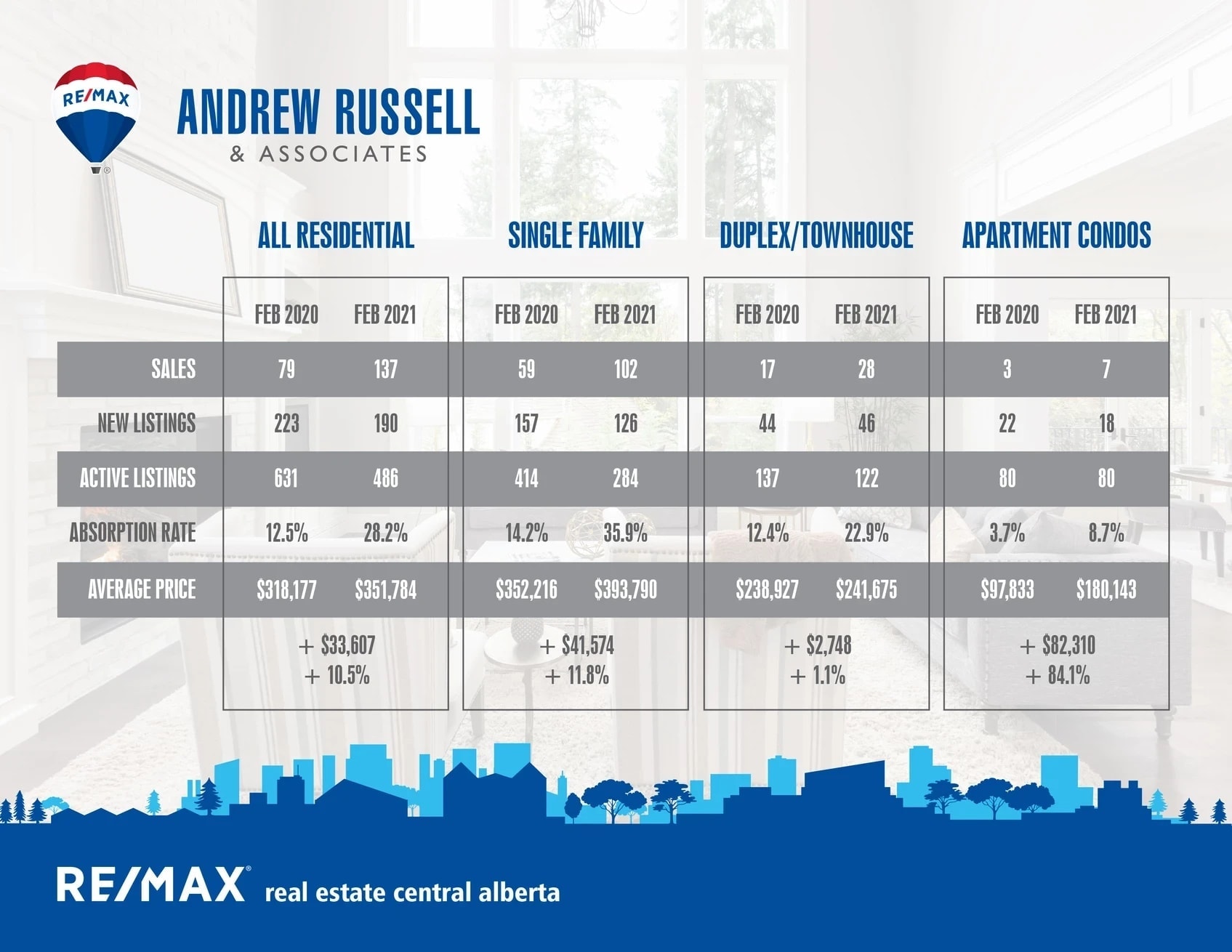

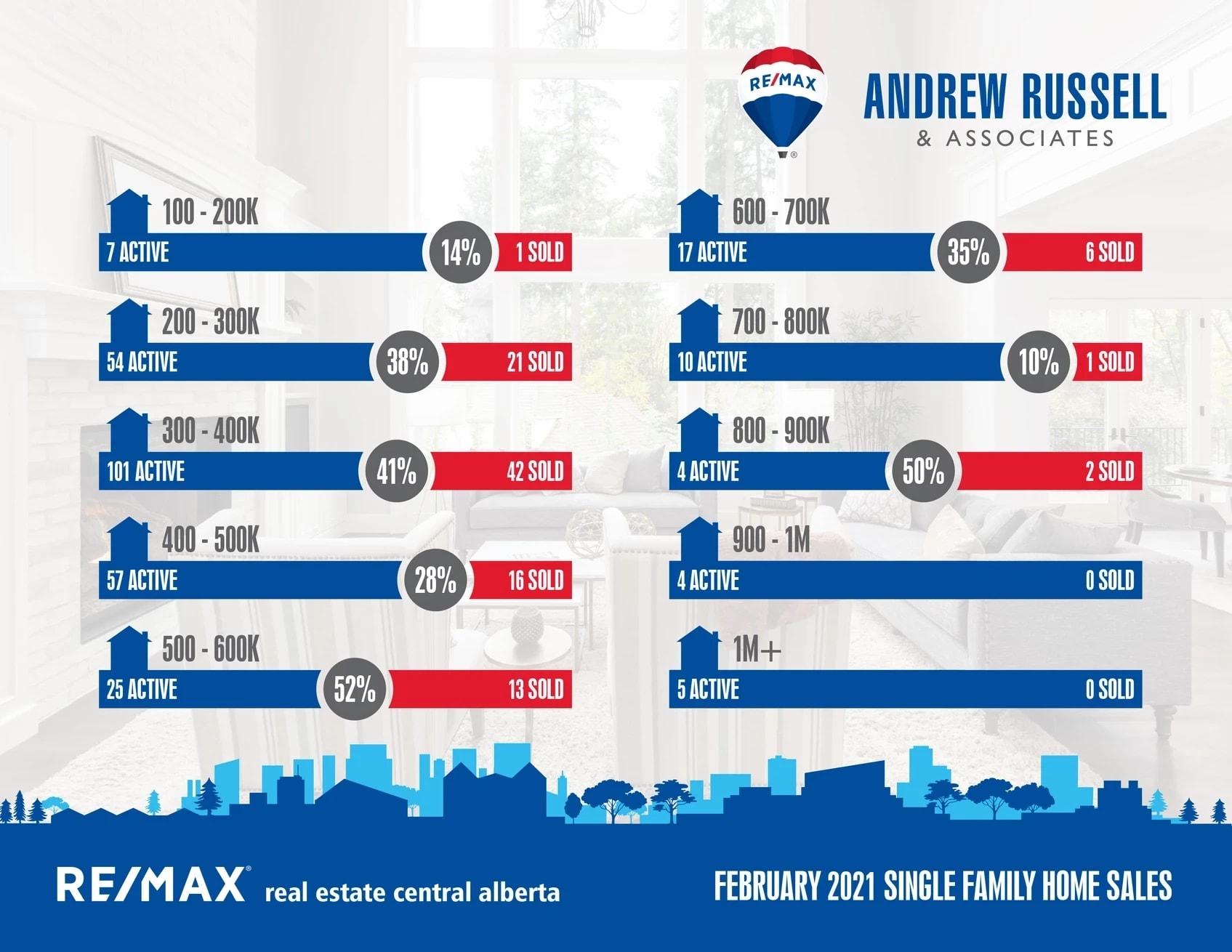

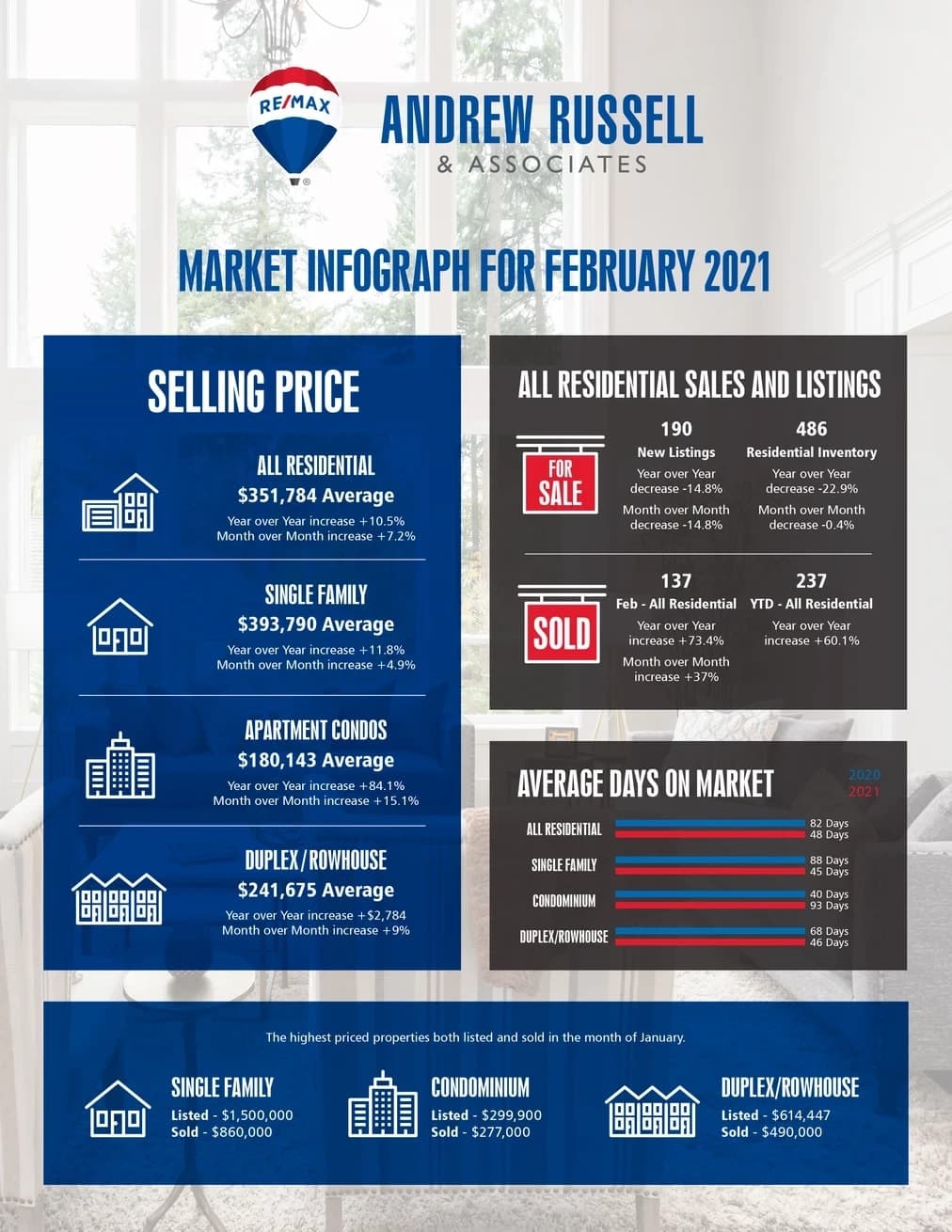

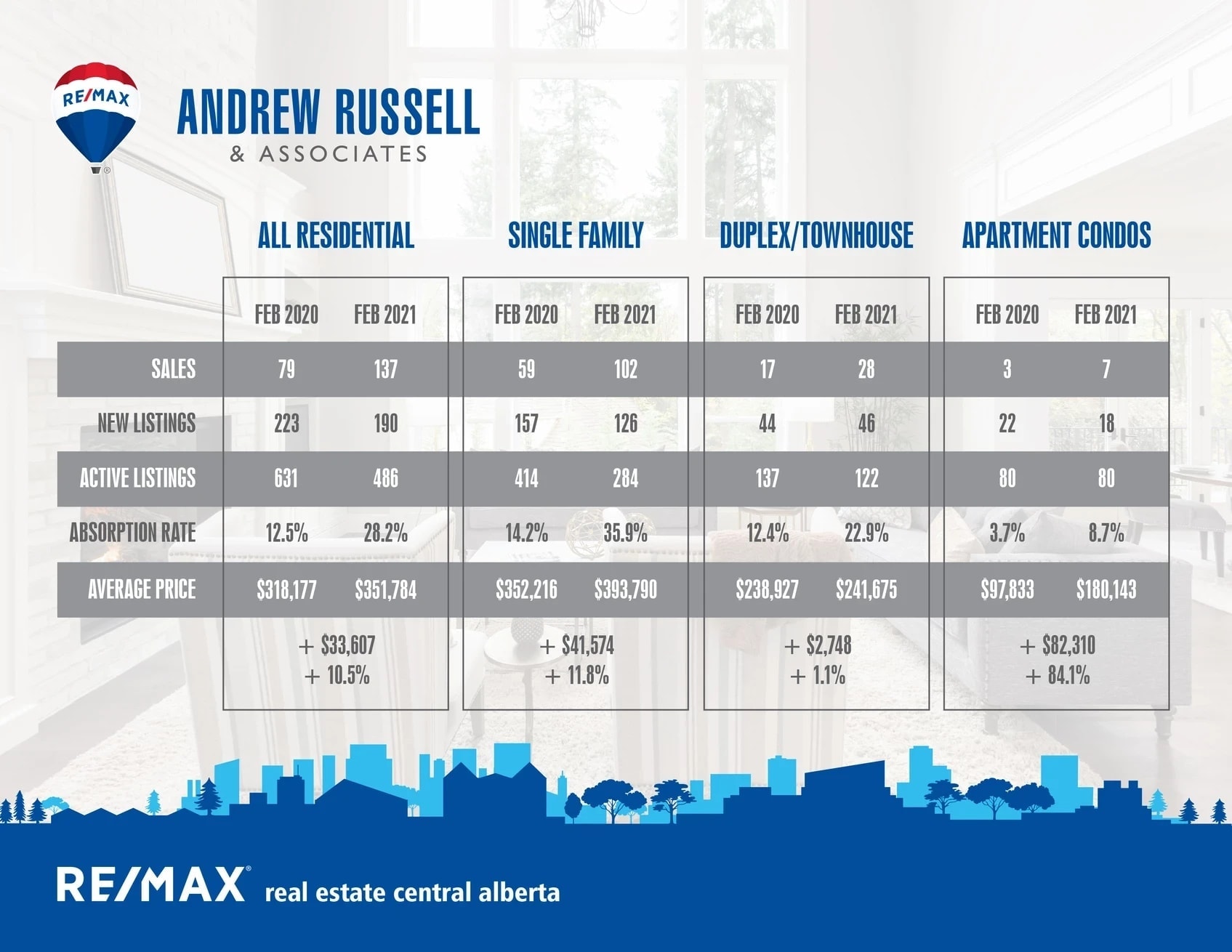

What a difference a year can make! The single family market is still on fire and for the first time since 2014 the overall market is pushing seller’s market territory. Sales were up 58 units in Red Deer (42%) compared to February of 2020, and demand for all types of housing except condos are in either balanced or seller’s markets

I’m not sure when this will end, but I believe a combination of low interest rates and COVID boredom are what’s currently fueling this market, as the economy in Central Alberta doesn’t justify seeing such an increase. Fixed interest rates have just gone up, reflecting increased confidence in the federal economy as bond yields rise. Fixed rates are tied to the bond markets, while variable rate are tied to the Bank of Canada’s prime rates. As the economy shows signs of improvement, rates will rise up to keep inflation in check, which will raise the cost of borrowing and either knock some buyers out of the market, or slow down their eagerness and ability to get a good deal. Fixed rates are still sitting around 2%, and variables are around 1.4% to 1.6% which is still an incredible rate.

I do believe that increasing interest rates and the world starting to open back up later this year as vaccinations become more widespread will cool this market off. If you’ve been wanting to sell, this spring and summer might be your best chance to maximize what you can get for your home. We don’t know what the long term holds yet, but forecasts for the price of oil increasing will be good for the Central Alberta economy. The recent increase in activity is definitely pushing prices up slightly in some housing categories, but don’t expect a massive increase in the value of your home that quickly. Real estate prices are generally slow and steady, and take a fair amount of time to go up and down, which is why real estate is generally considered a stable asset.

The one market that has barely changed is the condo market. Rising condo fees across the country due to increasing insurance rates and rising cost of materials/repairs/improvements/utilities are pushing condo demand down, along with prices. Buyer’s needing mortgages have to factor their monthly condo fee into their debt servicing ratios, and so rising fees result in reduced affordability. With interest rates at 2%, a monthly condo fee of $300 impacts a buyers purchasing power by about $72,000. This means a buyer can purchase a property for $300,000 with a $300 condo fee (total monthly payment of about $1555), or a property for $372,0000 with zero condo fees (total monthly payment of about $1555). For most buyers, $72,000 will get them into a much nicer home, so they’re using their extra purchasing power to get into single family homes. Most of the older population who want condo living for the lack of maintenance aren’t currently moving due to COVID concerns, and so I do believe we’ll see some improvement in condo sales later on this year.

Surrounding community snapshot:

Blackfalds:

Current Active Listings – 70

Sales in February – 25

Likelihood to Sell – 35.5% (balanced market)

Sylvan Lake:

Current Active Listings – 125

Sales in February – 38

Likelihood to Sell – 30% (balanced market)

Penhold:

Current Active Listings – 25

Sales in February – 2

Likelihood to Sell – 8.2% (buyer’s market)