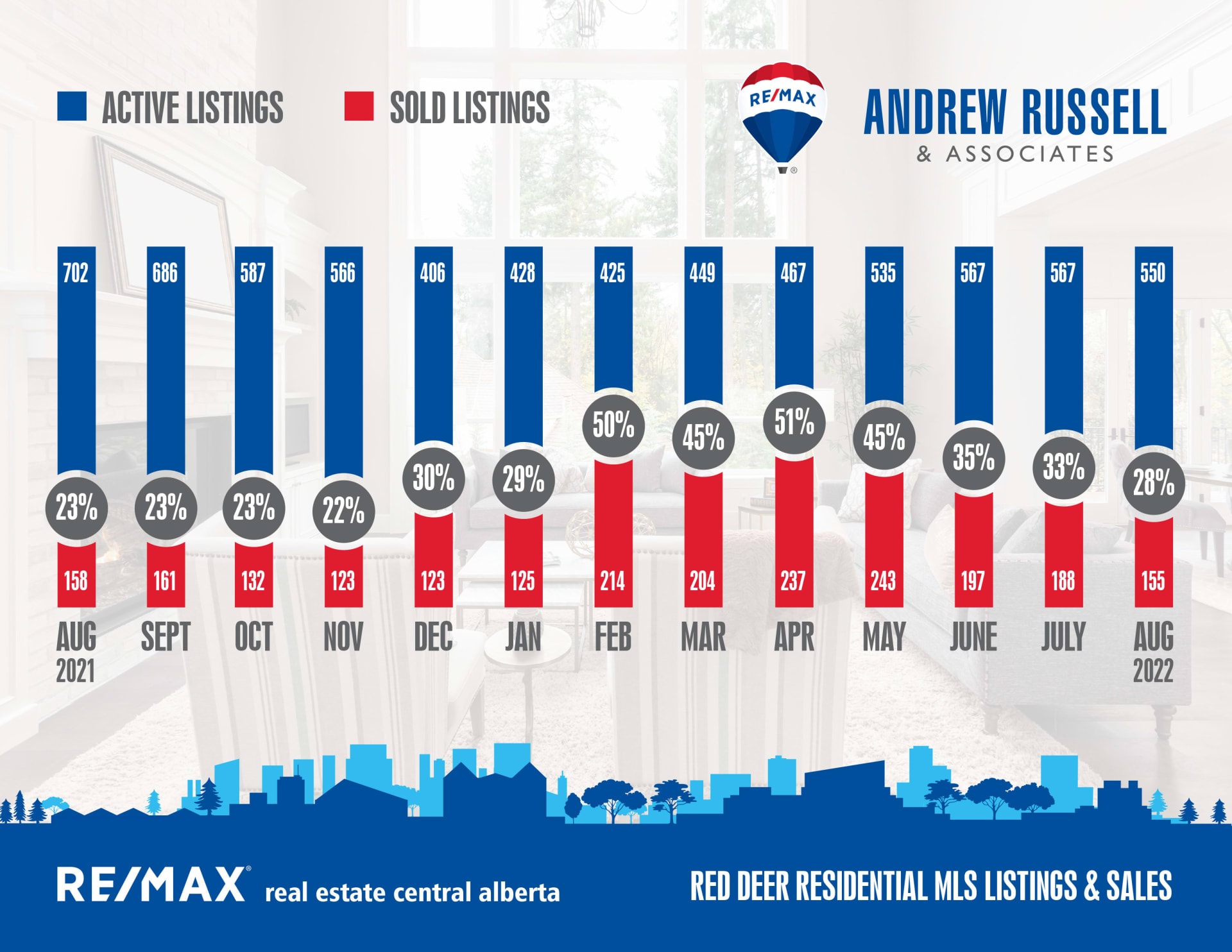

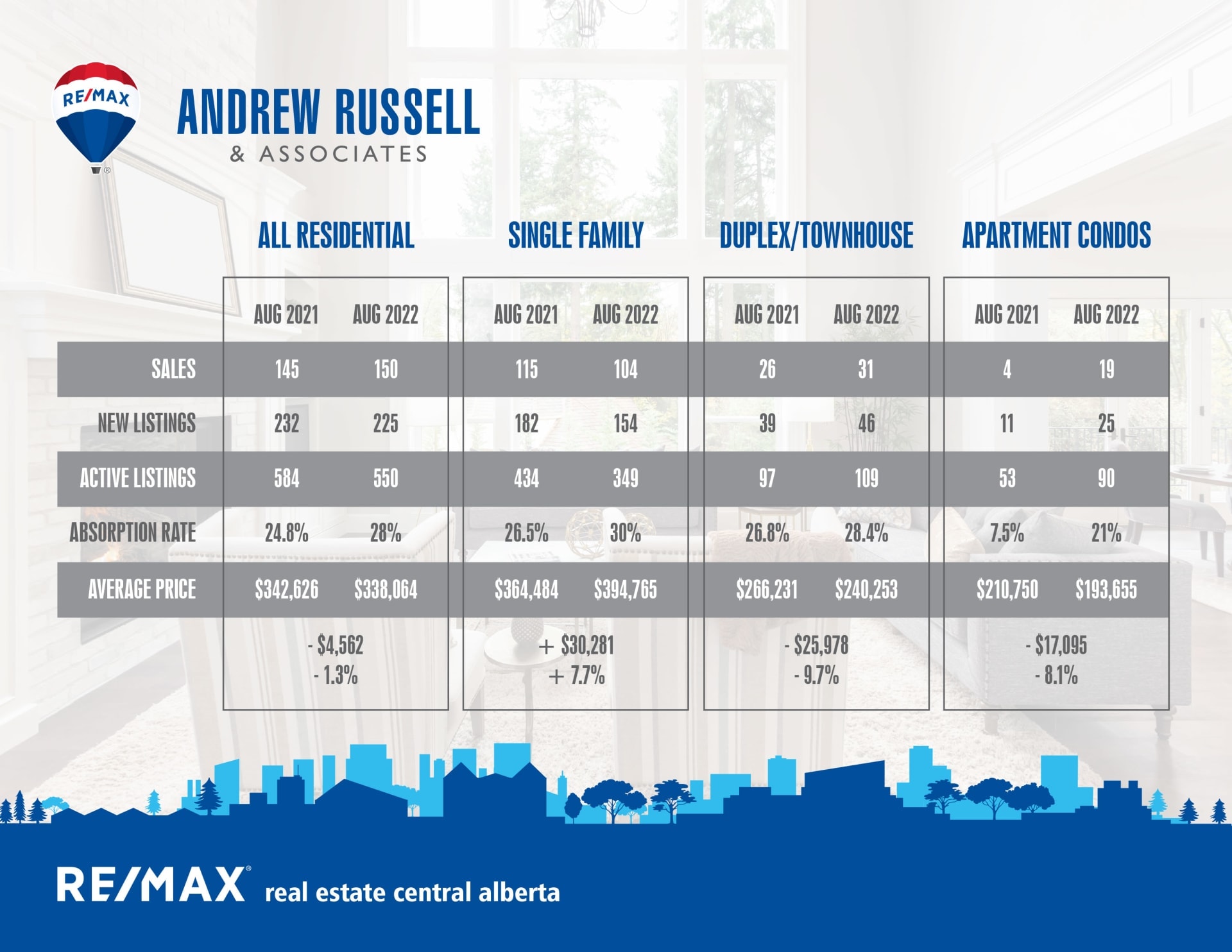

As expected, markets continue to cool as interest rates continue to rise. On September 7th the Bank of Canada raised rates by another 0.75% as they’re aggressively trying to slow record high inflation. Most Central Alberta markets are still in balanced territory, with Red Deer selling 28% of our inventory in August, still a good market, but a far cry from the hot sellers markets we experienced in the spring months.

Forecasts state that rate increases aren’t done, as the Bank of Canada will meet again on October 25, and for a final time on December 6. While the increases are expected to be smaller (0.25%), economists are now expecting recession in 2023. I do believe Alberta is going to weather this economic storm better than every other province due to the strength of the provincial economy, however it’s looking less likely that the market will rebound to previous activity levels next year.

With that, I don’t think we’ll see the level of decrease in property values that Ontario and BC are currently dealing with, but the market has visibly softened and sellers can no longer demand the premiums they did back in May and June. Historically, activity will generally slow as we approach December, and so it’s likely that prices may be down slightly more as we get closer to Christmas. If you currently have a home on the market, it may be wise to get more aggressive with your pricing now versus making incremental reductions and chasing the market down into the winter months.

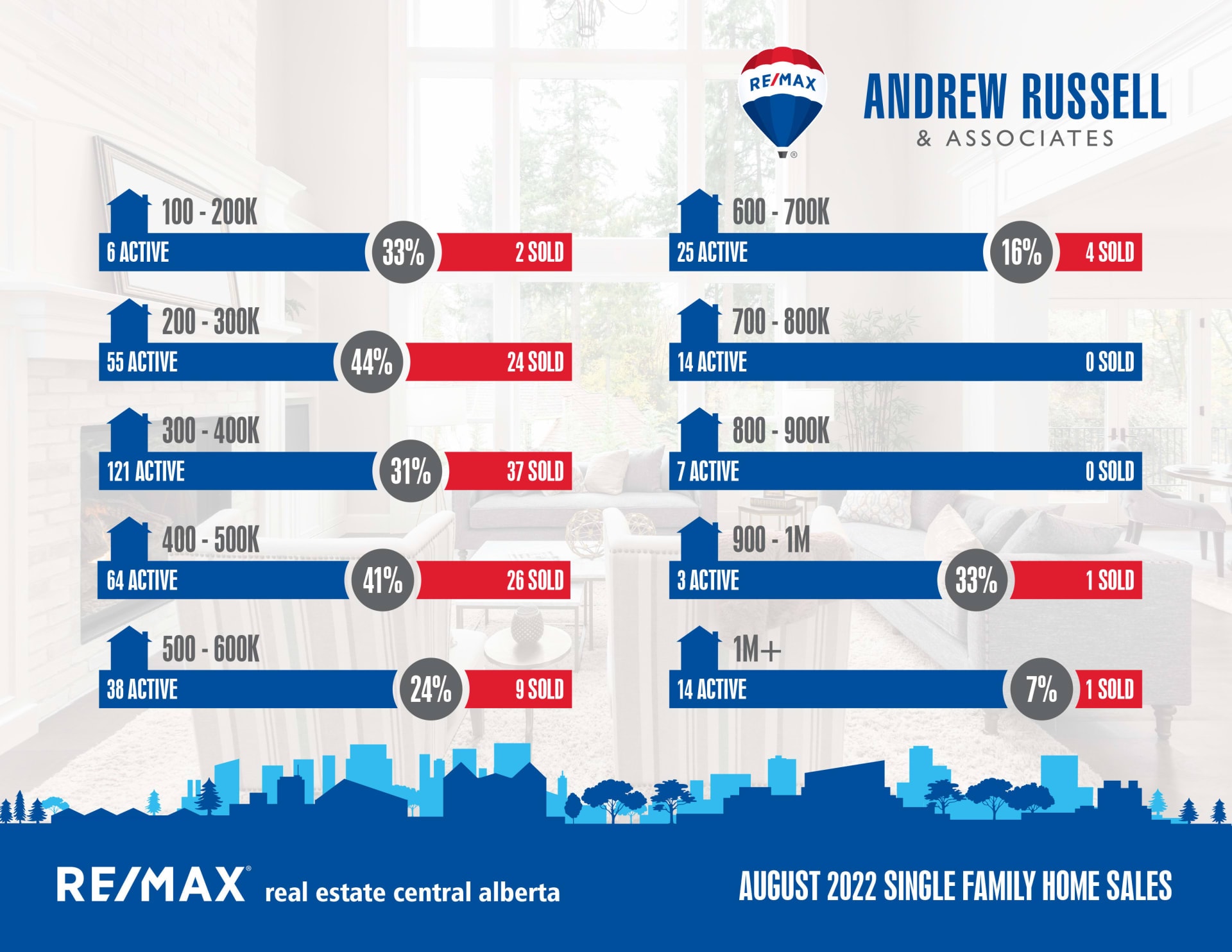

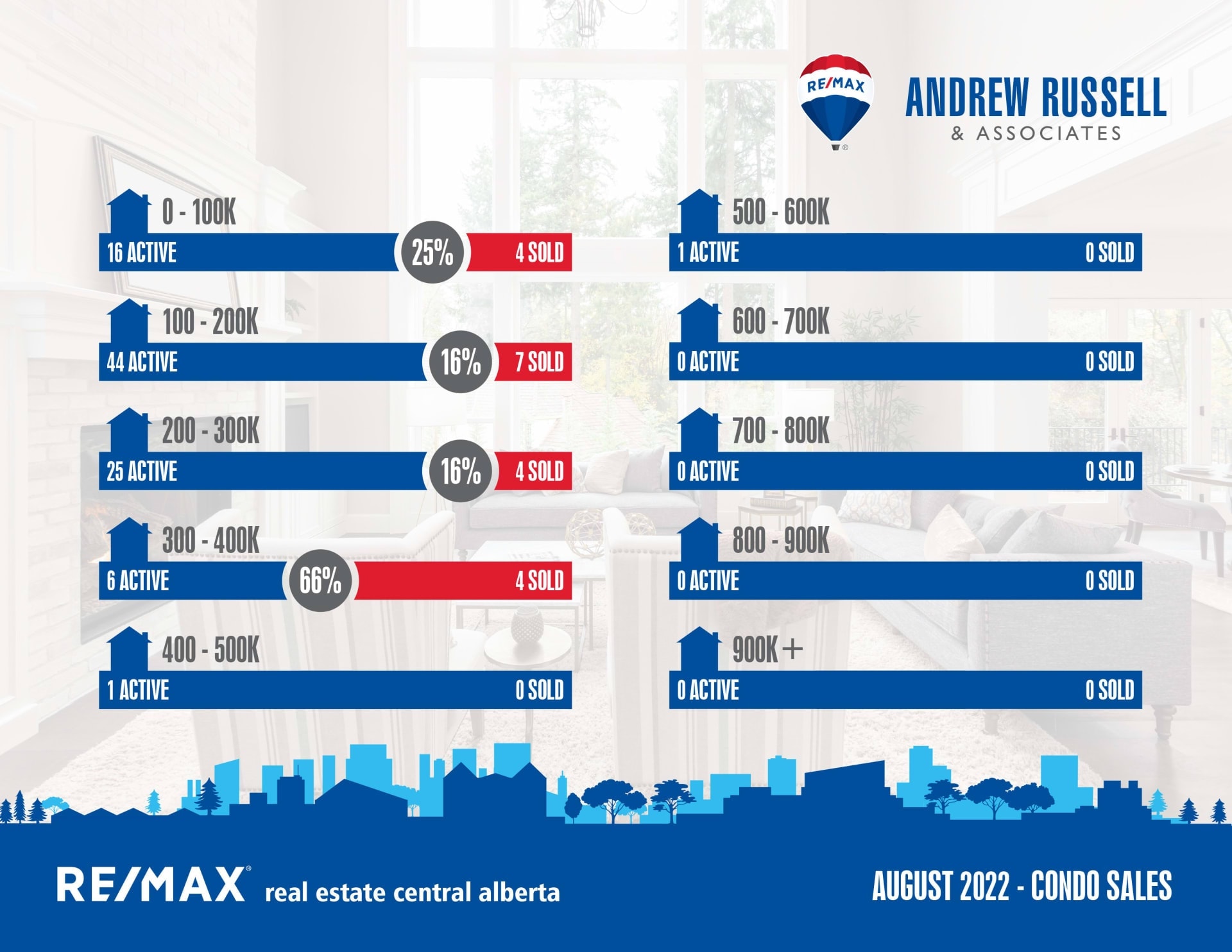

While interest rates in the 5-6% range are likely to be the norm for at least a couple of years, buyers will adapt as everybody still needs a place to live. With rentals in high demand and short supply, purchasing will still be a good option, however for every 1% increase in rates, buyers lose approximately 10% of their purchasing power. This will force many buyers to look at lower price points for their purchases, which will make the upcoming months a great time to purchase at the higher end of the market as demand drops off for homes over 600k.

Surrounding Community Snapshot:

Blackfalds:

Current Active Listings – 71

Sales in August – 17

Likelihood to Sell – 24.8% (balanced market)

Sylvan Lake:

Current Active Listings – 159

Sales in August – 45

Likelihood to Sell – 29.5% (balanced market)

Penhold:

Current Active Listings – 26

Sales in August – 13

Likelihood to Sell – 52% (seller’s market)