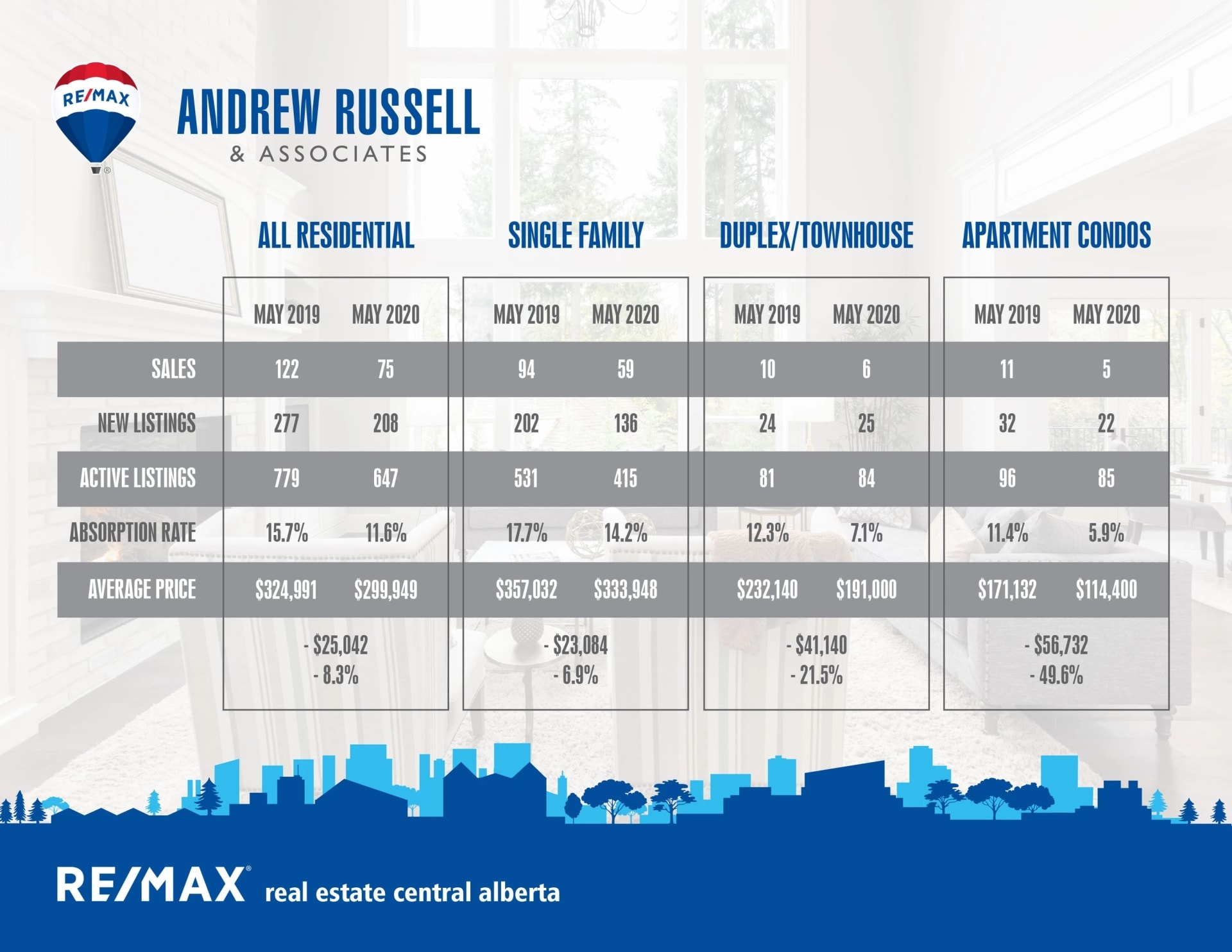

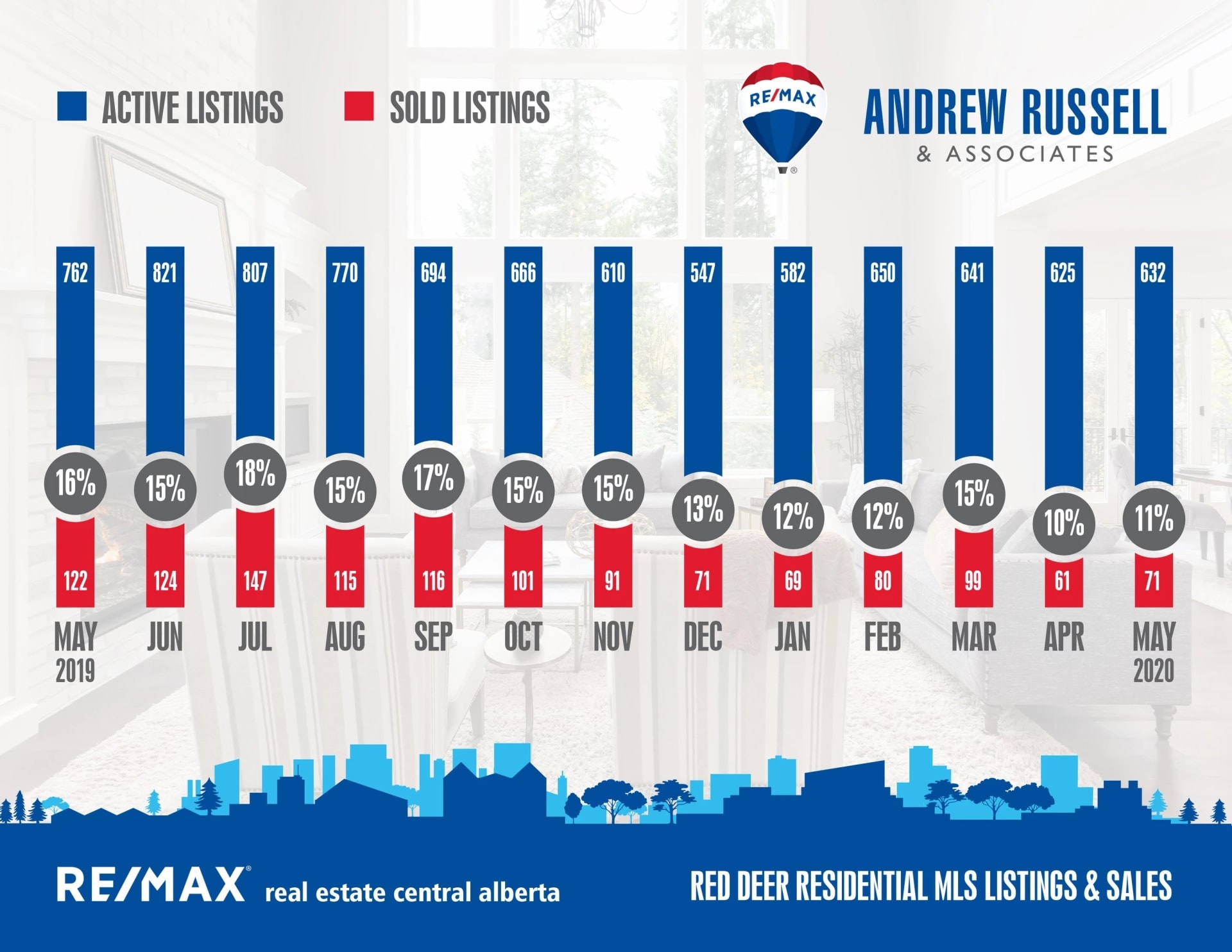

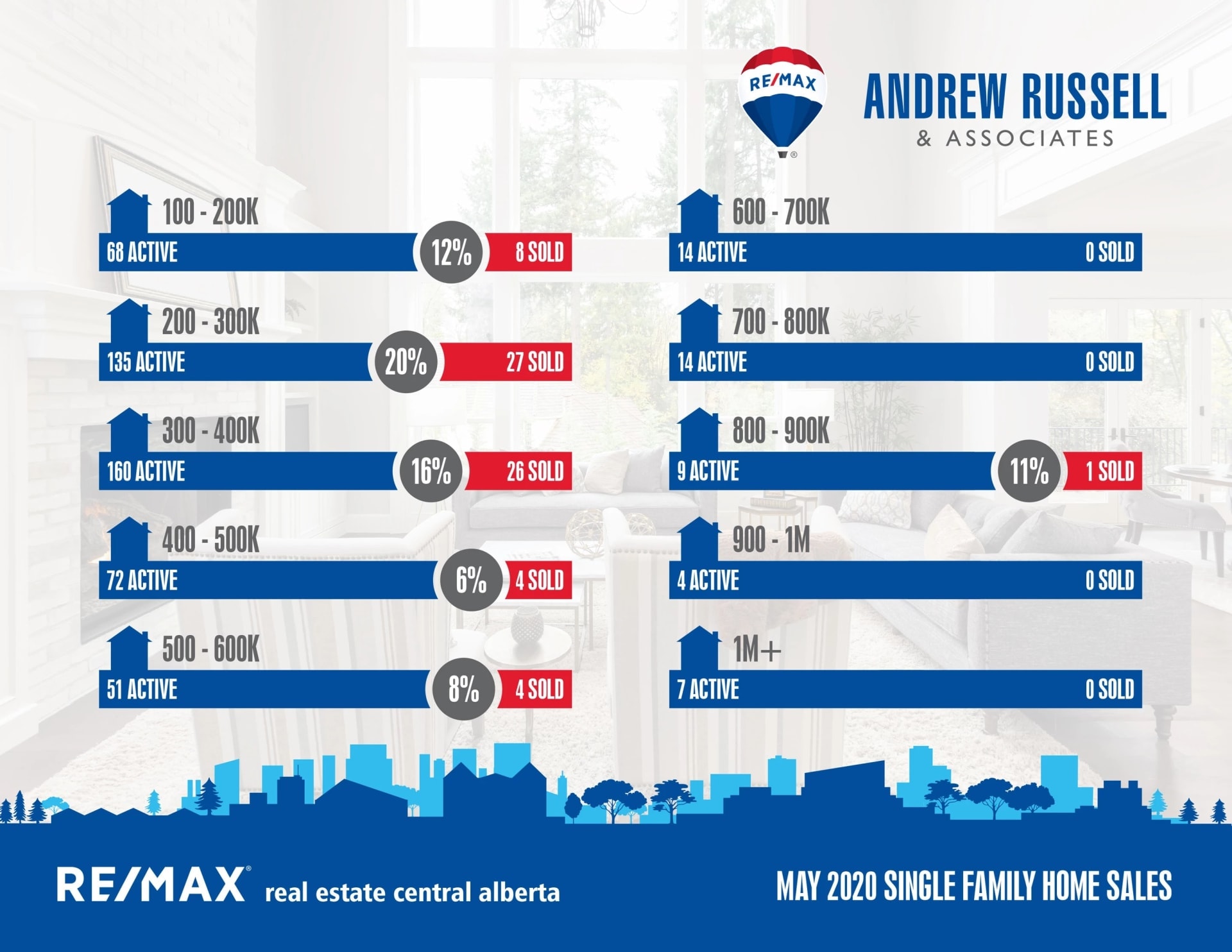

May sales were down 41% compared to 2019, but up 15% compared to April of 2020. The market is reasonably active up to $400k, and slower sales and activity beyond that. The $200-$300k market for single family homes actually squeaked into balanced territory, and given the activity I’ve had on most of my listings in those price points so far in June I’d say that’s likely to continue. Higher price points still remain slow, and with more amendments coming to the lending rules on July 1 making it harder to qualify for loans, I suspect that’ll remain the trend.

The acreage market has been extremely quiet this year, with only 4 sales posted in all of Red Deer County in May despite this usually being acreage selling prime time. Acreages have always been highly sought after but unaffordable for most buyers in Central Alberta, however I believe the price points and cost of ownership have become a problem. With not much product moving over $500,000 in general right now, and the average cost of an acreage being a fair bit higher than a property in town, I believe many buyers just no longer qualify to purchase what they want and so opt just not to move or look for large lots in town instead.

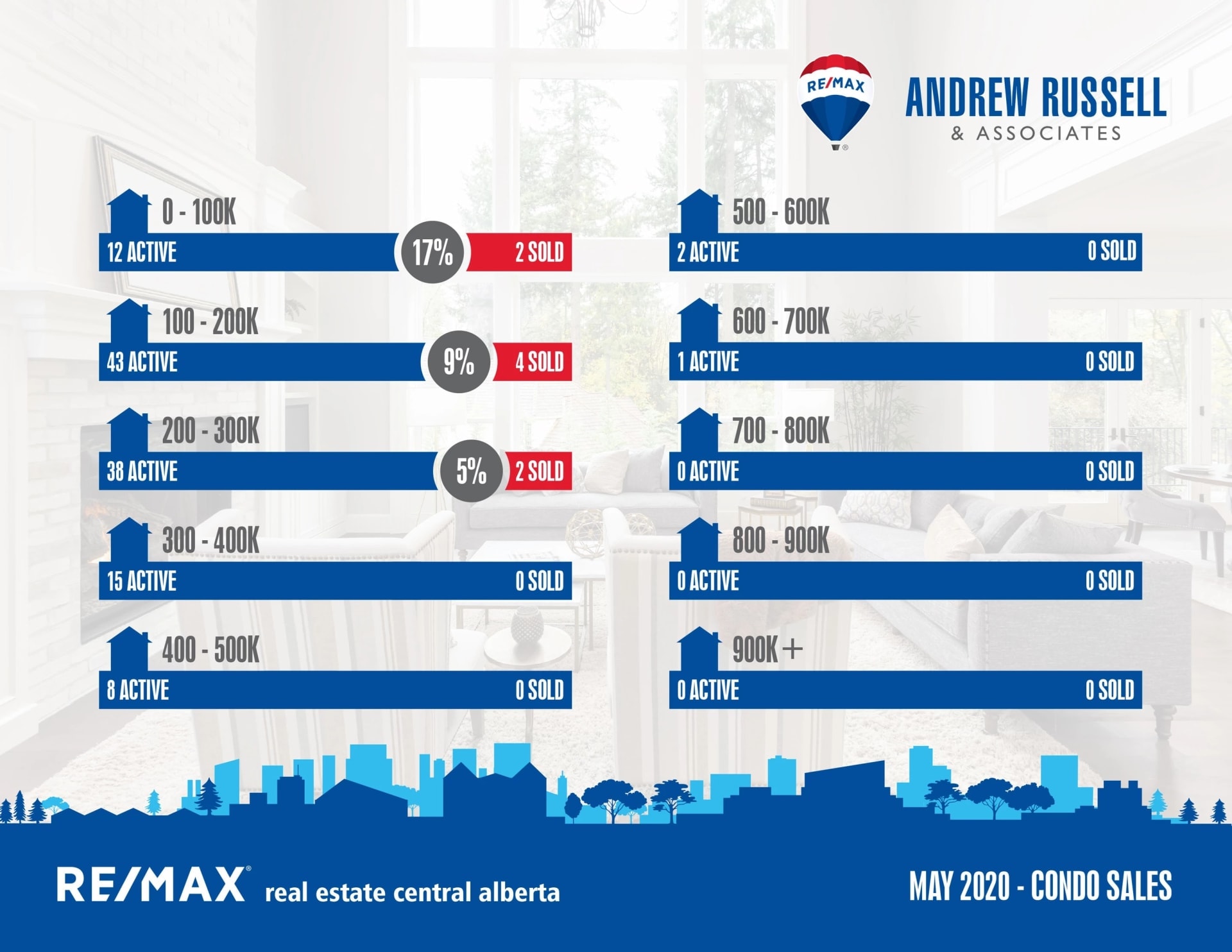

The condo market remains very slow as well, with the bulk of the apartments selling being in 55+ seniors buildings. Making the move from a house to a condo is a serious lifestyle shock for many, and the downsizing process of clearing out their existing homes and trying to live with 50% of their stuff is difficult for most people. Unless there’s something forcing their hand (health issues for example), many buyers looking to downsize into condos can often take a year or more to make a decision. When prices were high on single family homes, many first time buyers were forced to buy condos for affordability sake if they wanted to get into the market. They were also often forced to purchase as rentals were in high demand and difficult to find. With the price of housing dropping so much in the last 5 years, I believe many people who would have been condo buyers in the past are now opting to purchase single family homes or attached homes (duplexes, townhouses) instead.

That same concept is also why we’ve seen markets such as Blackfalds and Penhold slow down so drastically. Blackfalds grew very quickly during boom years, largely due to affordability. You could get a much nicer home in Blackfalds for the same money as Red Deer, and so many buyers were willing to commute the 10 minutes or so to get a nicer house. When prices fall in larger cities, the surrounding towns always take a larger hit, as many buyers would rather live in the city closer to work and amenities.

These are interesting times we’re living in, and our market continues to take shot after shot. Between the price of oil, lending rules, job losses, COVID, and so on it’s been a rough few years for many Central Albertans. The reality is this is probably the new normal for at least a few more years, or maybe longer. I do believe based on current events and economic factors that there’s a good possibility we’ll see prices slide a little further this year, although the next few months and specifically how the market reacts after the July 1st mortgage rule changes will probably give us a better idea of what to expect. Given that July isn’t far away now, the next update won’t be far off, and I’m optimistic June will show further improvement compared to the last few months.