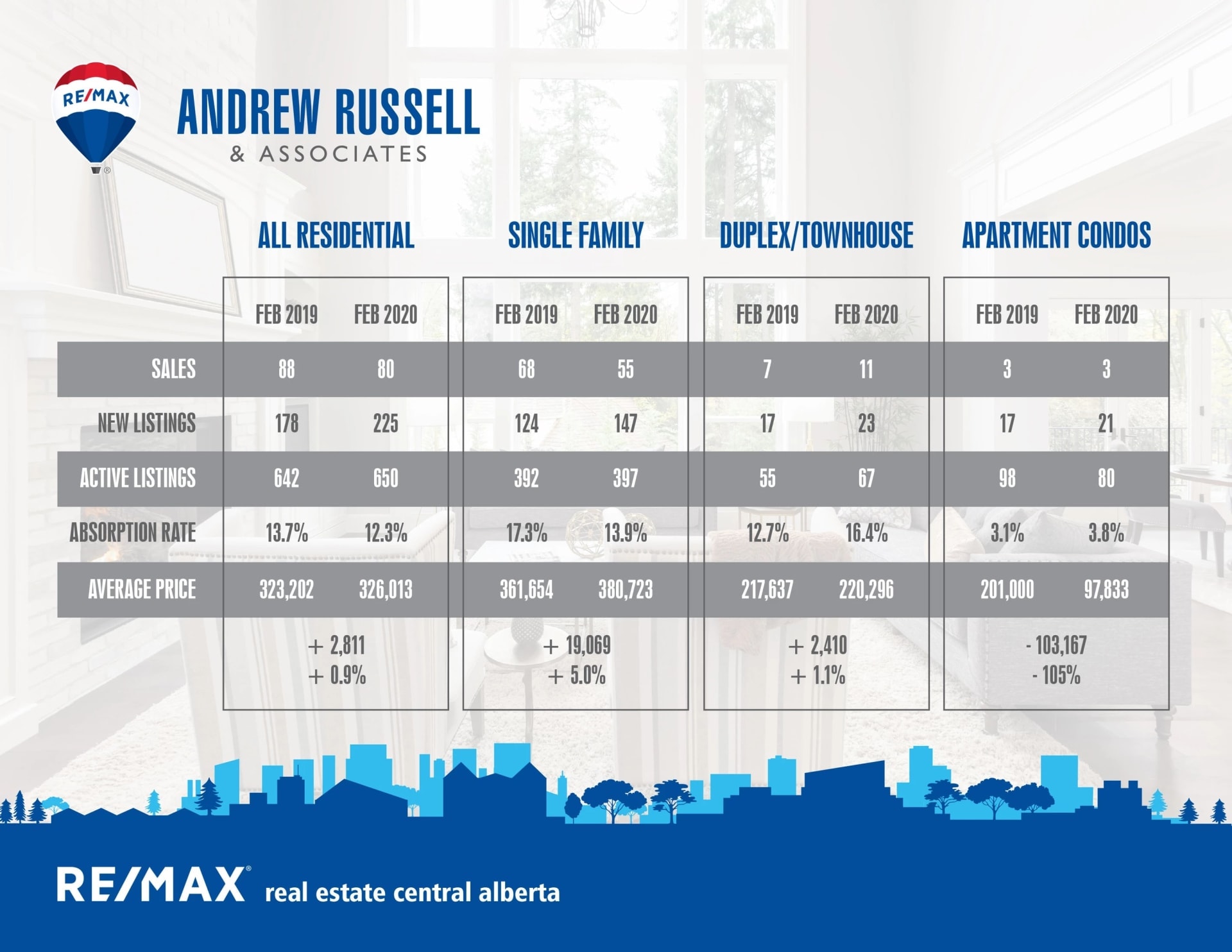

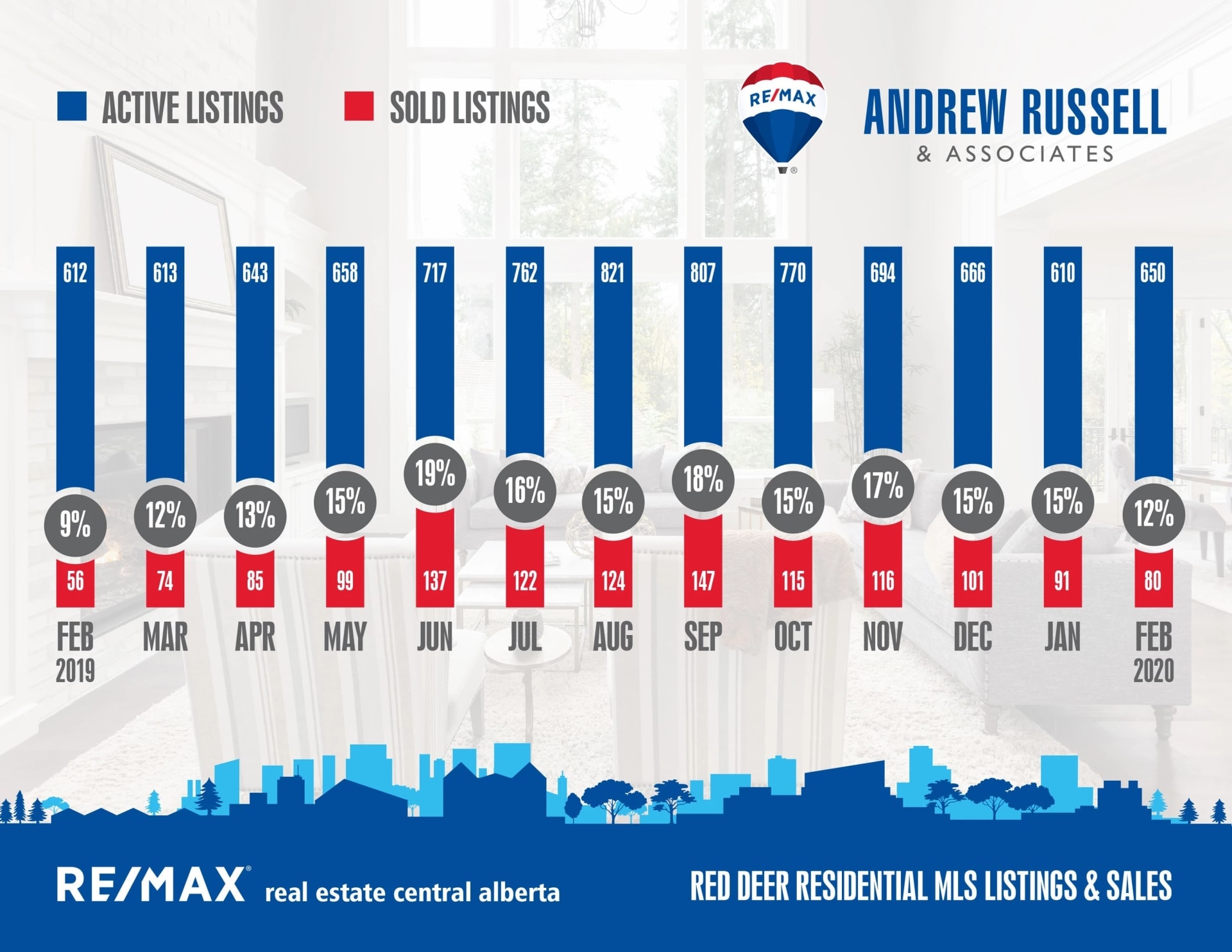

While it definitely feels like the market is picking up from the same time last year, the stats don’t reflect that yet. February sales were actually down from 2019, and listings are up. Not what you want to hear if you’re selling a home right now, however we’re still early in the year and I think a lot of sellers are getting ready for what will hopefully be a busy spring, hence the increase in inventory. The number of vacant properties for sale has come down from last month to 36%, which is more consistent for what we’ve been used to over the last 2 years, although still not a positive number.

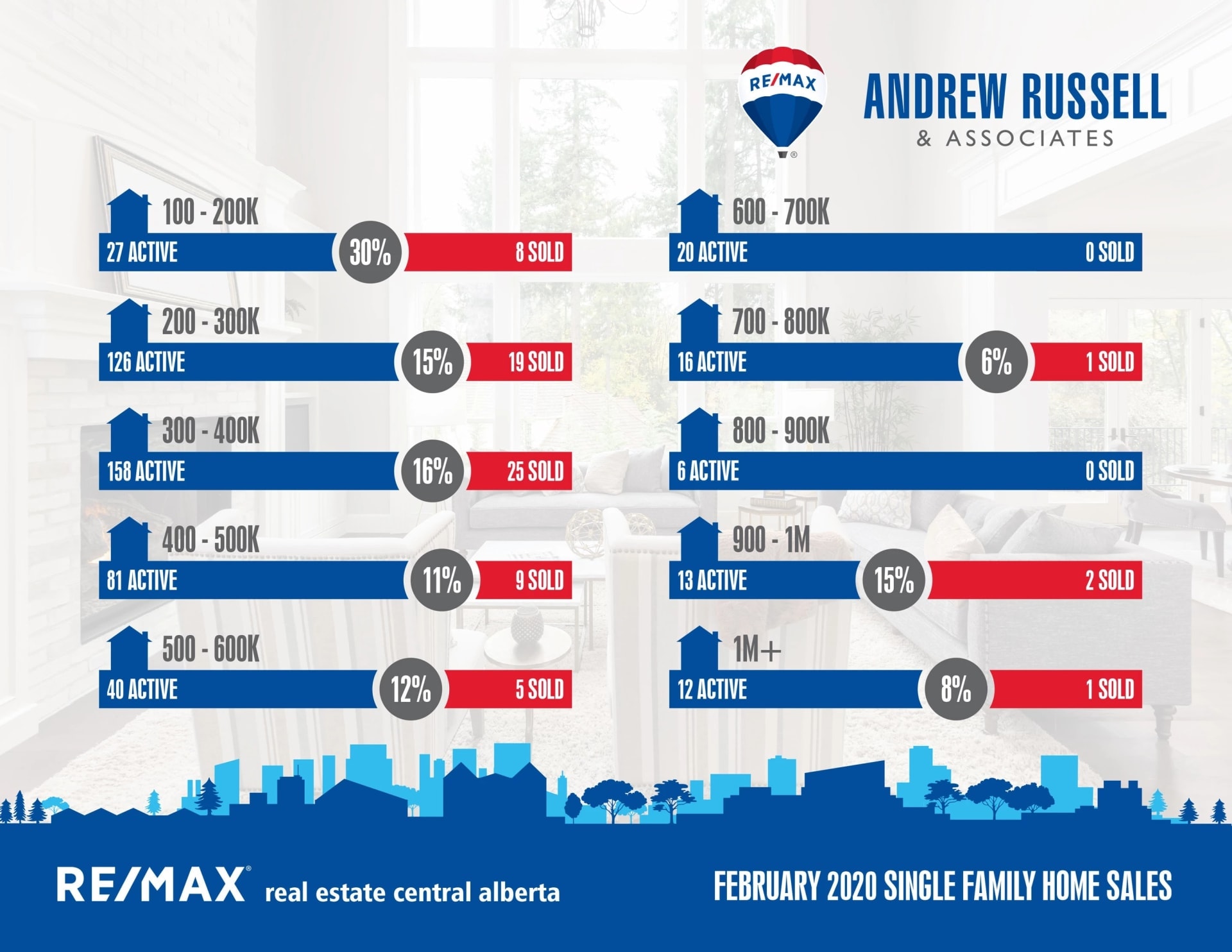

As usual, the market up to $400k is still the most active, although it’s still a buyer’s market throughout all price points. I’m happy to report that I sold the first million dollar property of the year, hopefully a sign that the higher end market may still have hope of picking up in 2020. We didn’t’ see a single million dollar sale happen until September last year. There were also a pair of sales in the $900k range, and another in the $700k range. I think one thing holding back the higher end market is a lack of well-priced inventory. Many sellers built these high end homes in 2014 and 2015 when prices were high, and they’re trying to mitigate their losses by pricing above the sale trends, however most of these homes are sitting on the market for long periods of time without selling.

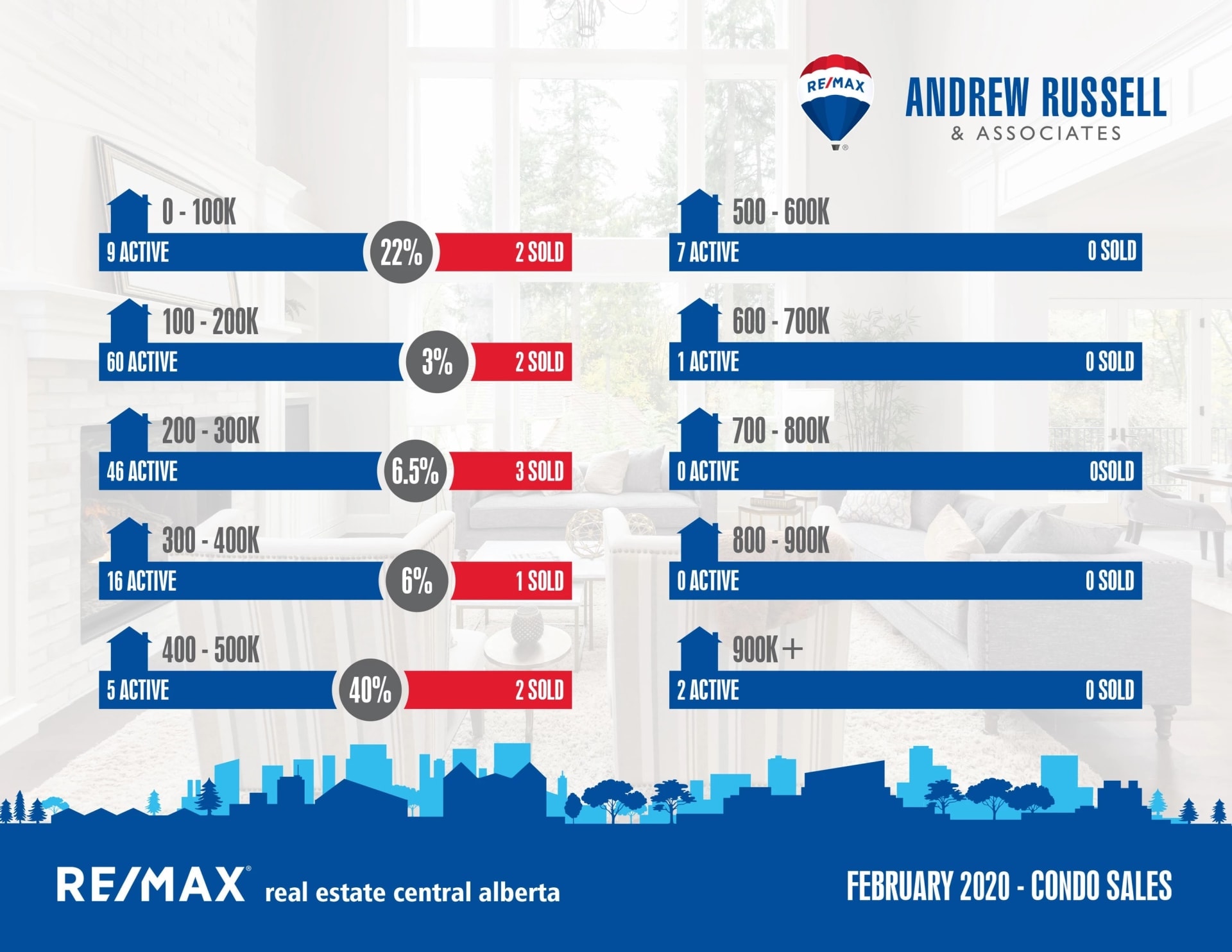

The apartment condo market is not faring well, with only 3 sales in February despite there being 80 active listings to choose from. The average price also dropped more than $100,000 from a year ago, indicating that most of the apartment sales are happening under $100,000. At the current rate of sales, it would take 27 months for us to run out of condo inventory. That is a staggeringly bad number. I suspect some buyers may be hesitant to buy into condos right now after what happened with condo insurance rates in Fort McMurray after the fires. Many residents there saw their condo fees skyrocket as much as $1000/mo simply due to the increase in insurance rates. Most people can’t handle that type of monthly payment increase, and while I don’t expect rates will go up that much in Red Deer where the forest fire risk is basically non-existent, there’s a good chance we may see the rates increase (as they have on both vehicles and single family homes), which will affect condo fees.

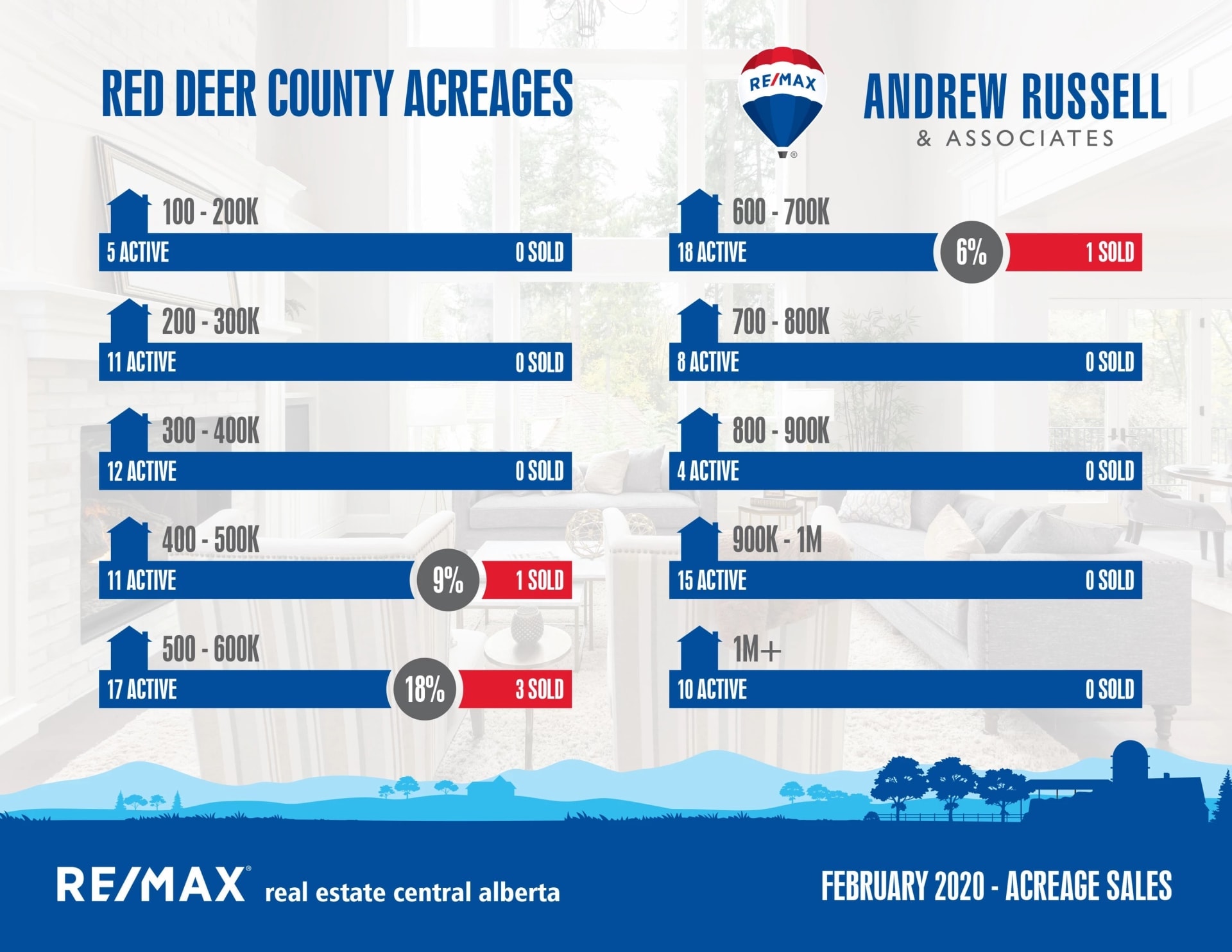

Acreage activity still remains slow, with only 5 sales posted in all of Red Deer County in February. While we’re slightly behind pace for sales compared to a year ago, the bulk of acreage sales don’t start to happen until April or May. With the higher end price points in town starting to show some signs of life, I’m hopeful we may start to see sales activity increase as we move through the year.

While the economy and stock markets are all a bit of a mess right now, the announced rate drop from the BOC this morning and the revised mortgage stress test should hopefully help get a few more buyers into the market this year. There are still plenty of people who are gainfully employed and in a position to buy homes. This market and economy can definitely be frustrating when trying to sell a home, but we have to remember to focus on what we can control when it comes to selling a home: Price, Presentation, and Exposure. Despite all of the other factors, having all three of those elements correct will get your home sold every time.