Despite another overall good month for sales, there has been a noticeable cool down in buyer activity over the last few weeks. It is very typical for things to quiet down in the last week of August and the first couple of weeks in September as families get their kids settled back into school and people resume their normal routines. These periods can feel like the market just dropped off entirely, but the sales numbers at the end of the month will still show things moving at a good pace. The best analogy I can offer for these slow downs is that when you’re on the highway doing 150km/h and you slow down to 100km/h, it can feel like you’re barely moving, despite still moving at a reasonably high rate of speed.

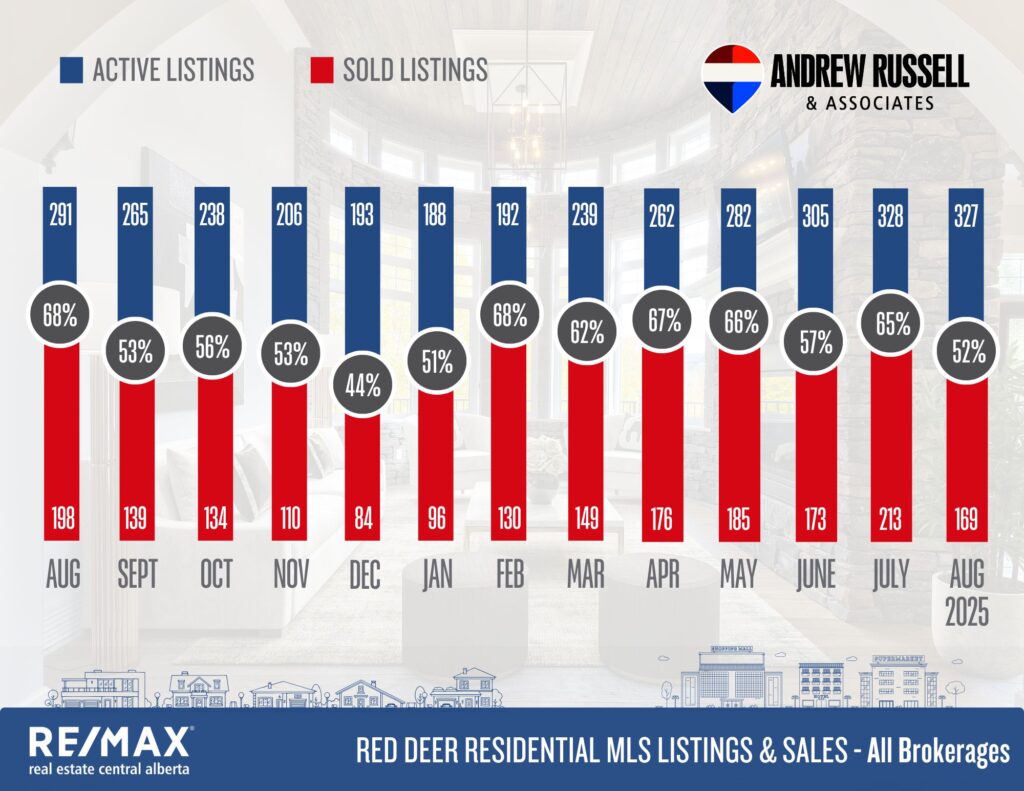

Historically, it’s very normal for both the volume of sales and new listings to slow down in the fall and winter months, and I dont think we’re going to return to our spring/summer pace this year. I do believe the market will still be very active, and I believe prices will generally hold steady through the winter, although this drop in demand and slight increase in inventory will likely lead to a slight correction in some price points.

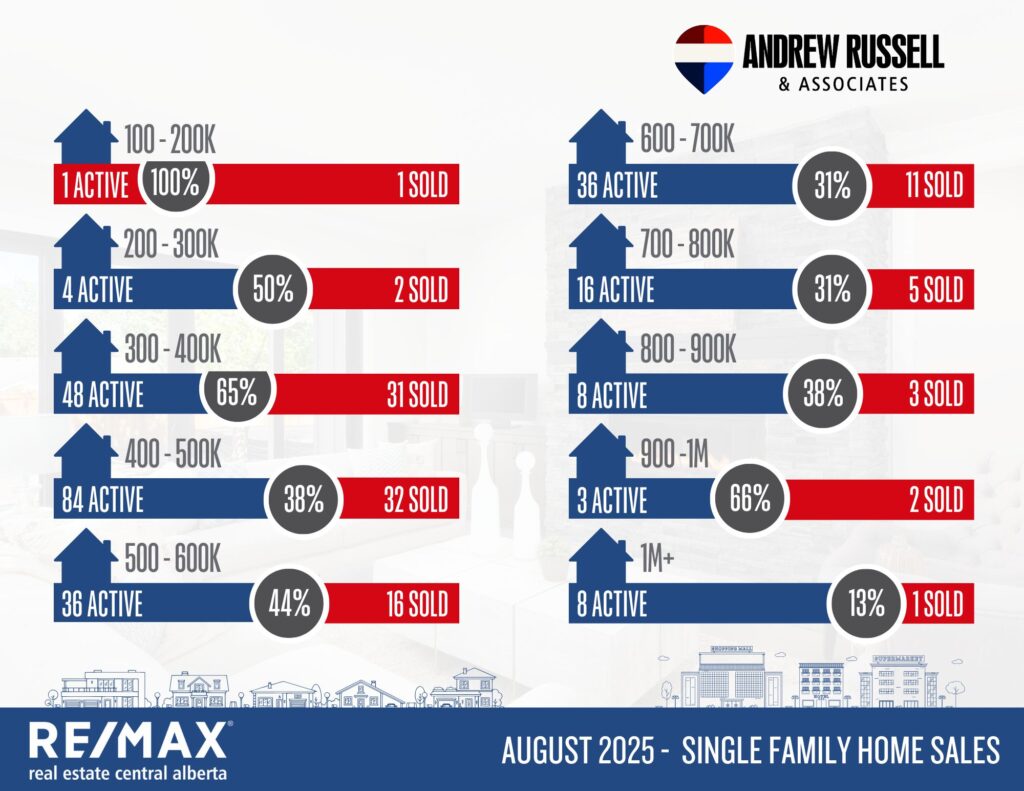

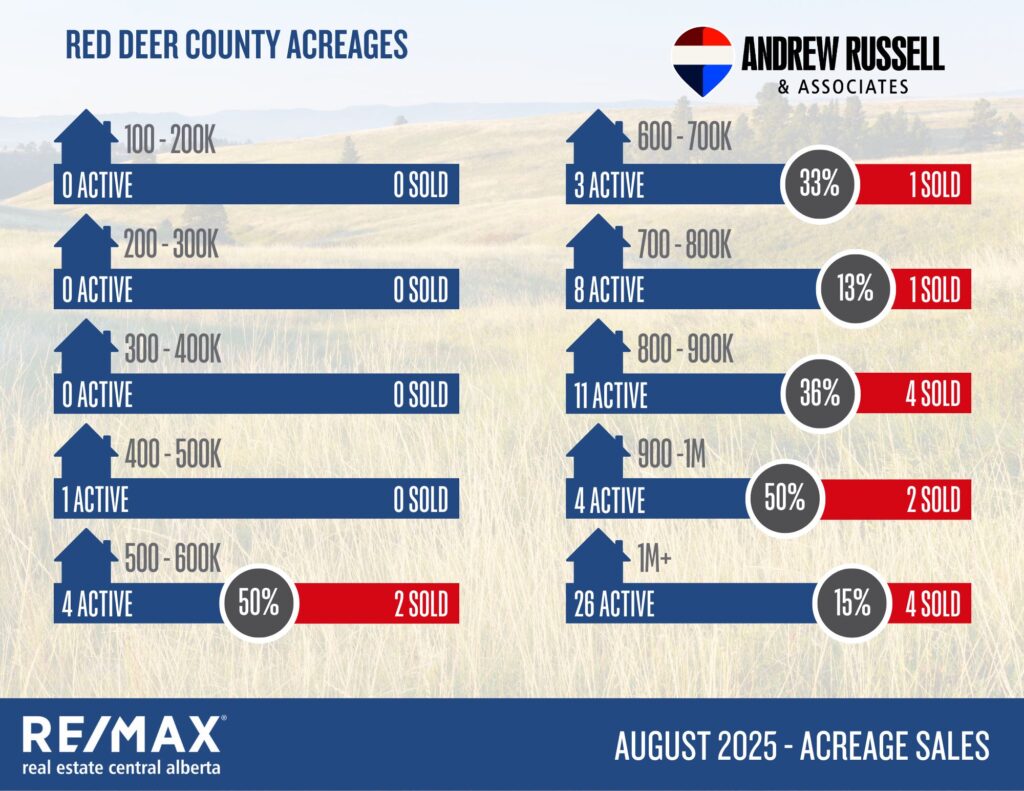

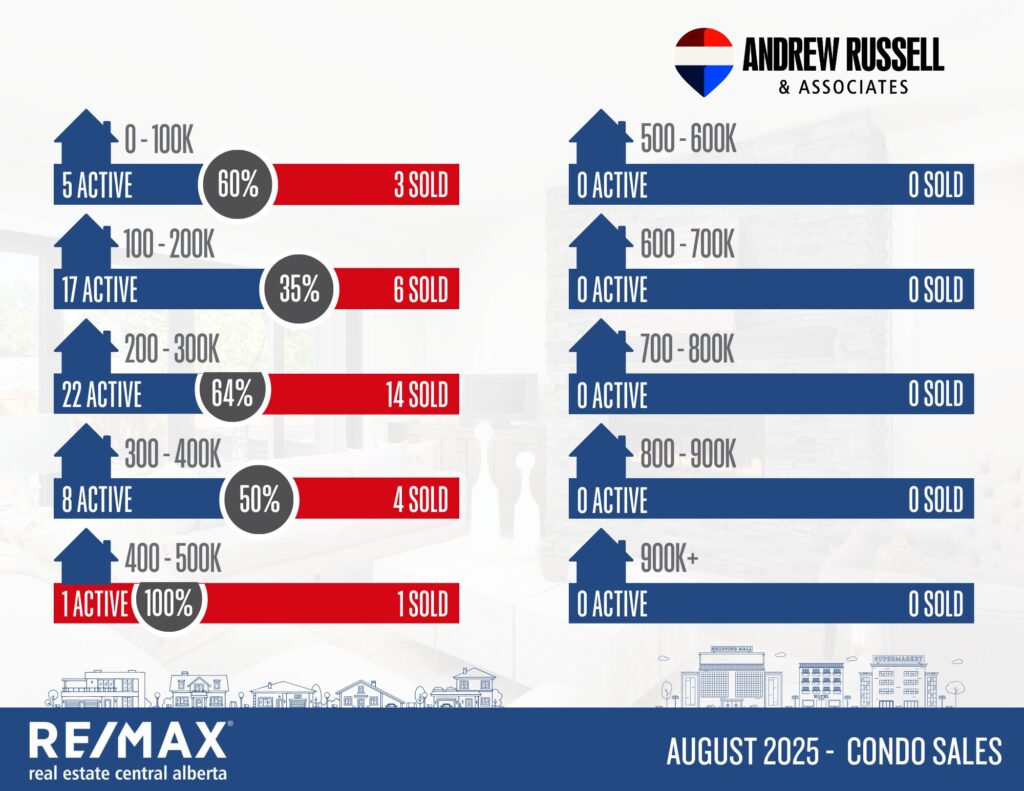

It’s important to look at the price point that your home sits in to get an accurate idea of what demand is specifically like in that segment. An absorption rate of 20-40% is considered a balanced market, where as over 40% is considered a sellers market, and under 20% is a buyers market. For example, if your segment had a 30% absorption rate last month, your home will need to be in the top 30% of available listings in that segment compared to your competition in order to find a buyer.

Here’s your quick stats for August:

Overall Market Trends

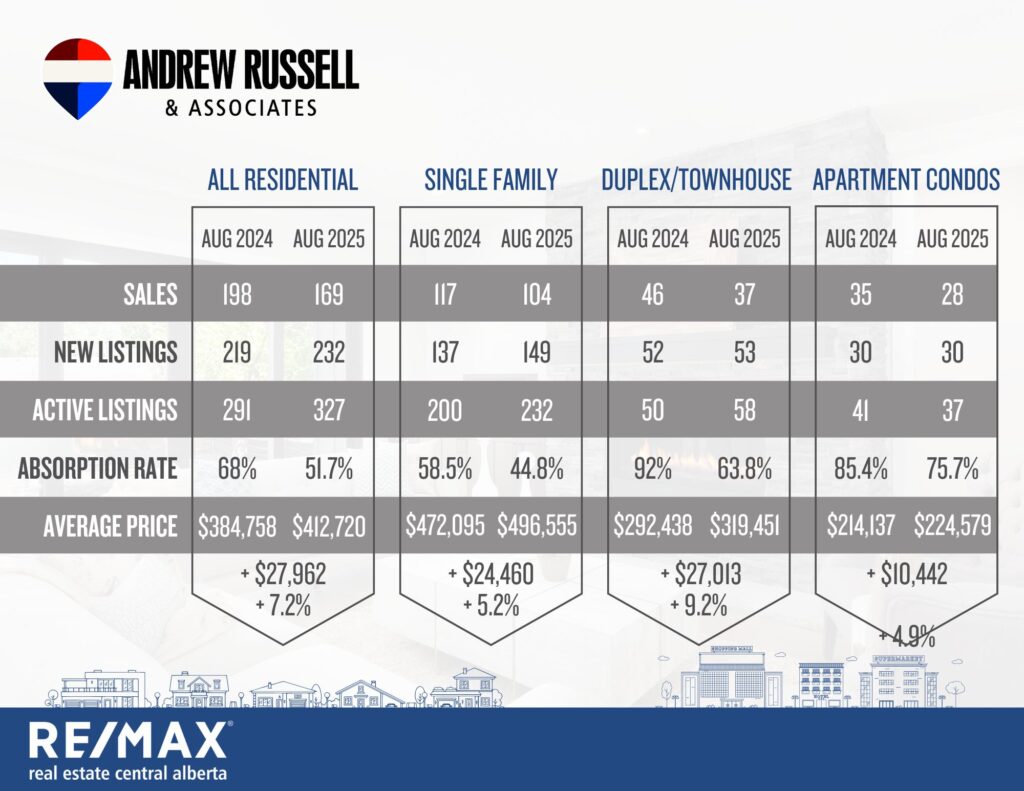

✅ Sales Activity: Total residential sales in August 2025 dropped to 169, down from 198 in August 2024.

✅ New Listings: Increased to 232, compared to 219 a year ago.

✅ Active Listings: Rose to 327, up from 291 in August 2024.

✅ Absorption Rate: Slowed to 51.7%, compared to 68% last year.

✅ Average Home Price: Climbed to $412,720, up from $384,758 – a healthy 7.2% increase year-over-year.

Single Family Homes

🏡 Sales Performance: Sales dipped to 104, compared to 117 in August 2024.

🏡 New Listings: Rose to 149, slightly above the 137 a year ago.

🏡 Absorption Rate: Softened to 44.8%, down from 58.5% last year.

🏡 Price Trends: The average price rose 5.2%, from $472,095 to $496,555.

Acreage Market

🌲 Inventory is Limited: There are very few acreages available in Red Deer County under 1M currently, which has been the case most of this year.

🌲 Moderate Mid-Range Demand: Acreages between $500K to $600K achieved a 50% absorption rate (2 sales from 4 active). The $900K–$1M range also performed well at 50% (2 of 4 sold).

🌲 Luxury Market Slowdown: Activity above $600K showed mixed results – $600K to $700K saw just 1 sale (33% absorption), $700K–$800K slowed with only 1 of 8 sold (13%), and the $1M+ segment saw 4 of 26 sell (15%).

Market Supply & Demand Trends

📉 Inventory Growth: Active listings climbed to 327, showing a buildup compared to 291 last year.

📉 Sales Volume: Total sales softened compared to 2024, reflecting a cooling late-summer market.

⬆️ Duplex/Townhouse Segment: Absorption slowed to 63.8% (down from 92%), though prices jumped 9.2% year-over-year to $319,451.

⬆️ Condo Market: Apartment condos held steady with 30 new listings and 28 sales. Prices climbed 4.9% to $224,579, while absorption remained strong at 75.7%.

What This Means for Buyers and Sellers

Buyers:

✅ Mid-Range Competition: Homes priced between $300K–$500K remain the busiest segment—buyers should act quickly.

✅ Luxury Advantage: Properties priced above $600K are slower moving, giving buyers more negotiation power.

✅ Acreage Opportunities: With higher inventory and softer demand at the top end, acreage buyers have time and leverage.

✅ Stable Price Growth: While prices are rising, increases remain steady and predictable.

Sellers:

✅ Mid-Range Sweet Spot: The $300K–$500K single family market continues to drive the most activity.

✅ Price Gains: Year-over-year price growth remains positive across all segments, boosting equity.

✅ Strategic Pricing Needed: High-end homes and acreages require sharper pricing to attract buyers in today’s market.

✅ Seasonal Shift: As summer winds down, motivated buyers are still out there, but demand is cooler than peak months. Timing and pricing are key.

Blackfalds:

Current Active Listings – 51

Sales in August – 34

Likelihood to Sell – 67% (Seller’s Market)

Sylvan Lake:

Current Active Listings – 115

Sales in August – 38

Likelihood to Sell – 33% (Buyer’s Market)

Penhold:

Current Active Listings – 19

Sales in August – 7

Likelihood to Sell – 37% (Buyer’s Market)