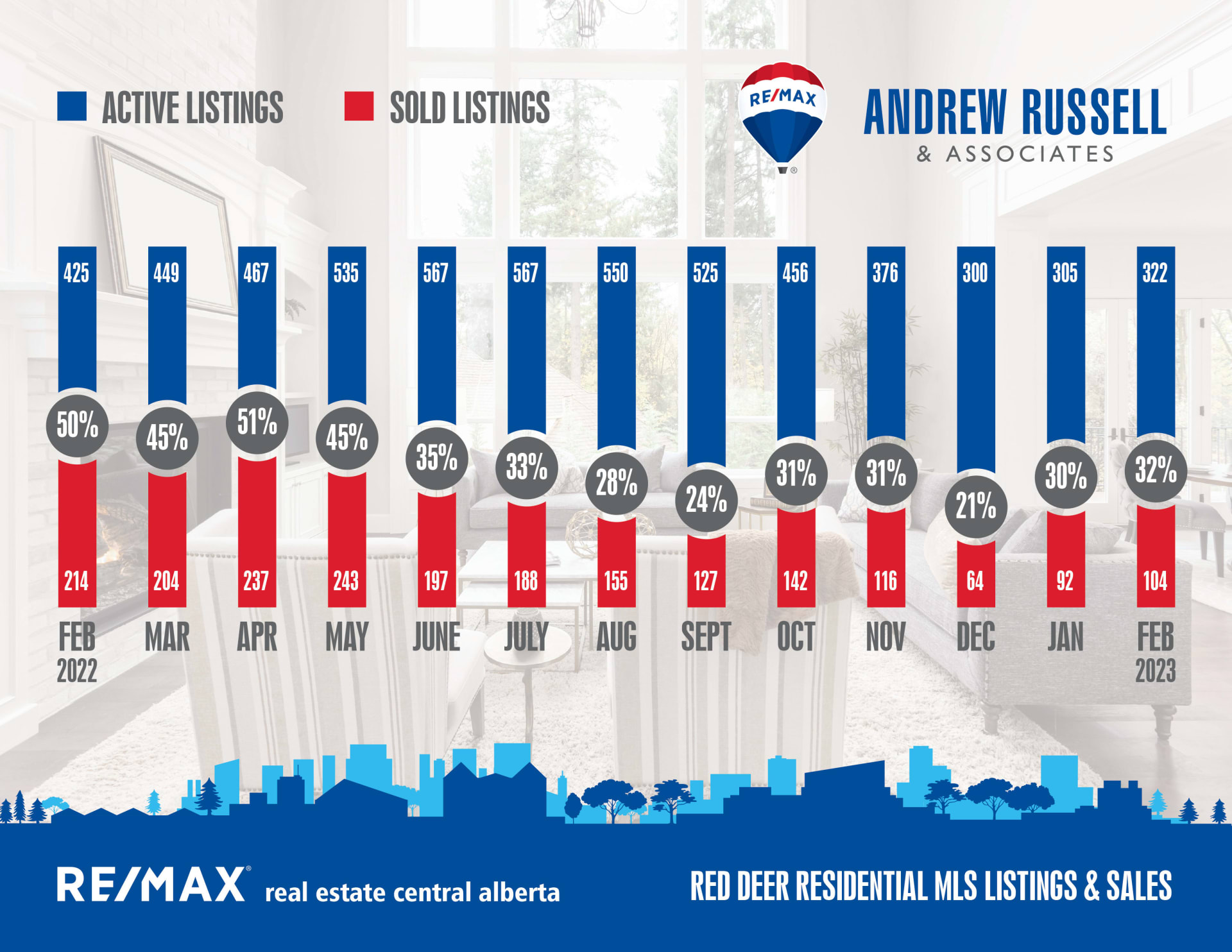

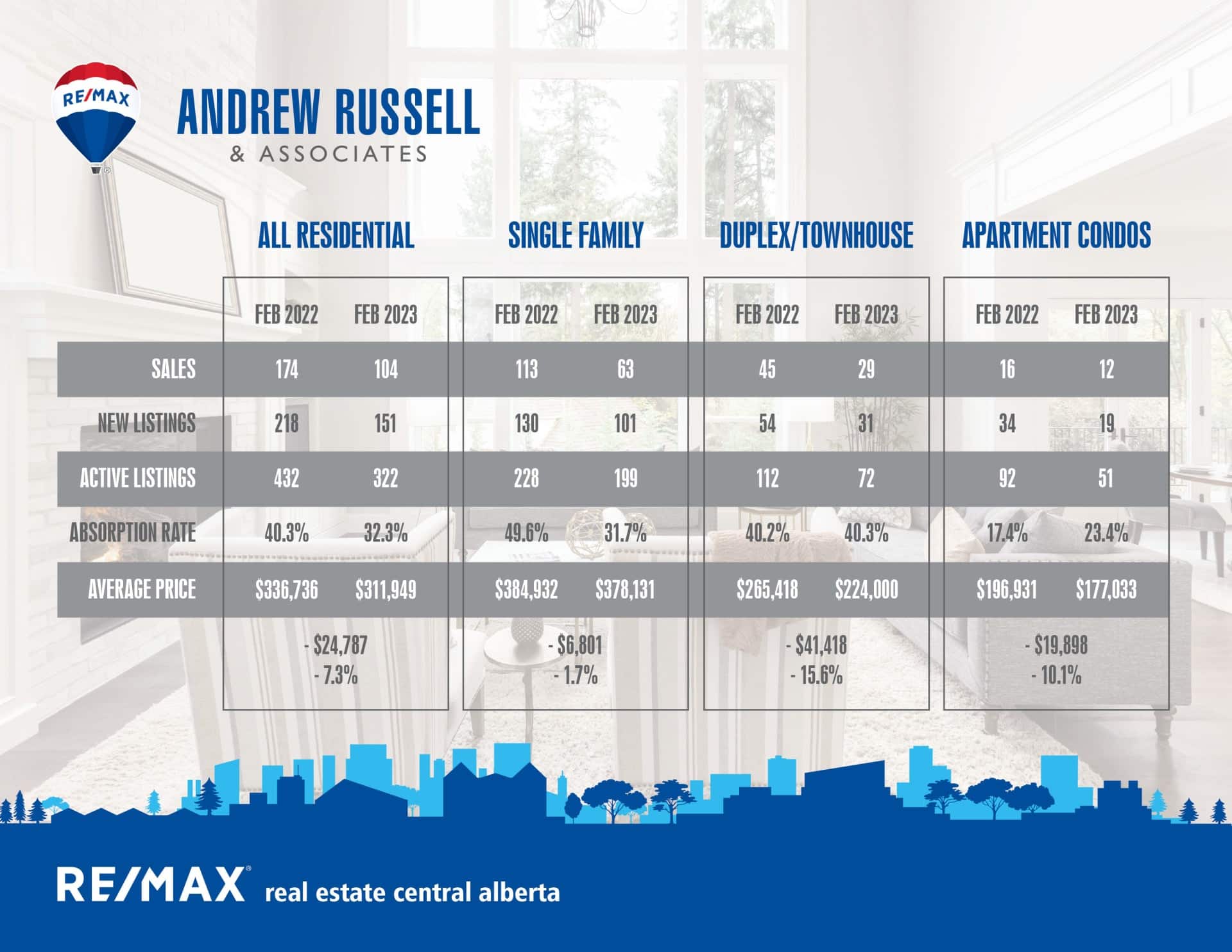

The Central Alberta market continues to move along, but at a much slower pace than 1 year ago. With only 104 sales in February, sales numbers in Red Deer are down 51% from where they were in 2022. The market is still sitting in a balanced position with just over 3 months of inventory, but buyers are not purchasing properties at the same pace as last year. Keep in mind, the pace of sales in the first 8 months of 2022 was not typical.

So what’s changed?

Interest rates are the primary factor. A year ago, 2% mortgages were still a thing, where as buyers currently looking at a 5 year fixed rates are in the 5% range. For perspective, on a $400,000 purchase with 5% down, a mortgage payment at 2% interest is $1673/mo. At 5% interest, that same payment is now $2299/mo, which is a 27% increase. That’s $626 more per month, or $7512 more per year for the same home.

Inflation is the next factor. The cost of living and purchasing everyday goods such as food, fuel, and heat/electricity has increased dramatically over the last year, but most people’s incomes have not. Because these items are generally necessity and not “want” purchases, any extra money somebody may have had to purchase a home and pay that extra $626/mo mentioned above may now be eaten up just in the cost of everyday living.

Immigration is the 3rd major factor, in that the pace of immigration has slowed. Last year, our market was flooded with buyers coming in primarily from BC and Ontario, taking advantage of high prices in their home markets and buying in Alberta at a significant discount. Those markets have seen considerable drops in the last 12 months, with some properties coming down 30% in value over the last year. While Alberta prices are still significantly cheaper, nobody wants to sell their home at the bottom of a market if they can avoid it, and so there seems to be less urgency to relocate. The lack of available inventory in both the re-sale and rental markets could also be holding people back, as it’s daunting to think about moving to a new province and running the risk of not finding a place to live. Central Alberta is also not seeing the same rate of immigration as Calgary and Edmonton, largely due to a smaller job base.

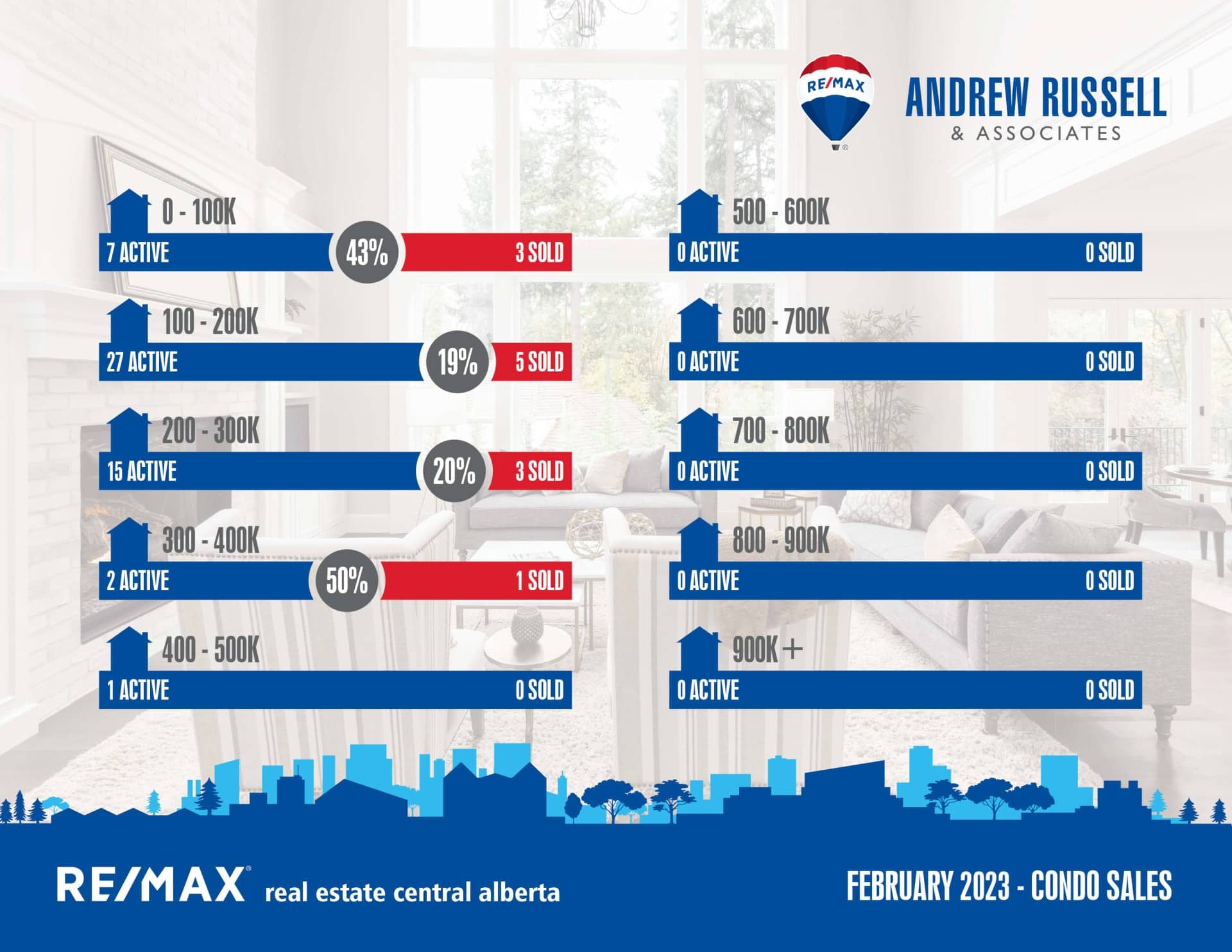

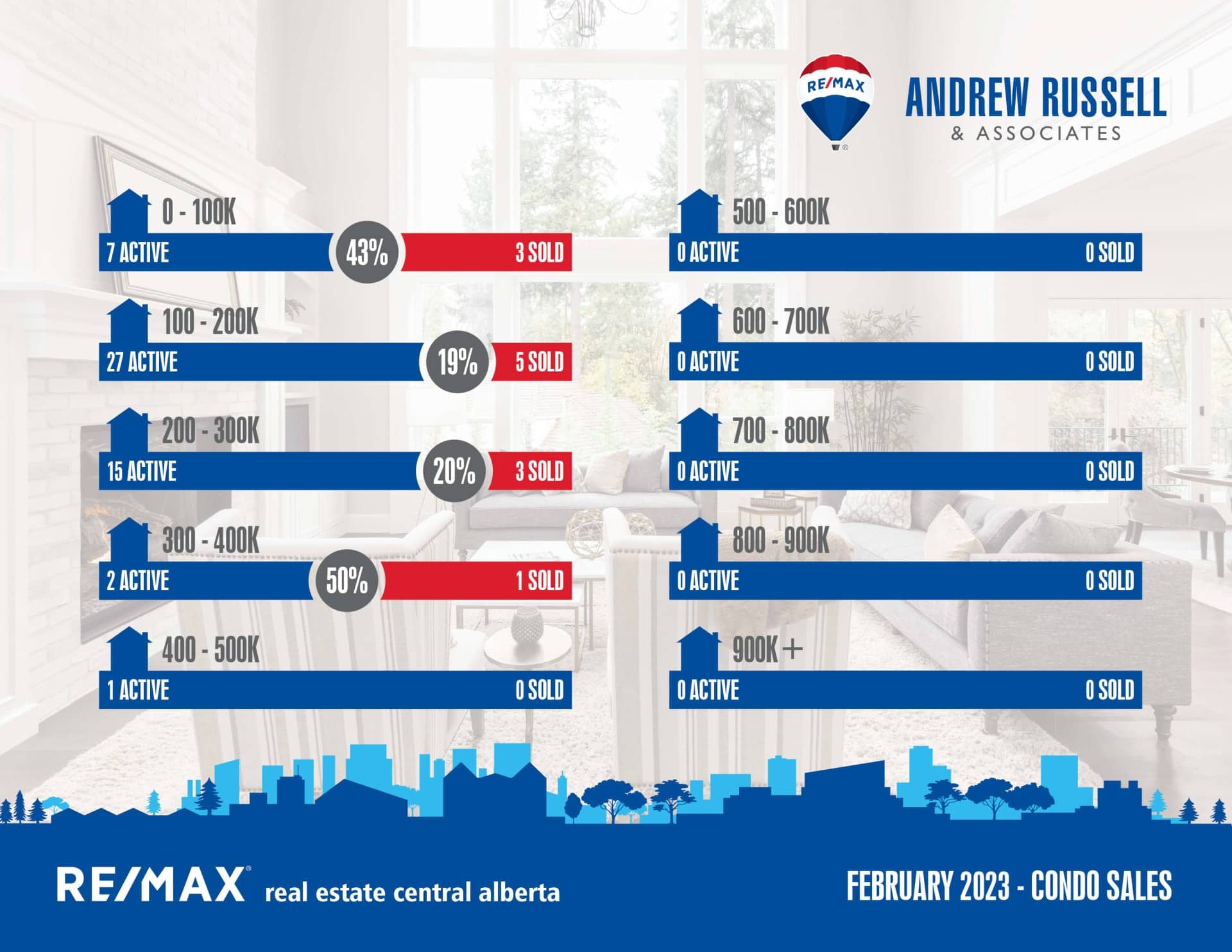

As you can see from our graphs, demand for single family homes under $400,000 is very high, and I do believe we’ll see home prices in these price points push higher this year. The higher end market also has low inventory, but buyer demand is also much lower. Between inflation and interest rates, many buyers no longer qualify at these higher price points. For buyer’s looking to move up who can afford it, now is a great time to take advantage of the quieter luxury market.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 46

Sales in January – 14

Likelihood to Sell – 30% (Balanced Market)

Sylvan Lake:

Current Active Listings – 87

Sales in January – 32

Likelihood to Sell – 36.7% (Balanced Market)

Penhold:

Current Active Listings – 17

Sales in January – 9

Likelihood to Sell – 53% (Seller’s Market)