December stats are in, and the market held a great pace despite the holidays and cold weather. Generally an active market in December and January is a positive sign of a busy year ahead!

Inventory levels have dropped off substantially, with only 383 active listings on the market in Red Deer as I type this. It’s normal for homes that haven’t sold by Christmas to come off the market for a short period of time, as people either don’t want to be bothered with showings over the holidays, or to give a listing that’s been on the market for a while a bit of a break. Inventory levels should start to come up as we get further into January, especially if sales activity continues at the current pace, however I expect the number of listings to stay low over the course of the year.

Demand for single family homes under $500,000 is still very strong. While properties still need to be listed at the right values to receive interest, buyers are becoming slightly less sensitive to smaller discrepancies in price if the home is in a high demand area or price point and ticks all of their boxes. If things continue at the same pace as they did last spring, we’ll likely see multiple offers and properties starting to sell over list again as we get closer to March and April when the spring market typically takes off.

Another factor that could push things along in the spring market is the possibility of mortgage rates increasing. Fixed rates are currently hovering around 2.49 to 2.65% for a 5 year fixed, while variable rates are sitting around prime minus 1% (currently 1.45%). Many forecasts state rates could jump by a full percent over the course of the year, typically done in .25% to .5% increases. While higher rates will affect affordability for buyers, these are still extremely good rates. If you’re going to be purchasing a home in the next 90-120 days, I would suggest locking in a rate with a bank or mortgage broker, as it may save you some money in the long run.

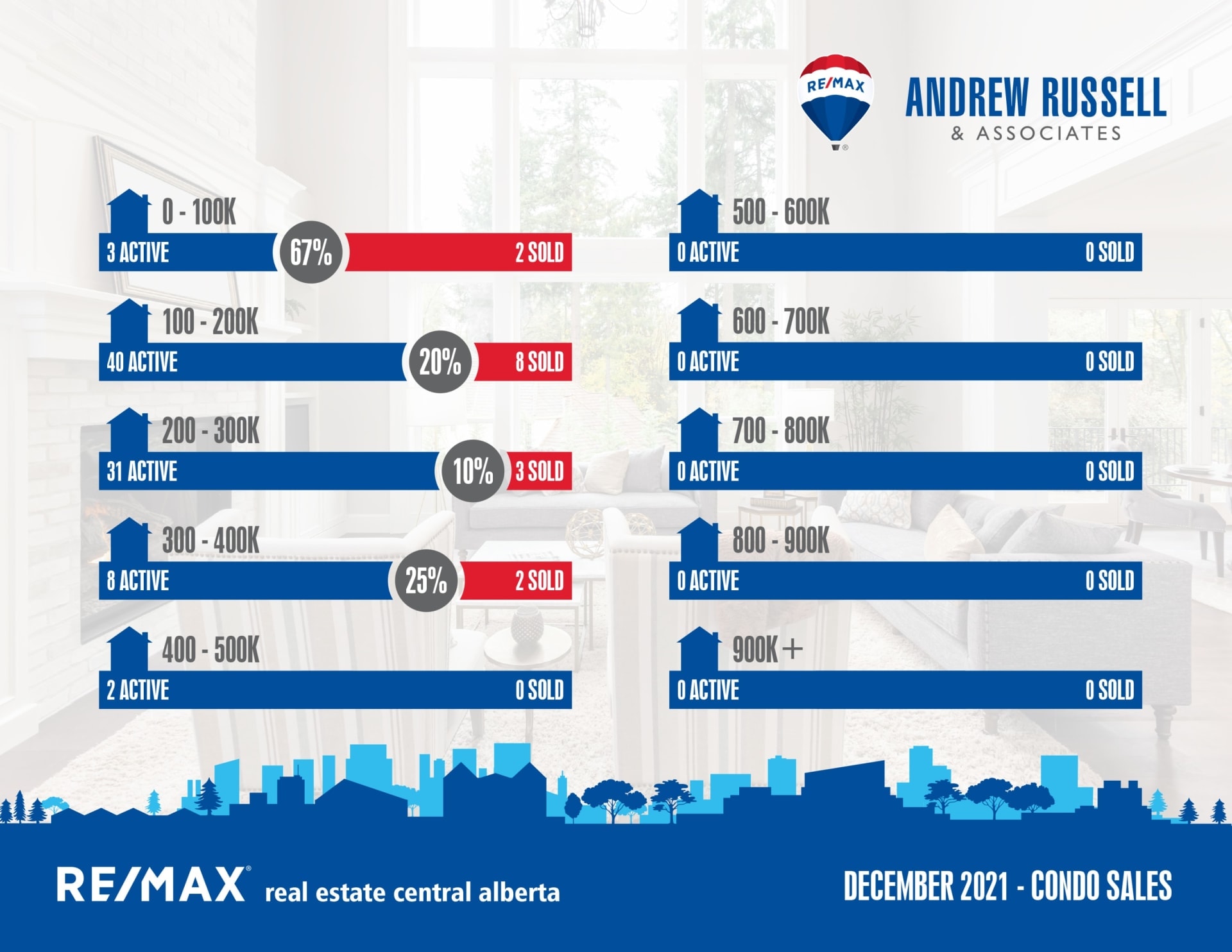

I believe we’ll see demand increase this year for attached housing (duplexes and townhomes) as single family homes will likely start to push out of the affordability range for some buyers, while the condo market will likely continue to lag due to condo fees impacting affordability for most buyers (this does not apply to adult/senior buildings which are in their own niche).

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 59

Sales in Dec – 19

Likelihood to Sell – 27.3% (balanced market)

Sylvan Lake:

Current Active Listings – 71

Sales in Dec – 27

Likelihood to Sell – 31% (balanced market)

Penhold:

Current Active Listings – 20

Sales in Dec – 4

Likelihood to Sell – 17.7% (buyers market)