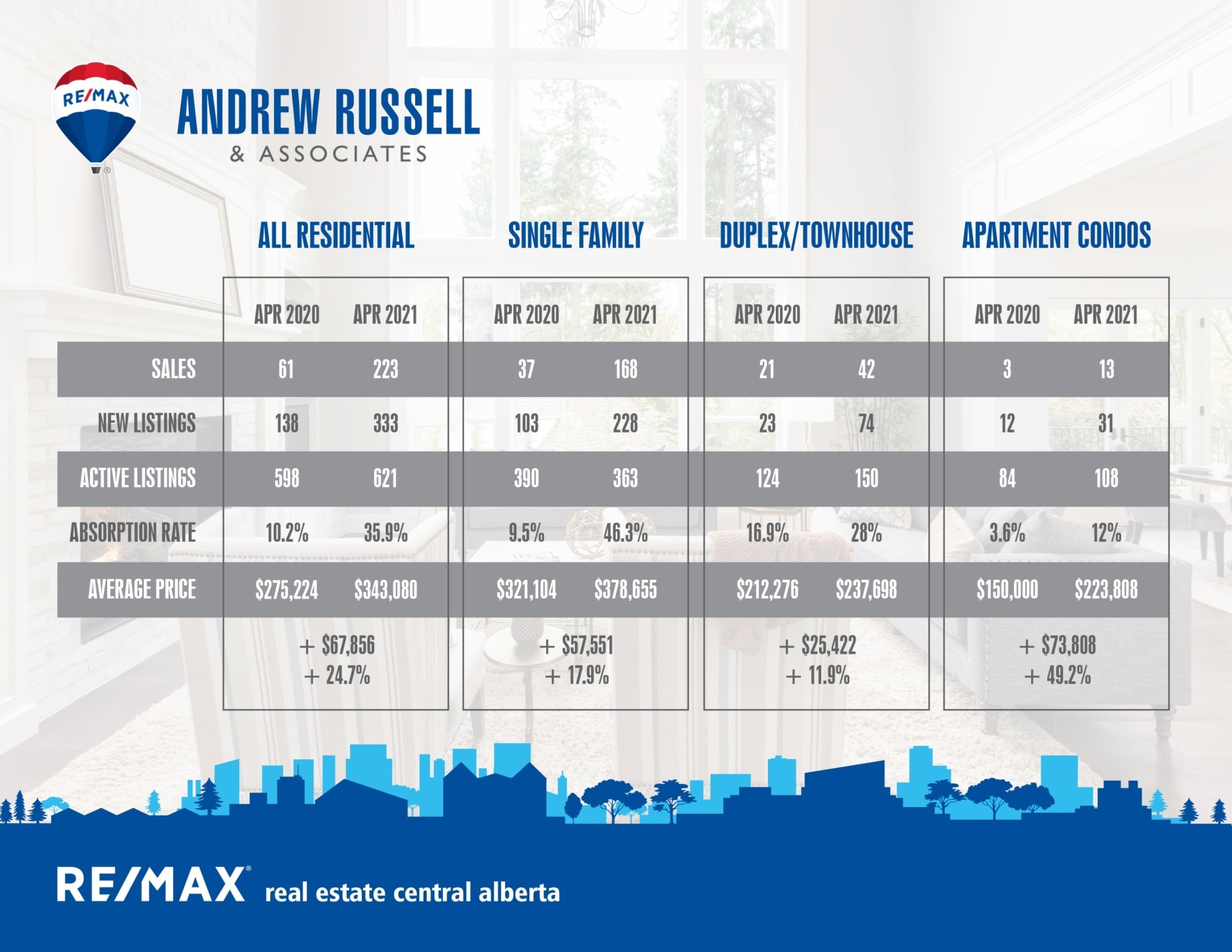

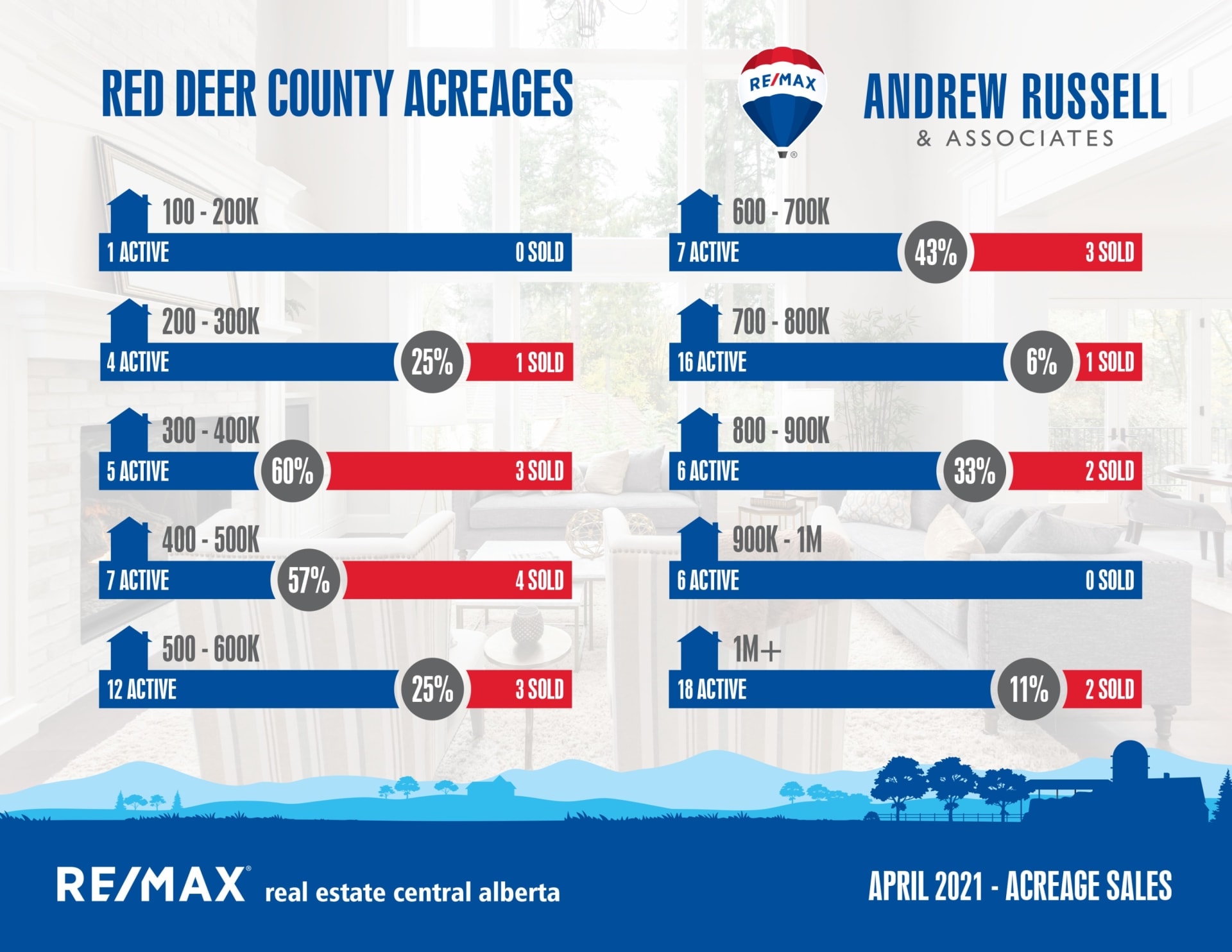

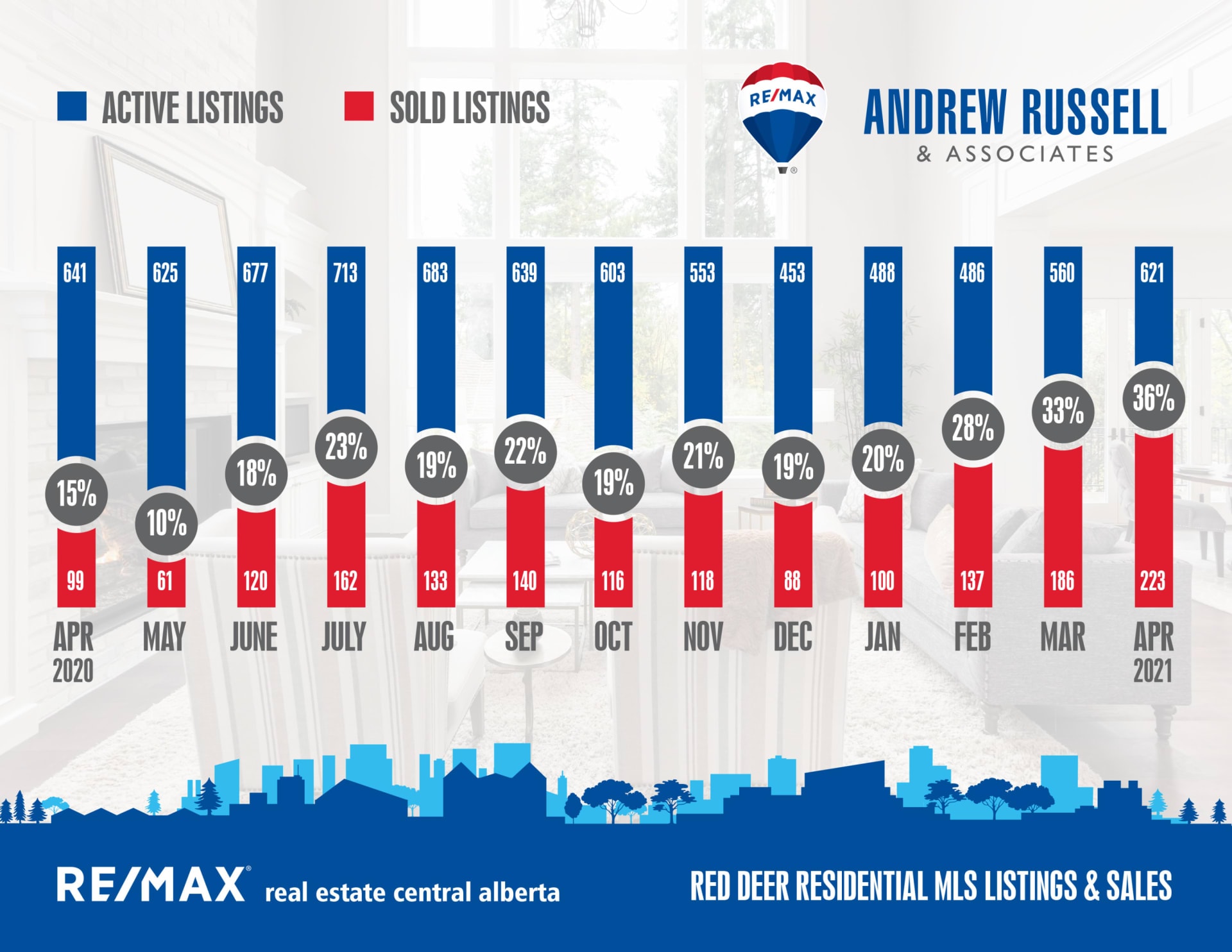

It was another hot month, obviously not weather wise, but market wise, it was the best month for real estate in Red Deer we’ve seen in a very long time. Demand for single family homes and acreages remains extremely high with limited inventory available, while the condo market is still slow. The overall market picture is a very nicely balanced market with 36% absorption rate (36% of listed homes sold last month, CMHC defines a balanced market as 20-40% of inventory selling each month). The number can also be calculated as months of inventory, (currently 2.78 months) which is to say at our current pace of sales, if no new homes were listed after today, we would run out of inventory in 2.78 months. These figures are being impacted by slow condo sales, if you remove condo’s from the equation and look only at single family properties, our absorption rate moves up to 46%, which is a hot seller’s market. While demand is strong, buyers are still price sensitive, and we’re not seeing the same level of activity in smaller cities as we are in large centers like Calgary and Edmonton. Overpriced homes, and homes that need work/renovations continue to sit on the market, while well priced, turn key homes are selling very quickly, usually within the first couple of weeks.

Sales activity like this puts upward pressure on prices, and the average home in Red Deer has increased in value roughly 3-5% in the last 4 months. While this is a welcome bump in prices for existing home owners, we still haven’t come anywhere near recovering the 10-15% loss from the last peak of 2014. Economically, in the short term at least, I don’t foresee us recovering to 2014 prices. In 2014, oil peaked at $107/barrel and the Alberta economy was extremely hot. People were moving to Alberta from places like BC, Ontario, and the Maritimes because jobs were plentiful, they paid well, and Alberta had one of the lowest costs of living in the country. While we still have a low cost of living compared to many other provinces, many of those high paying jobs were wiped out when oil collapsed in 2015. Less people moving in means less demand for goods and services, and drastically less demand for housing.

While it does seem like Alberta’s economy is starting to shift back in the right direction, recovery takes time. This current bump in the market is being fueled by people’s inability to travel (therefore having more available cash), being stuck at home, and record low interest rates. As vaccine rollout continues, travel will open back up. Interest rates are also going to go back up as economic recovery continues. “Normal” life is on the horizon again, and demand for real estate is likely to return back to a more normal pace, which means we’re going to need job creation and population growth to see markets improve and prices climb back up.

Surrounding community snapshot:

Blackfalds:

Current Active Listings – 100

Sales in April – 38

Likelihood to Sell – 38% (balanced market)

Sylvan Lake:

Current Active Listings – 152

Sales in April – 65

Likelihood to Sell – 42.7% (seller’s market)

Penhold:

Current Active Listings – 37

Sales in April – 7

Likelihood to Sell – 18.9% (buyer’s market)